FX Daily Strategy: Asia, January 7th

AUD well supported regardless of CPI if risk appetite remains strong

USD and equities could be sensitive to non-manufacturing ISM

GBP strength looks excessive

EUR also starting to look toppy

AUD well supported regardless of CPI if risk appetite remains strong

USD and equities could be sensitive to non-manufacturing ISM

GBP strength looks excessive

EUR also starting to look toppy

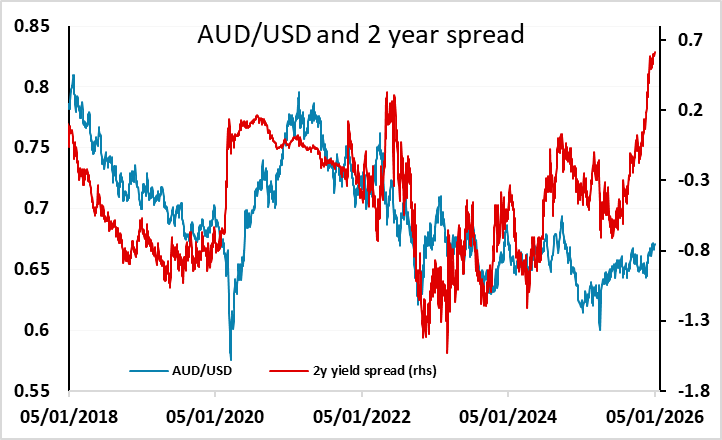

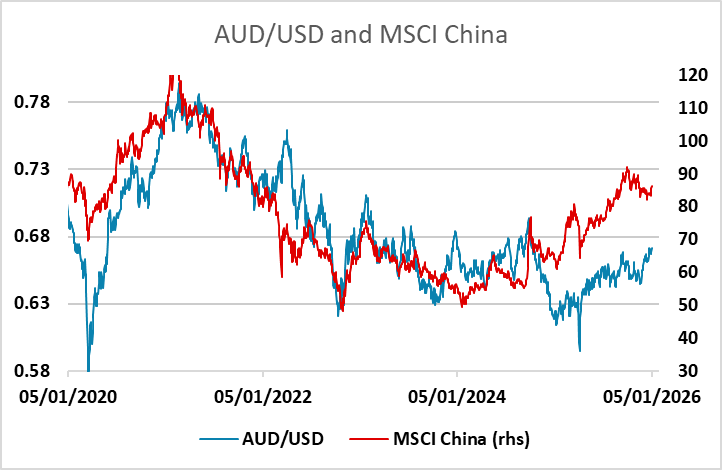

First up on Wednesday we have Australian CPI data for November, but right now the AUD should be quite resilient in the face of domestic news, as there is already strong support for the AUD based on current yield spreads. But whether the AUD can continue to advance to new highs looks likely to depend on global equity market performance more than domestic data, with recent AUD/USD moves tending to correlate with moves in global equities. We like the AUD as the best of the riskier currencies, but against the safer havens it is likely to require positive risk appetite to extend recent gains.

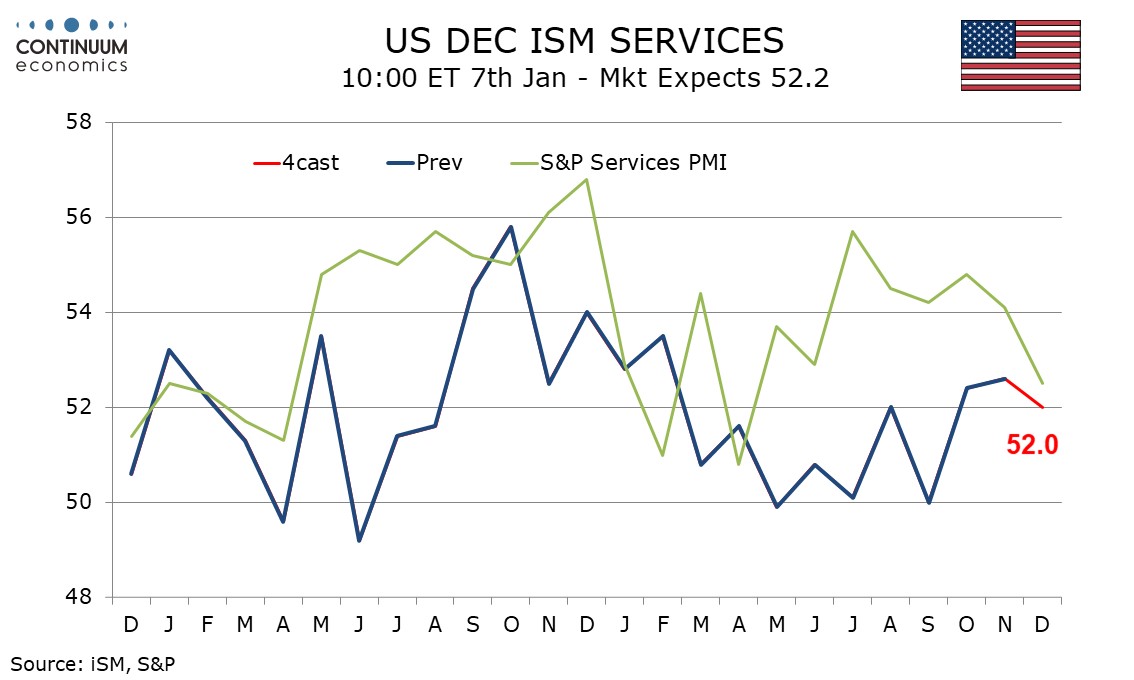

Wednesday sees non-manufacturing ISM, which is the more important of the ISM surveys given the relative size of the service sector. We expect December’s ISM services index to slip to 52.0 from November’s 9-month high of 52.6. A weaker December S and P services PMI suggests downside risk even if its level at 52.9 remained above November’s ISM services index, but the correlation between the two is weak. There is still a general impression of a solid US economic picture, supported by the latest GDP data, but the Q2 and Q3 GDP numbers were no doubt flattered by the weakness in Q1. Weak survey data that suggests a slowdown ought now to challenge the heady heights that the equity market has reached, with history suggesting it only requires a mild slowdown to trigger a significant equity correction from here.

We would therefore be a little wary of the risk positive FX moves we have seen at the beginning of the year, particularly the strength in GBP, as the UK economic data doesn’t justify much confidence, and GBP is already at quite high levels against a range of currencies, notably the JPY. While a comparatively hawkish Bank of England justifies some GBP resilience, we doubt this will last long into the year if the UK data continues to show weak/no growth and declining wage and price pressures. GBP hit its highest level since September against both the USD and EUR on Tuesday, and GBP/JPY hit is highest since 2008! It’s hard to see value in the pound here, and there should be vulnerability if there is any weakening in risk sentiment.

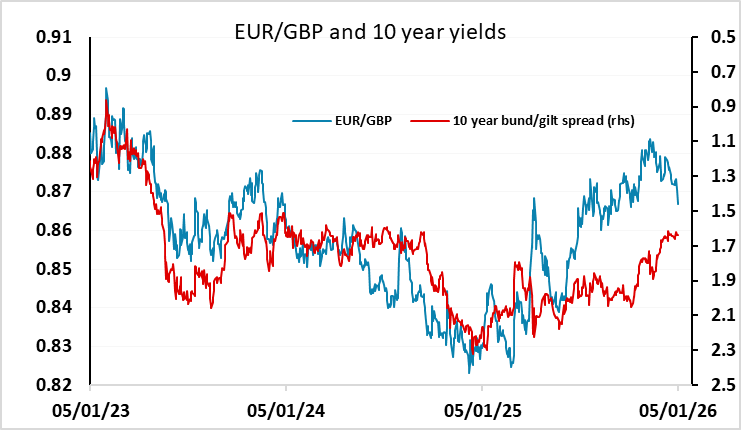

The EUR is also showing some signs of topping out after a strong performance in 2025. The weaker than expected French and German preliminary December CPI data on Tuesday combined with the downward revision in the S&P December PMI support our view that there is scope for further ECB easing through 2026, despite the very flat EUR curve (see here). This should allow some re-widening of the USD/EUR yield spread, unless we see similar weakness in the US, in which case some EUR weakness might be seen on the back of an equity market correction. So either way, the EUR/USD risks look to be to the downside from here, and while there is technical support around 1.1600-1.1650, a break of this level could target a move to 1.14.