USD flows: US data mixed, initial USD gains look unjustified

USD gain after the US data look hard to justify goven slowing retail sales trend and weak Empire survey

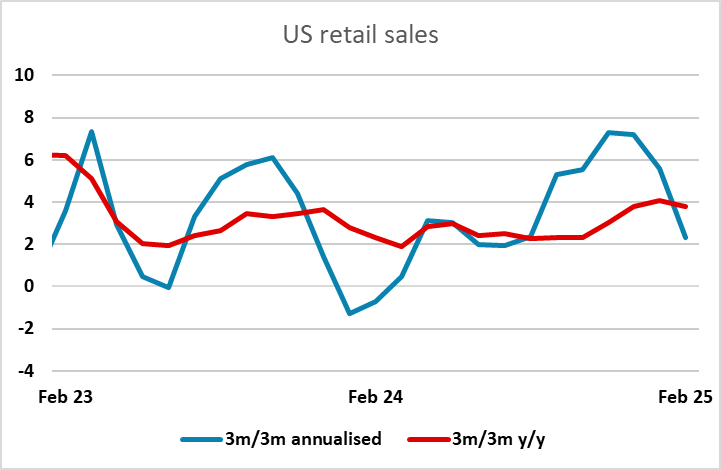

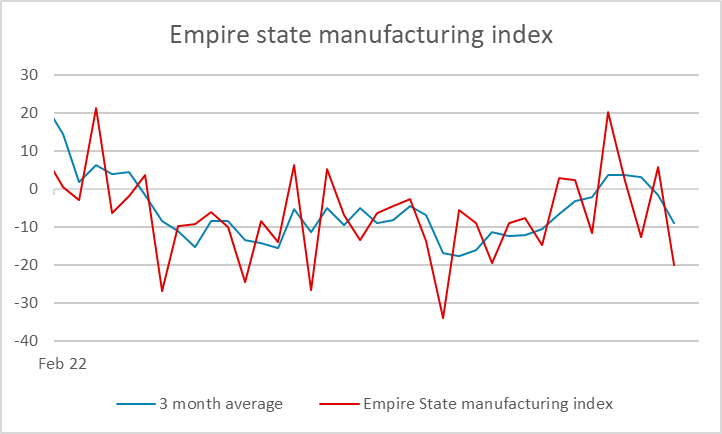

The US retail sales numbers were mixed, with the retail control measure particularly strong at 1.0% m/m but the headline below consensus at 0.2% and the core in line at 0.3%. However, the Empire manufacturing survey was clearly weaker than expected, with the main index dropping to -20, its lowest since January 2024. This can be quite a volatile number, so on its own we wouldn’t be inclined to read too much into it. But after the softer University of Michigan confidence number son Friday and some other weak surveys, this may be taken as mor significant and will increase the focus on the Philly Fed survey later this week.

The initial USD response to the data has been mildly positive, perhaps responding to the higher retail control number. But it’s hard to see the data as particularly positive in total, and we would tend to favour the USD downside after the initial bounce.