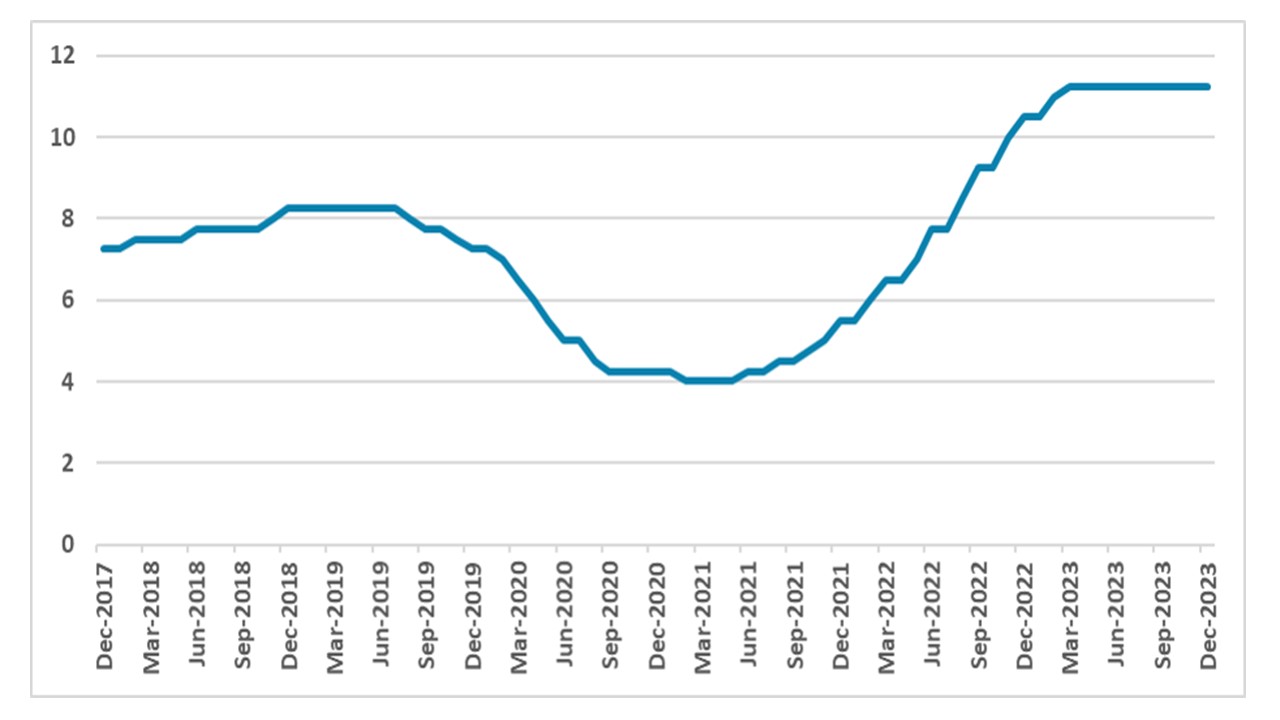

Banxico Review: No Cuts and Same Message

Banxico decided to maintain the policy rate at 11.25%. Despite positive notes on core CPI, rising inflation projections pose challenges. In the foreign market, Banxico noted global inflation decline, a weaker U.S. dollar, and reduced long-term maturities. Domestically, robust activity and a strong labor market persist. Although headline CPI increased, core CPI fell. Banxico signals potential cuts, with risks tied to a robust Mexican economy. We anticipate the first cut in February, with a three-cut strategy and a pause.

Figure 1: Mexico Policy Rate (%)

Source: Banxico

The Mexico Central Bank (Banxico) has decided on the policy rate (Overnight). The board has unanimously chosen to keep the Overnight unchanged at 11.25%. The communique has had a neutral tone; with positive news, there are comments on core CPI, which declined, while the bad news came from the rise of Banxico's inflation projections, although the convergence for the 3.0% target was maintained for the first quarter of 2025. Regarding the foreign market, Banxico stated that inflation has declined in most advanced economies while the policy rate remained unchanged. Additionally, the U.S. dollar has shown a generalized weakness in an environment of lower risk aversion. Long-term maturities have decreased compared to the last meeting.

Concerning the domestic economy, Banxico stated that activity continues to be robust, and the labor market is strong. Although headline CPI has shown a marginal increase, core CPI continued to fall. Despite the slowing pace of inflation, the outlook is positive, as there are currently no signs of pressures, although wage inflation presents double-digit inflation. Banxico has also maintained the same message from the latest meeting. Rather than stating that the policy rate will be kept at the same level for a prolonged period, they are now stating that the policy rate will be maintained at the current level for a certain period, which gives us the clue that cuts are coming.

The risk factor for Banxico is the current strength of the Mexican economy, especially given the higher demand for Mexican products from the U.S. Additionally, with the output gap now approaching positive values, demand pressures exist, making the task of disinflation tougher. Expectations also remain unanchored. In light of this decision, we have no reason to change our view that the first cut is likely to happen in February. Banxico has already cemented the path for cutting and has seen a good reaction in terms of inflation and the exchange rate. Our take is that Banxico will cut three times at a 50bps rate and then pause before resuming cuts at the end of the year.