EUR, JPY, SEK, NOK flows: EUR under pressure, SEK strength to fade

EUR under pressure on political uncertainty. Weak Swedish GDP should cap SEK

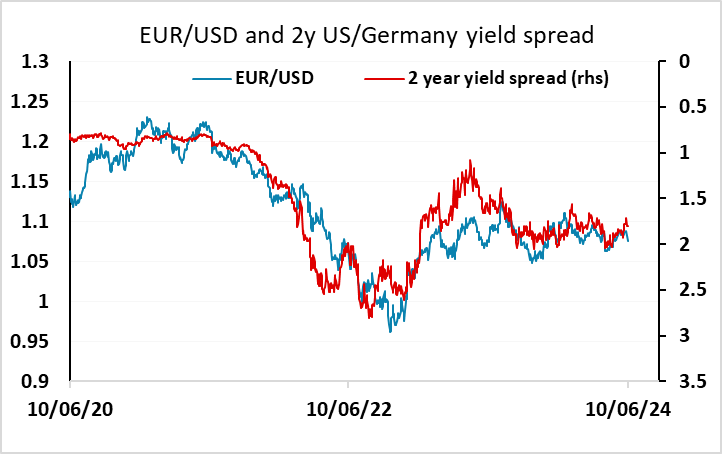

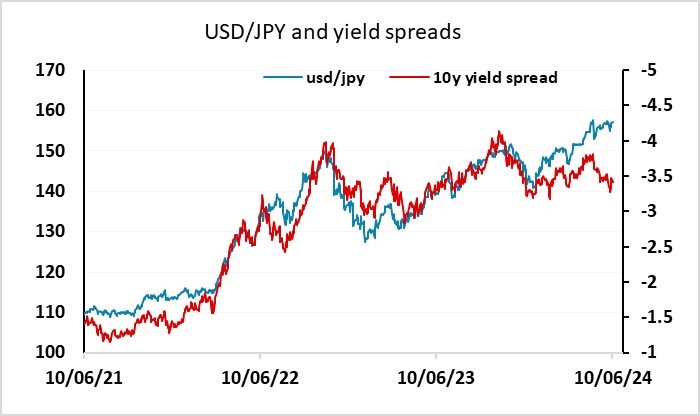

After the ECB meeting and US employment data at the end of last week, there is much less to focus on today with nothing of note on the Eurozone or US data calendar. However, the snap legislative election called by Macron in France at the weekend is keeping downward pressure on EUR/USD, which was already under pressure after the strong US employment report on Friday. The strong performance by right wing populist parties in the European elections means there is a risk of a similar outcome in the French elections, which might destabilise the Macron administration. Even so, while the USD has received a boost from the employment data and the political news, yield spreads have only moved modestly in its favour, and we doubt that there will be much more EUR/USD downside sub-1.0750. Similarly, USD/JPY has limited scope for gains above 157 for now. The focus no will be on the FOMC on Wednesday and the BoJ on Friday, with no change in policy expected at either meeting, but the market looking for signals for the policy trajectory in the second half of the year.

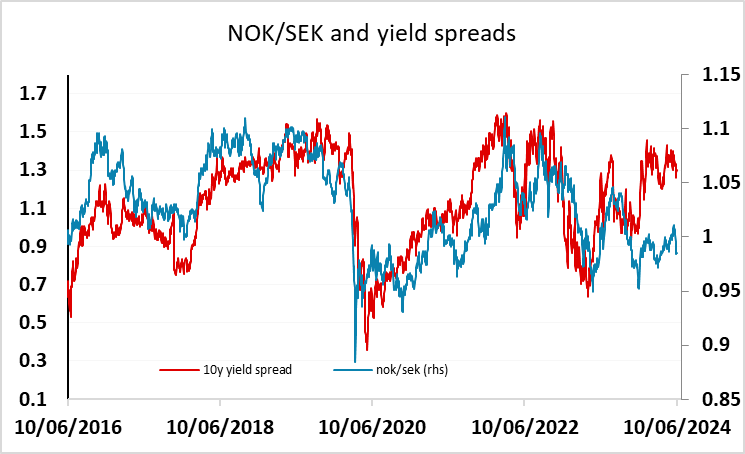

This morning has seen some data out of Norway and Sweden, with Norwegian CPI slightly on the soft side of expectations and April GDP data in Sweden very weak at -0.7% m/m. Although the monthly GDP numbers are quite volatile and subject to revision, the data may help to cap recent SEK gains against the NOK. Even though the Norwegian data is slightly on the soft side, it is unlikely to change the Norges Bank stance.