USD flows: USD slightly firmer despite softer data

ADP and initial claims both suggest mild labor market weakness, but USD resilient

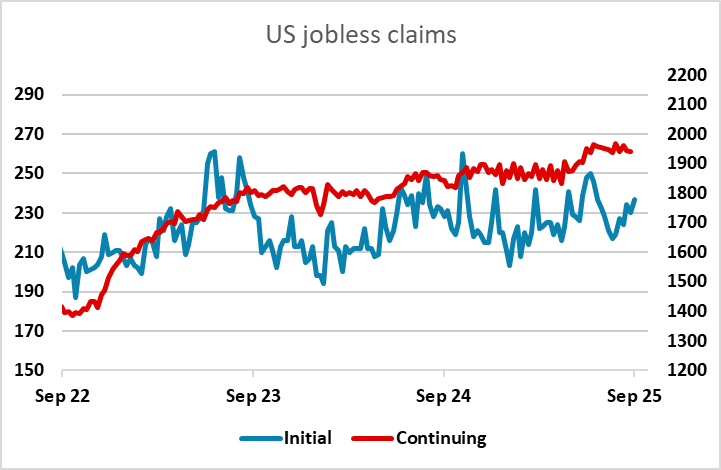

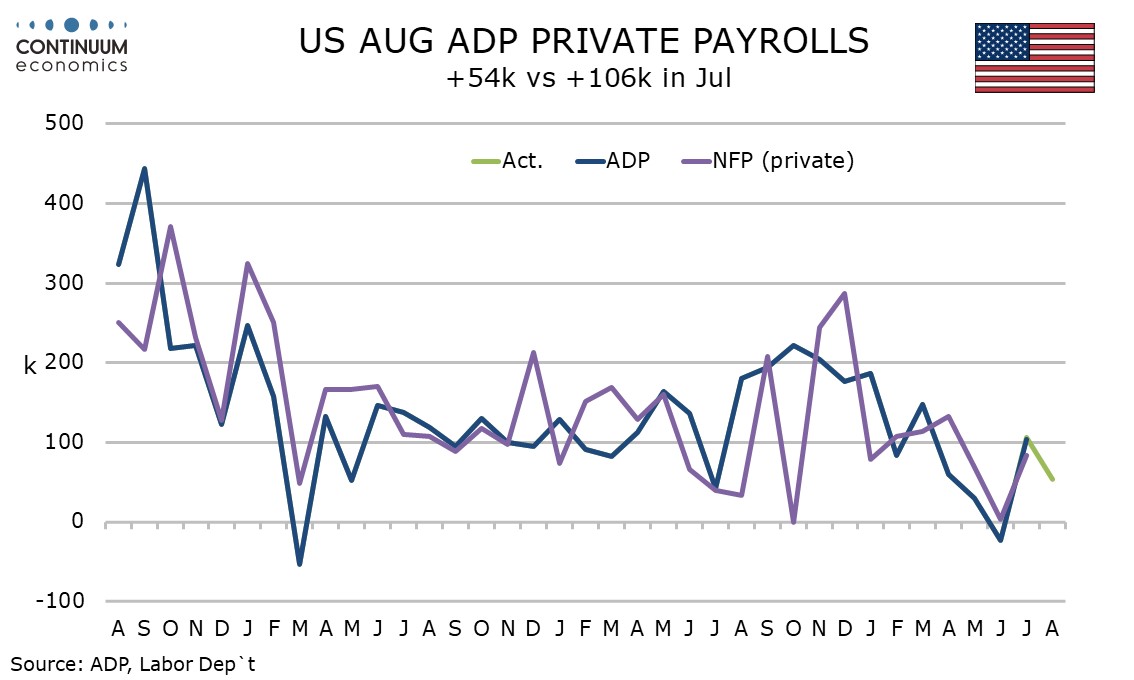

US data generally on the soft side of consensus, albeit only modestly. The ADP employment number was slightly below consensus at 54k, while initial claims were higher than expected at 237k and unit labour costs lower than expected at 1.0% in Q2. While continuing claims were slightly below expectations, the general tone is of weaker activity data and lower costs, suggesting scope for Fed easing. However, the USD has rallied on the second set of data after initially dipping a little on the ADP numbers. US yields are a little lower on the day, but the decline came before the data. It’s hard to justify USD gains on this set of data, but the data also aren’t notably weak, only marginally so. Reaction may suggests some short positioning into the numbers. But it’s hard to see any major moves away from current ranges ahead of the employment report tomorrow in the absence of a shocking ISM services number later.