Published: 2023-12-14T12:14:57.000Z

GBP/USD, EUR/GBP flows: GBP gains as BoE remains relatively hawkish

Senior FX Strategist

-

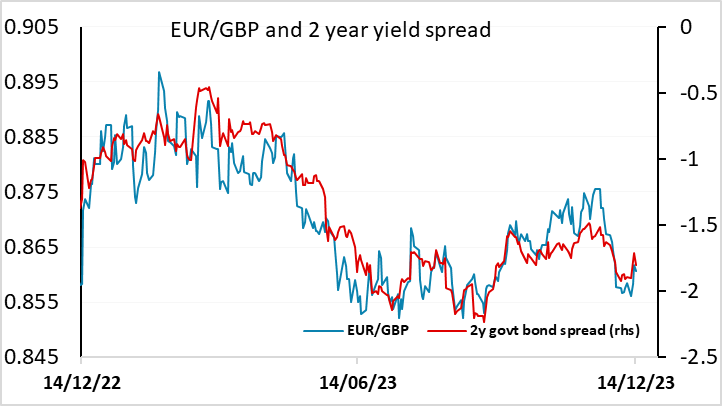

MPC still votes 6-3 for no change in rates. GBP and UK yields rise

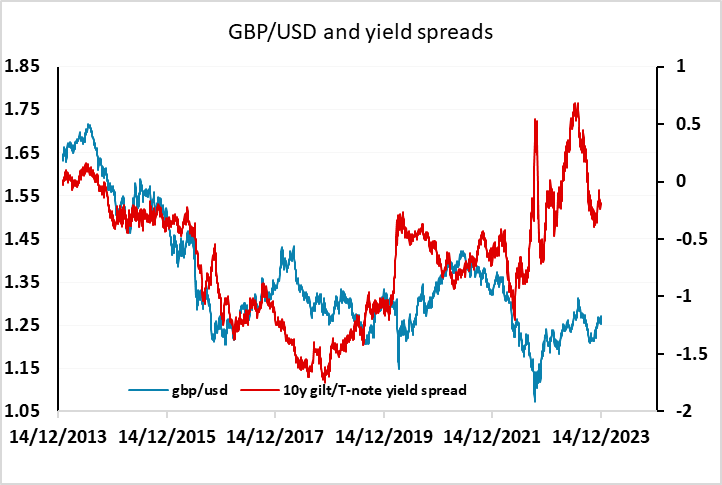

The Bank of England have left rates unchanged, but the decision was only carried 6-3 once again, with the three hawks continuing to vote for a rate hike. This has pulled GBP higher in response, with EUR/GBP dropping around 20 pips, as UK 2 year yields have moved around 5 pips higher. This only partially corrects the decline in UK yields seen since the FOMC decision last night, so the market is still pricing more easing than it was yesterday, but UK yields have moved up relative to the US and Eurozone. The implications are clearly GBP/USD positive, but less clearly EUR/GBP negative as the ECB may be similarly less dovish than expected. GBP/USD is in any case a long way below the level normally associated with current yield spreads. While there is still some risk premium associated with the UK because of the growth underperformance of recent years and perceptions of Brexit risk, this may start to be unwound and GBP/USD can move towards 1.30 as a first step.