FX Daily Strategy: N America, February 16th

UK retail sales to bounce, but GBP still vulnerable

US PPI unlikely to have a market impact

USD to stay firm for now

JPY weakness on the crosses is stretched

UK retail sales to bounce, but GBP still vulnerable

US PPI unlikely to have a market impact

USD to stay firm for now

JPY weakness on the crosses is stretched

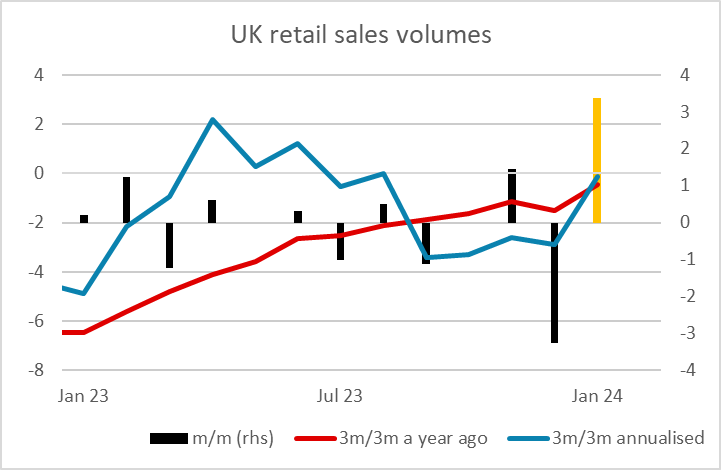

GBP initially rose on the back of the larger than expected rise in retail sales in January, but since this only reverses the decline seen in December, it is primarily a seasonal adjustment issue rather than any indication of fundamental strength or weakness. The trend looks to be improving, but a flat number next month would see the 3m/3m trend dip lower once again, so it looks too early to judge, and we wouldn’t put a lot of faith in the data.

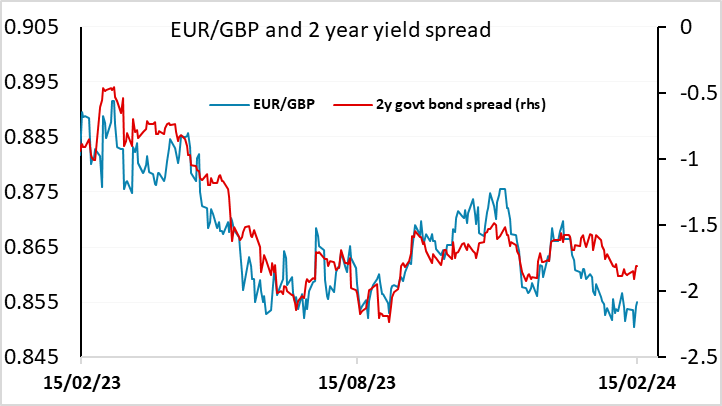

The weakness of the Q4 GDP data yesterday, the softer CPI data this week, and the flattening of the trend in average earnings all suggest there is likely to be scope for UK rate cuts before the August date that the market currently has for the first cut. The 0.85 level still looks likely to be strong support, and is unlikely to be tested, and after the inititial GBP bounce, we have seen weakness resume, with a break back up above 0.8550. We still see scope for more medium term gains.

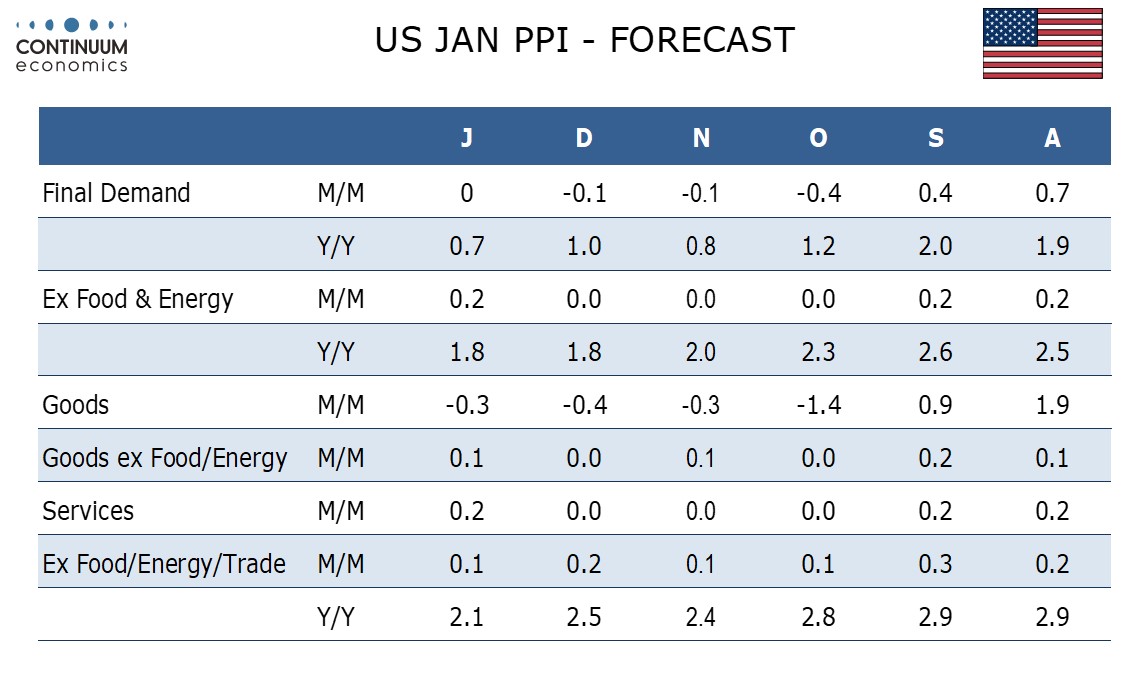

Otherwise the calendar is fairly quiet, with US PPI the main US data. This is usually of minor interest after CPI, but we have seen some significant reactions in recent months, so the data may be o some interest. We expect an unchanged outcome from January’s PPI to follow three straight declines, and a 0.2% increase ex food and energy to follow three straight unchanged outcomes. Ex food, energy and trade we expect a 0.1% increase, to confirm the underlying picture remains subdued. This is broadly in line with market consensus, so shouldn’t have a major impact.

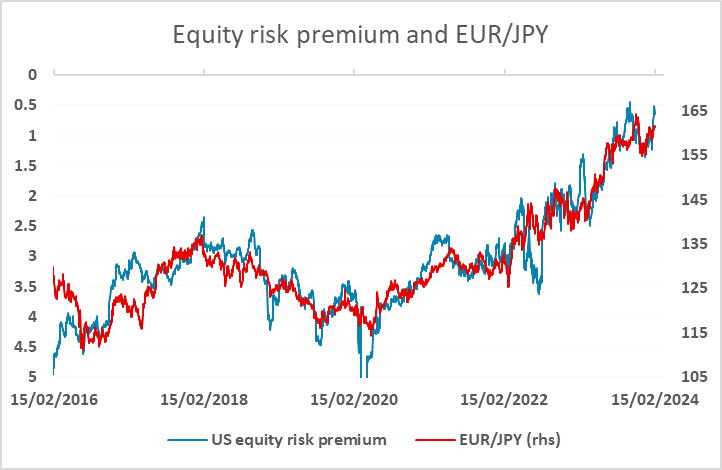

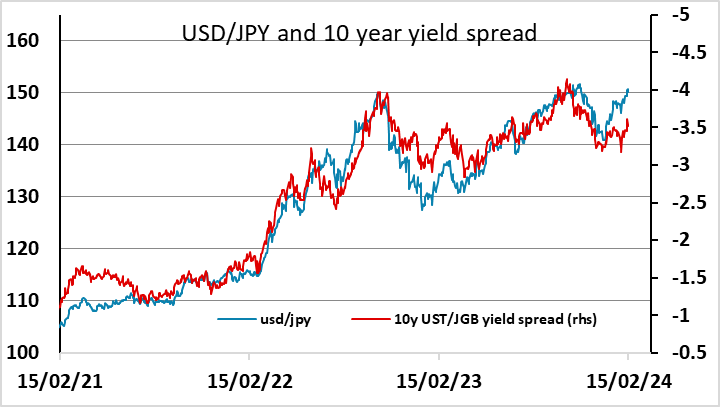

In general, the USD has had a strong week due to the strength of the CPI data, and is likely to remain reasonably firm through Friday. There was a mild decline after weak retail sales data on Thursday, but one weak month after a strong Q4 (though Q4 did see downward revisions with this report) does not make a trend, and January’s weakness may be in part weather-induced. The riskier currencies have been relatively resilient to USD strength, helped by the fact that rises in US yields have been largely matched in Europe, and by the resilience of equities, with US equities still pressing on the highs. EUR/JPY hit a new high for February on Thursday, and is approaching the January highs. We would expect JPY weakness on the crosses to continue as long as US equity risk premia continue to decline, but we are becoming quite concerned about the extremely low level of US equity risk premia, which are now below pre-GFC levels. We still a lot of JPY upside in the medium term, and If the US retail sales data prove to be the first sign of slowdown, the JPY recovery may start soon.