Norges Bank Preview (Sep 18): Taking Foot Further of the Brake?

Recognizing the stronger than expected data seen of late (real and price-wise), we still see the Norges Bank cutting a further 25 bp at next week’s policy meeting. While still high, targeted (CPI-ATE) inflation is being boosted by stubborn services inflation, this partly offsetting ever softer goods and imported inflation, the latter coming in spite of the weak Krona backdrop that continues to influence Board thinking excessively. We are a little less confident about the extent of easing into 2026 but see another 25 bp cut likely in December and then every quarter through next year. That would still leave the policy rate roughly in the middle of the neutral rate range estimated by the Norges Bank. In other words, the Norges Bank will be merely taking its foot of the brake, rather than pressing on the accelerator.

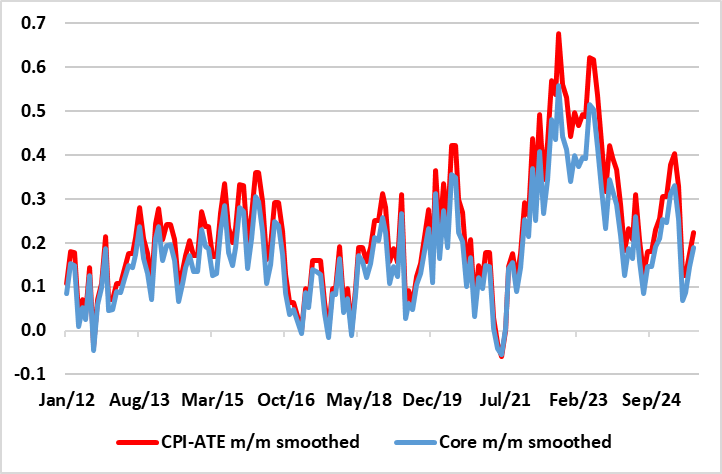

Figure 1: Underlying Inflation Consistent with Target in Adjusted Short-Term Dynamics

Source: Stats Norway, CE; core is CPI-ATE ex food

After the surprise 25 bp rate cut in June, it was back to humdrum predictability last month with the widely expected stable policy decision, leaving the policy rate at 4.25%. Regardless, the Board could be attacked for plagiarism given the manner in which the updated press release mimicked that seen in June, save for the fact that both are the production of a still cautious and hawkish Norges Board. As we have said before, we thought the Norges Bank’s unexpected easing in June was very much warranted, as are the further cuts being flagged in the Monetary Policy Report (MPR) that came alongside – ie up to two more such moves by end year.

The hawkish line still being pursued by the Norges Bank – whatever the decision this month –still only helps bring inflation in its view back to target only 2-3 years hence, at least according to its updates MPR. Obviously, it has been swayed by softer CPI data and by what was, then, a more stable exchange rate, and perhaps a realization that amid the downside risks facing the European economies it is better to take out policy insurance sooner than later. Admittedly, Norway is at least in a better situation than some other economies regarding the U.S. tariff threat. It now faces a 15% tariff but did not cave in to pressures regarding (vague) promises to both invest in the U.S. and purchase goods.

Regardless, as for inflation, we think that the Norges Bank is still being too cautious, even though we would not disagree materially with its upgraded 1.6% and 1.4% GDP projections for the year and next rate – projections that are likely to be repeated in the updated Monetary Policy Report due alongside this month’s decision. Even so, it does seem as if the Board now echoes our thinking in seeing a larger and earlier output gap. Indeed, we think the latter is partly responsible for the marked fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Notably, although seemingly suggesting price persistence, August data shows that despite targeted inflation (CPI-ATE) staying at 3.1%, chiming with Norges Bank thinking, the details, CPIF and core inflation (ie the former ex food) are running at rates more consistent with the 2% target on an adjusted and smoothed m/m basis.

How Restrictive?

But regardless of the output gasp, to what degree has this fall back in inflation, to rates actually below that consistent with the 2% remit, reflected policy action. In this regard, it is helpful to look at neutral rates, albeit with the proviso that looking purely at policy rates can be misleading. Regardless, the Norges Bank has published a most likely interval for the neutral rate. During the past two years, the Bank has revised up the assessed interval of r∗. but this still leaves its estimate of the neutral real policy rate between 0.25% and 1.5%. All its models estimate that the neutral rate has risen above zero, but that the average estimate of the neutral rate is around 0.4 percent, which indicate that an assumed inflation on target backdrop would mean policy is very restrictive, by almost two full ppt!