FX Daily Strategy: Asia, February 14th

GBP strength may moderate on CPI

Declining risk premia also supporting GBP and other risky currencies…

…but are at levels which suggest danger of an equity correction is rising

JPY preferred to CHF as safe haven if risk premia rise

GBP strength may moderate on CPI

Declining risk premia also supporting GBP and other risky currencies…

…but are at levels which suggest danger of an equity correction is rising

JPY preferred to CHF as safe haven if risk premia rise

After Tuesday’s strong US CPI, Wednesday sees UK CPI. UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%, the first rise in 10 months, while the core rate remained at 5.1%, still a 23-month low. We see both the headline and core begun unchanged on a y/y basis in the January data with services inflation boosted by adverse base effects around airfares but this being offset by lower food and non-energy goods price pressures (developments that chime with BRC survey numbers) as well as further falls in petrol prices.

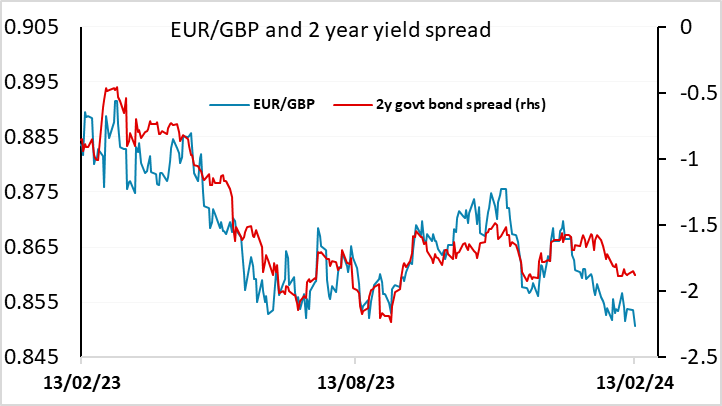

The market consensus is slightly on the strong side of our forecasts, looking for a 0.1% rise in the y/y rate in both the headline and the core to 4.1% and 5.2% respectively. After the stronger than expected US numbers on Tuesday, and UK labour market data that was also on the strong side of consensus, the market may now be primed for an even stronger number, with UK 2 year yields gaining 8bps on Tuesday and the first full rate cut now not priced in until August. Our forecasts consequently suggest some downside risks for GBP. EUR/GBP continued its downtrend for the year on Tuesday after the UK labour market data, just holding above 0.85, but with EUR/GBP trading below the level implied by yields spreads, and little further downside for UK yields, the dip to 0.85 may prove to be a medium term buying opportunity.

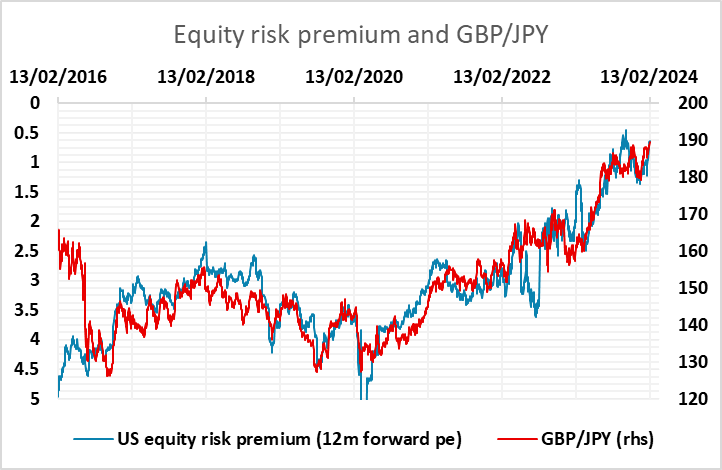

The picture for GBP and the other risky currencies will also to some extent be determined by general risk appetite. GBP/JPY hit its highest since August 2015 on Tuesday, and as with many other JPY crosses, continues to hold a strong correlation with the US equity risk premium. While equity indices fell back on Tuesday after the US CPI data, the equity risk premium actually fell slightly further because the decline in equities didn’t fully offset the rise in US yields. As long as equity markets are resilient to rising yields, risky currencies will remain well supported. But risk premia are now very,very low, below the levels seen before the GFC, and this remains hard to justify given growth prospects are moderate at best starting from a level close to full employment. So we are becoming wary that as the market reduces rate cut expectations, equities will start to suffer more.

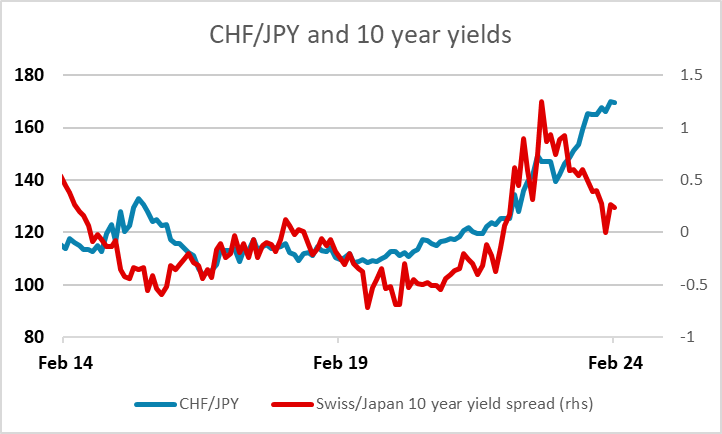

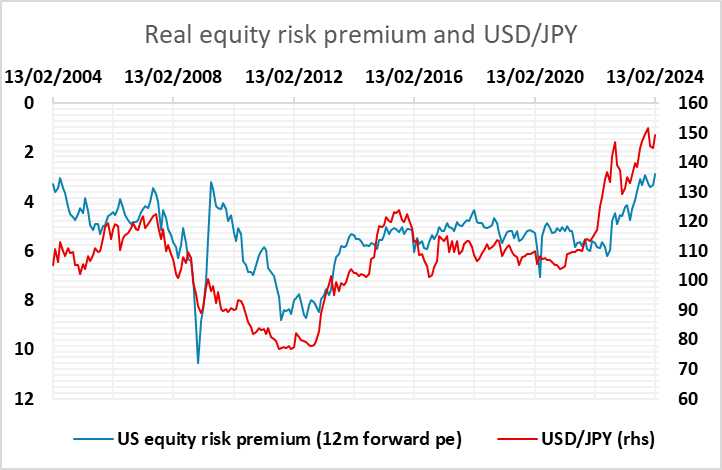

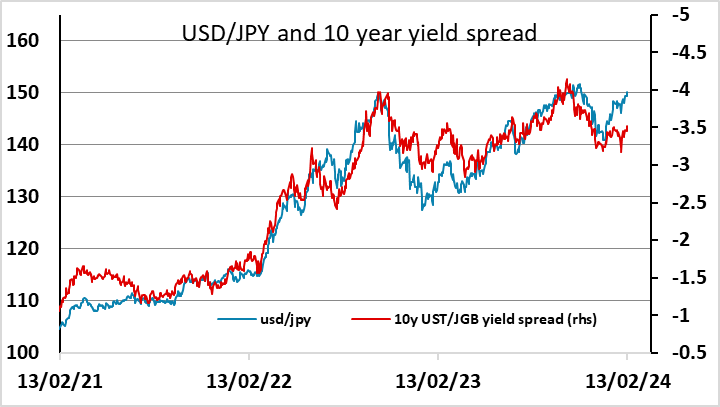

This suggests that JPY weakness is also likely to be on its last legs, especially given the prospect of a BoJ exit from ultraeasy policy in the spring. Yield spreads already suggest USD/JPY is overdone above 150, and it looks to be primarily the strength of the equity market and the decline in risk premia that is keeping the JPY bear trade afloat. The CHF also suffered on Tuesday, with weak Swiss CPI contrasting with the strength in the US, but there is a much stronger case for CHF weakness than JPY weakness given the strong CHF starting levels and the probability that SNB and BoJ policy will be moving in opposite directions, from the spring, favouring the JPY.