FX Daily Strategy: Europe, May 22nd

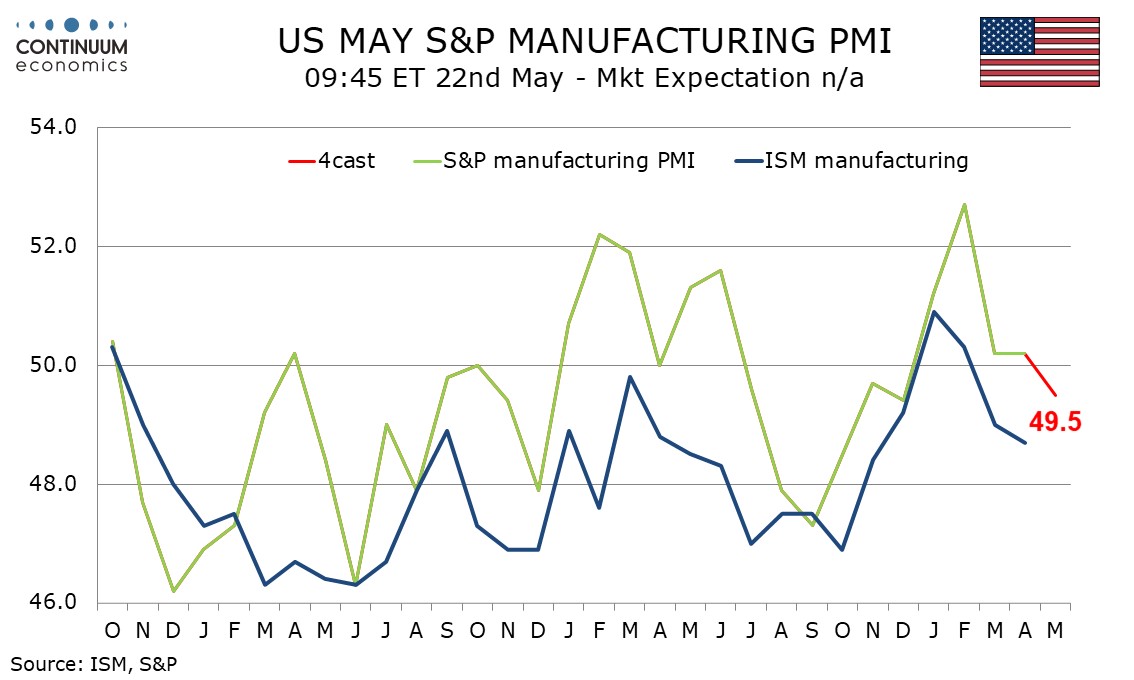

U.S. May S&P Manufacturing PMIs to slip below neutral, Services to hold above

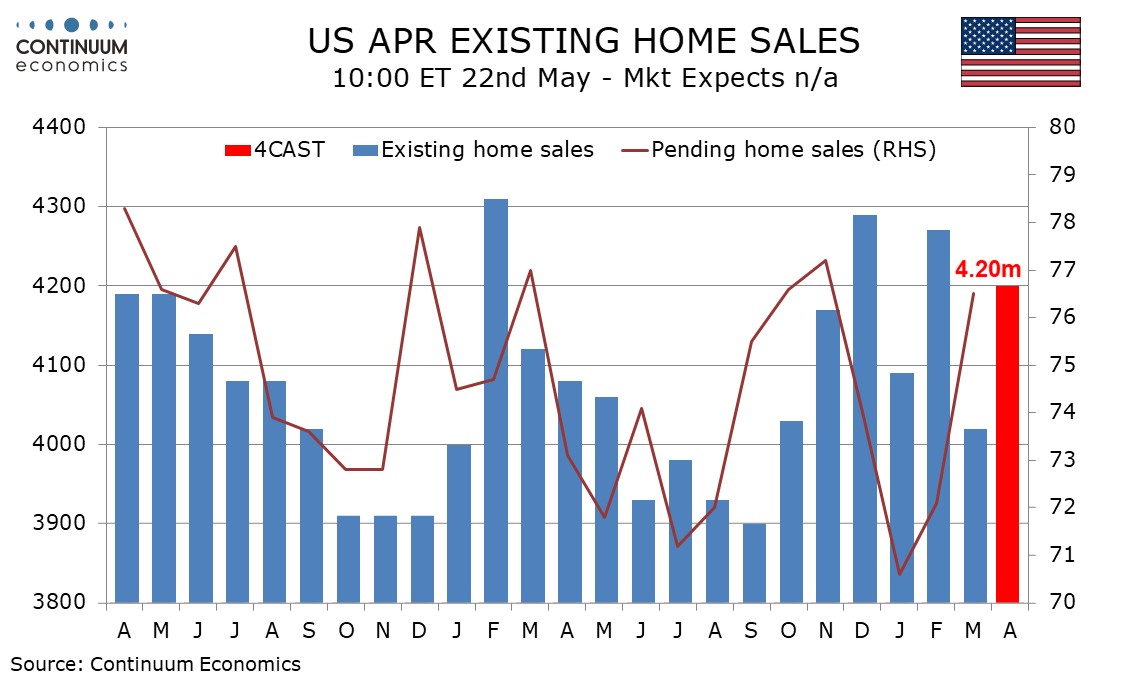

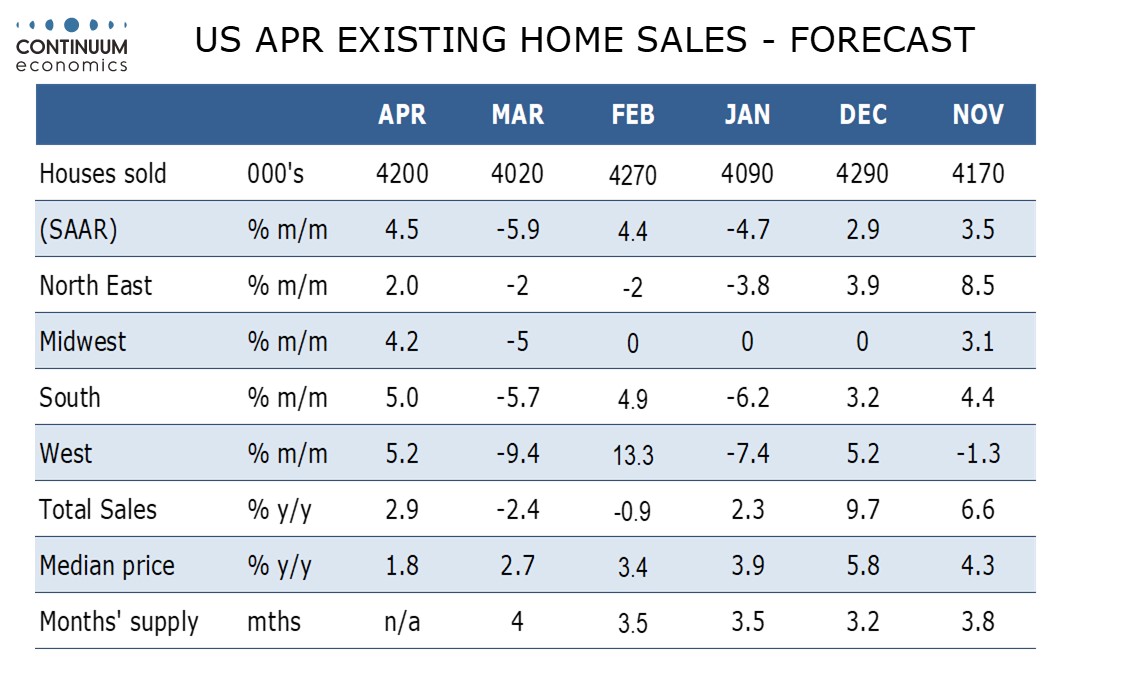

U.S. April Pending home sales suggest a rise

G7 Meeting Headlines May Affect Sentiment

USD/JPY Looking to Retest April Low

We expect May’s S&P PMIs to show slippage in manufacturing, to 49.5 from 50.2, but a correction higher on services, to 51.5 from 50.8. Underlying momentum in both series appears to be slowing, though this may fade if trade uncertainty is reduced. Manufacturing was unchanged in April, after showing an increase in the preliminary release, and that contrasted weaker data from the ISM and most regional manufacturing surveys. That suggests slowing is likely in May’s S and P index. Reduced tariffs on China may reduce the downside risk, but probably came too late to give the index a lift.

A modest rise in the S and P services index would put it at a level consistent with April’s ISM services index, though most regional service surveys were weaker in April. The ISM and S and P services indices have been volatile with monthly moves often in opposite directions, but both have moved off recent highs as tariff fears have undermined consumer confidence, while holding above the neutral 50.

We expect April existing home sales to rise by 4.5% to 4.20m, which would not fully erase a 5.9% decline seen in March. Sales would then be up 2.9% on a yr/yr basis, after two straight negatives. Pending home sales, designed to predict existing home sales, saw a strong 6.1% increase in March. However we do not see existing home sales quite returning to February’s level with February data having had a recent tendency to come in above trend. Pending home sales are still below November’s level and we expect April existing home sales to underperform December’s 4.29m pace. April data from the MBA and NAHB surveys did show some improvement, but gains were far from impressive.

We expect the median price to see a 2.5% increase on the month, but this would be largely seasonal. We expect yr/yr growth to extend a recent slowing, to 1.8% from 3.7%. This would be the weakest since July 2023.

The G7 meeting may come up with some interesting headlines. While the U.S. has mentioned there will be no trade deal announcement in the G7 summit, the stance of Japan seems to have tilted lately. Japan was originally asking for a full exemption of tariffs, especially for autos and agriculture product but the latest remark from economic minister is showing signs that Japan will be willing to accept the minimal level of tariffs to keep the ball rolling. Japan FM Kato also bring up FX for discussion in his latest comment when previously he has openly rejected the idea of leveraging JPY for a trade deal. Such change of stance could facilitate a middle ground to be met between the U.S. and Japan for another trade deal. Japan has announced they will resume talk after the G7 summit.

Apart from the U.S., the G7 are reported to be in discussions over coordinated tariff measures targeting low-value Chinese imports. Canadian FM François-Philippe Champagne confirmed that talks are underway and could pave way similar to the U.S. removal of "de minimis" exemption for Chinese import tariff. While it will have inflationary complication, market participants will likely be wary of Chinese retaliation. Market has been in a cheerful mood since the de-escalation of U.S.-China relationship earlier in May. Any Chinese retaliation could be a shock to those would are too optimistic and see a chance in market sentiment.

On the chart, prices remain under pressure to extend rejection from the 148.65 high of last week and see support at 144.00 under threat. Negative intraday and daily studies suggest consolidation here expected to give way to selling pressure to open up room for extension to support at 142.35/142.00 congestion area. Below this will return focus to the 140.00, April YTD low. Meanwhile, resistance is lowered to the 145.50 high of Tuesday and this extend to the 146.00/146.55 area. The latter is expected to cap corrective bounce and sustain losses from 148.65 swing high.

USD/JPY has retraced from the monthly high as market participants turns toward offering USD on Moody's downgrade of U.S. rating. The knee-jerk jump has been partially reversed and see fresh wave of USD bids dried up. The consolidation in U.S. equities also did not help as the initial euphoria on U.S.-China's defrosting fades and see less offer in the JPY end. Looking forward, it is still likely USD will be in the driving seat. Few market participants are seeing an imminent hike from the BoJ and given the current trade complication, our central forecast only see another hike to come after a trade deal is reached, likely around July. The USD will be more vibrant from yields changes and the broad risk atmosphere.

On the chart, the greenback is under pressure as prices extend break of the 2024 year low at 100.15 and the 100.00 congestion. Negative daily studies keeps pressure firmly on the downside to extend pullback from the 102.00 high of last week and see room to 99.00 congestion. Below this will see retest of the 98.00 level and 97.92, 21 March YTD low. Break here will further extend the broader losses from 114.78, September 2022 multi-year high. Meanwhile, resistance is lowered to the 100.00/100.15, congestion and September 2024 year low, which is expected to cap.