FX Daily Strategy: N America, December 17th

USD strength to be sustained by US retail sales

GBP gains after strong earnings data

CAD remains under pressure…

…but positioning is extreme.

USD strength to be sustained by US retail sales

GBP gains after strong earnings data

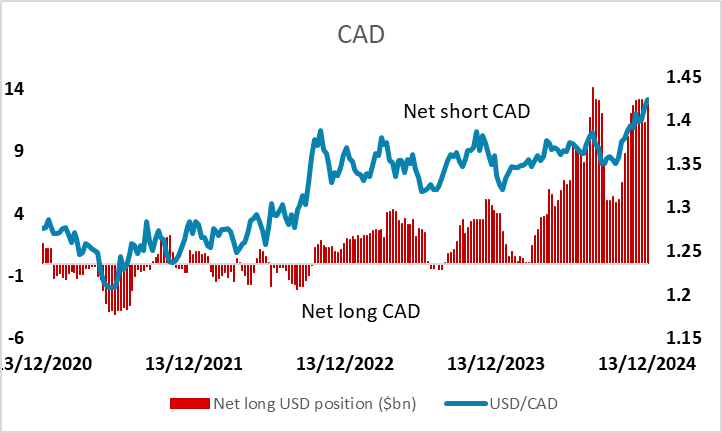

CAD remains under pressure…

…but positioning is extreme.

Tuesday sees US retail sales data, Canadian CPI and UK labour market data. The strength of the USD on Monday was underpinned by the continuing evidence of a solid US economy, with the December US PMI data maintaining that story. The US service sector numbers were above expectations and although the manufacturing index dropped this sustained the recent strength in the US composite index and its outperformance of the data elsewhere. However, the PMIs are not always well correlated with official data, and the retail sales numbers will be seen as important as a gauge of consumer demand going into the FOMC on Wednesday.

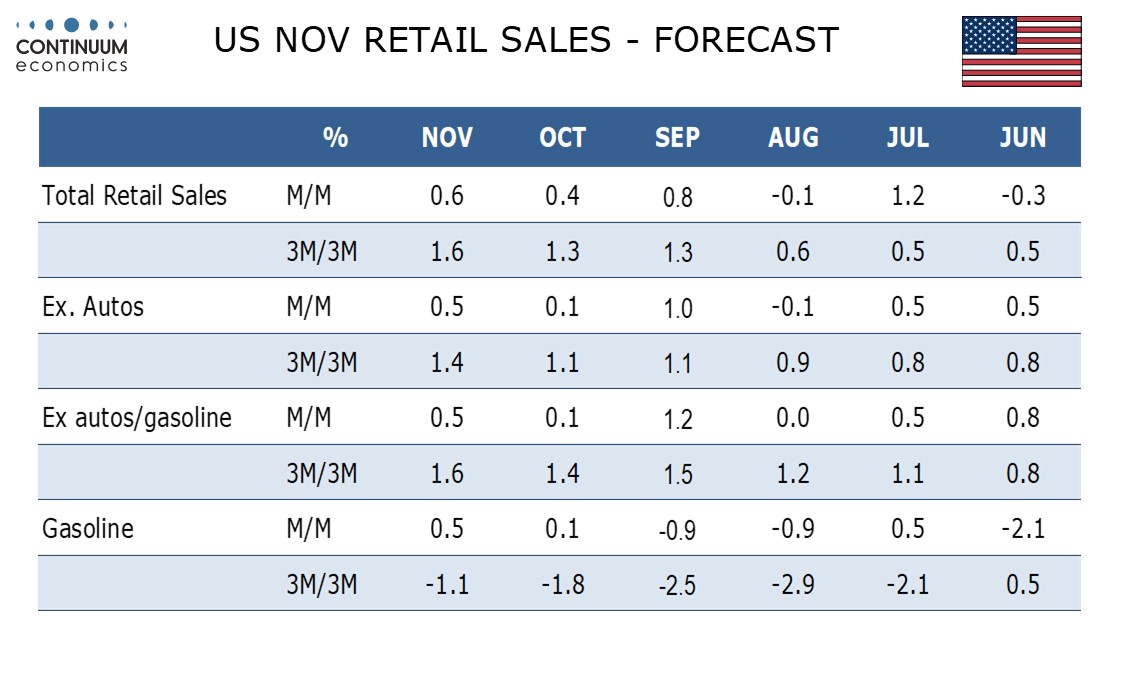

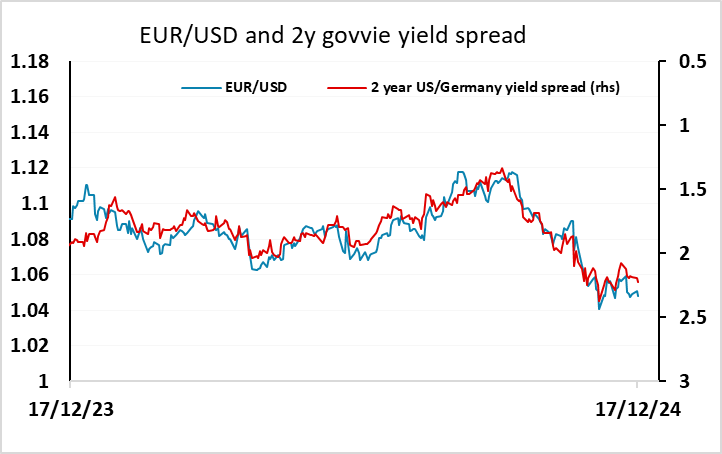

We expect US retail sales to maintain momentum in November, with a 0.6% increase overall with 0.5% gains both ex auto and ex auto and gasoline. Auto sales have gained momentum in recent months, probably supported by falling interest rates. Ex autos and gasoline the picture is solid, and we expect November data to look more in line with trend after an above trend September was preceded by a subdued August and followed by a subdued October. Our forecast is in line with the consensus, and would imply a further improvement in the 3m/3m trend, further bolstering USD strength and expectations of a less dovish Fed. Even so, we still expect the Fed will ease on Wednesday, and with only one more cut priced in over the subsequent three meetings in January, March and May, it’s hard to see the market reducing easing expectations much further, as the Fed aren’t going to commit themselves to halting easing at this stage. So while the USD is likely to hold onto recent gains, we wouldn’t see much more upside to US yields and consequently wouldn’t see much extension of the recent strength, even though the EUR remains under pressure after a weaker than exoected IFO survey this morning (see here).

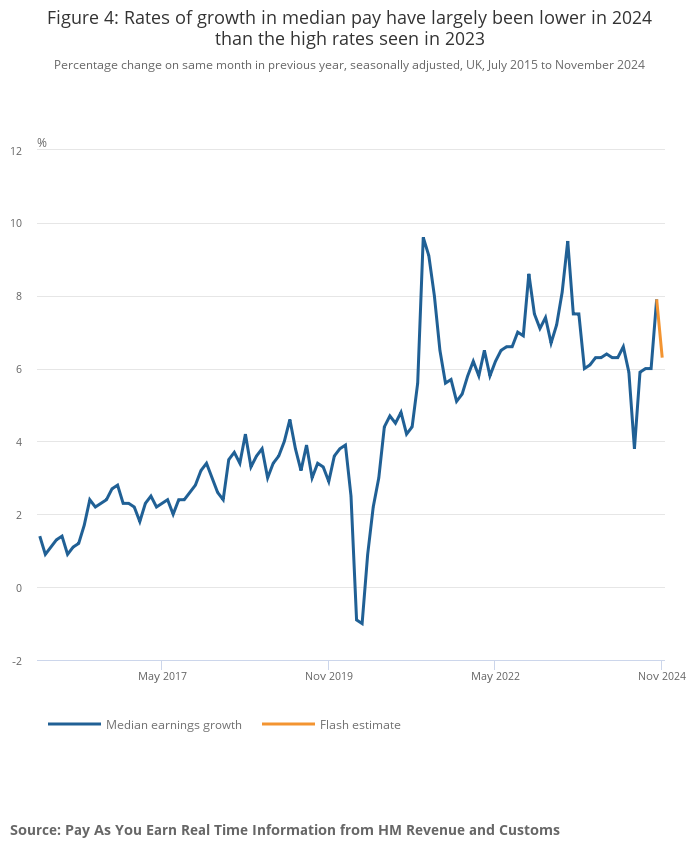

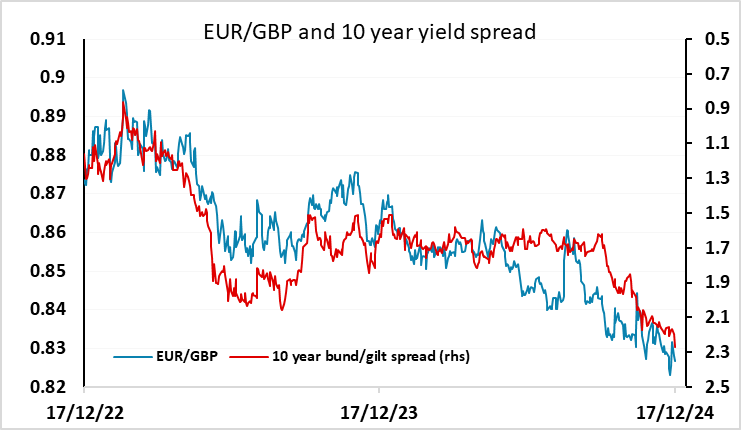

EUR/GBP dropped 20 pips in response to the UK labour market data released this morning. Most aspects of the data were on the strong side of expectations, notably average earnings growth, which showed a 5.2% rise y/y in the ONS data representing the 3 months to October, and 6.3% y/y in the HMRC data for November.

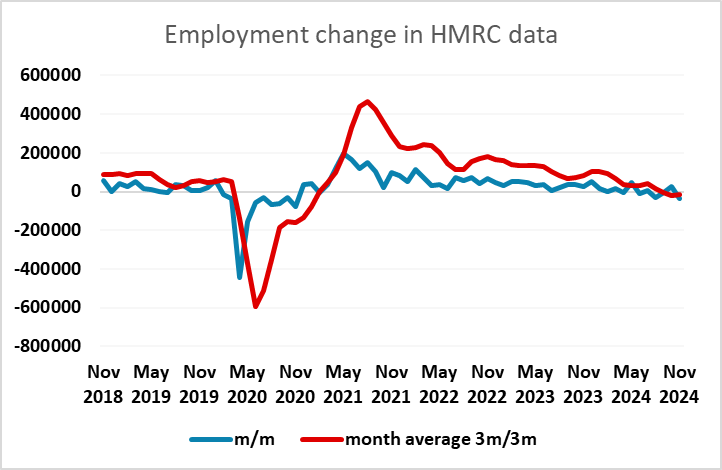

Employment growth in the ONS data was 173k in the quarter to October, but the HMRC data on payrolled employment shows a decline of 35k in employment in November, after a revised 24k rise in employment in October, and over the last 3 months employment has fallen an average of 16.6k per month. The ONS data includes self-employment, but is nowadays seen as unreliable due to small sample sizes, and the HMRC data is both more accurate and more up to date, so the underlying trend in employment does seem to be falling. Even so, the data on earnings is sufficiently strong to maintain the market’s scepticism about the potential for UK rate cuts, and GBP is consequently likely to remain well bid into the BoE MPC meeting this week.

The hawks on the MPC will also likely see the data as evidence that wage growth is too strong to allow anything more than very gradual easing, so for now EUR/GBP looks set to hold below 0.83.

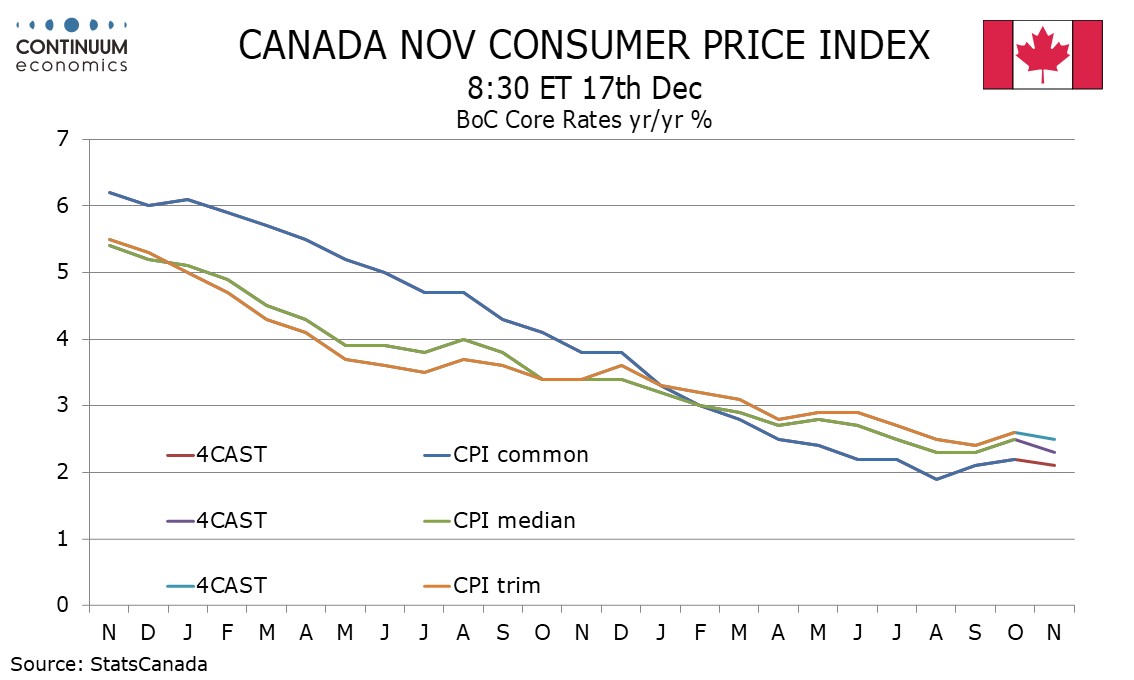

After an upward correction in October, we expect downward progress in Canadian CPI to resume in November, with the yr/yr rate slipping to 1.9% from 2.0%, while remaining above September’s 1.6%. We expect downward progress in the Bank of Canada’s three core rates to resume too. On the month we expect CPI to be unchanged on the month before seasonal adjustments with a 0.1% increase ex food and energy, though seasonally adjusted we expect both series to see gains of 0.2%. This would be the third straight 0.2% seasonally adjusted gain ex food and energy, implying a subdued underlying trend. The Bank of Canada’s core rates, measured on a yr/yr basis, bounced in October largely because October 2023 data was weak. With less weak year ago data dropping out in November we expect renewed slippage in the BoC’s core rates, CPI-Median to 2.3% from 2.5%, CPI-Trim to 2.5% from 2.6% and CPI-Common to 1.9% from 2.0%.

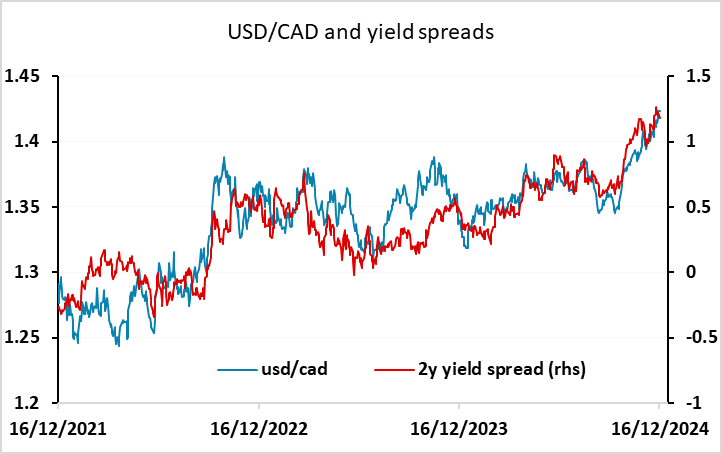

These forecasts are marginally weaker than the consensus, suggesting we could see some upward pressure on USD/CAD. The CAD already participated in the general USD gains on Monday, making another new post-pandemic high, and continues o move in line with the rising yield spreads in the USD’s favour. However, further gains are likely to prove more difficult, given the relative dovishness already priced into the CAD curve and the now quite restrained Fed cuts priced into the US curve. Additionally, speculative positioning remains extremely short CAD, so any USD/CAD gains from here may prove choppy.