USD flows: USD firmer after durable goods orders data

USD generally firmer after durable goods orders come idn a tad above consensus, but underlying picture is of risk positive FX moves

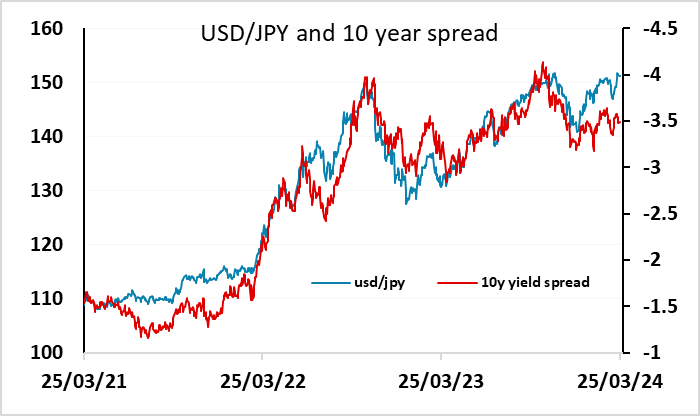

The USD is a tad firmer after the US durable goods orders numbers, which came in a fraction above expectations. But the underlying story for the market is a risk positive one – the JPY and particularly the CHF are on the back foot, while the riskier currencies are all firmer on the day, although they have eased back after the US data. We remain wary of USD/JPY here, as it remains well above the level suggested by yield spreads, the Japanese authorities are becoming increasingly vocal about the possibility of intervention, and we are half a figure from the 24 year high of October 2022 at 151.94. USD bulls would therefore be better focused on USD/CHF, with the CHF underperforming everything since the SNB rate cut last week.