Published: 2025-04-29T12:07:16.000Z

Preview: Due April 30 - U.S. Q1 Employment Cost Index - Slowing trend, though still above pre-pandemic pace

-

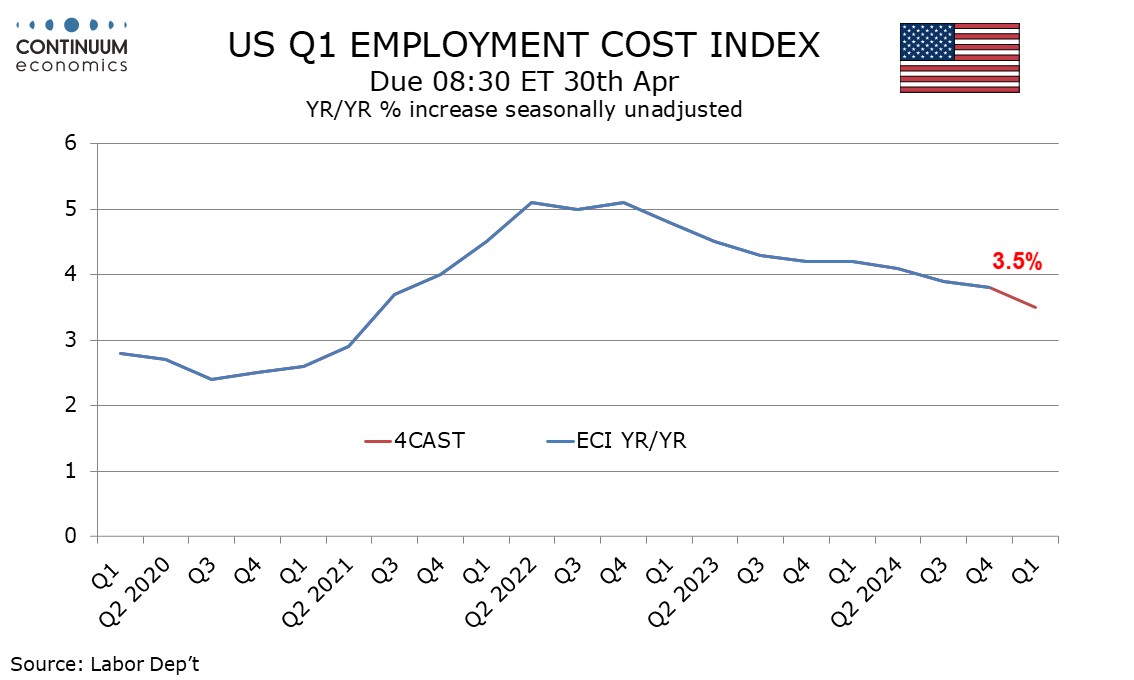

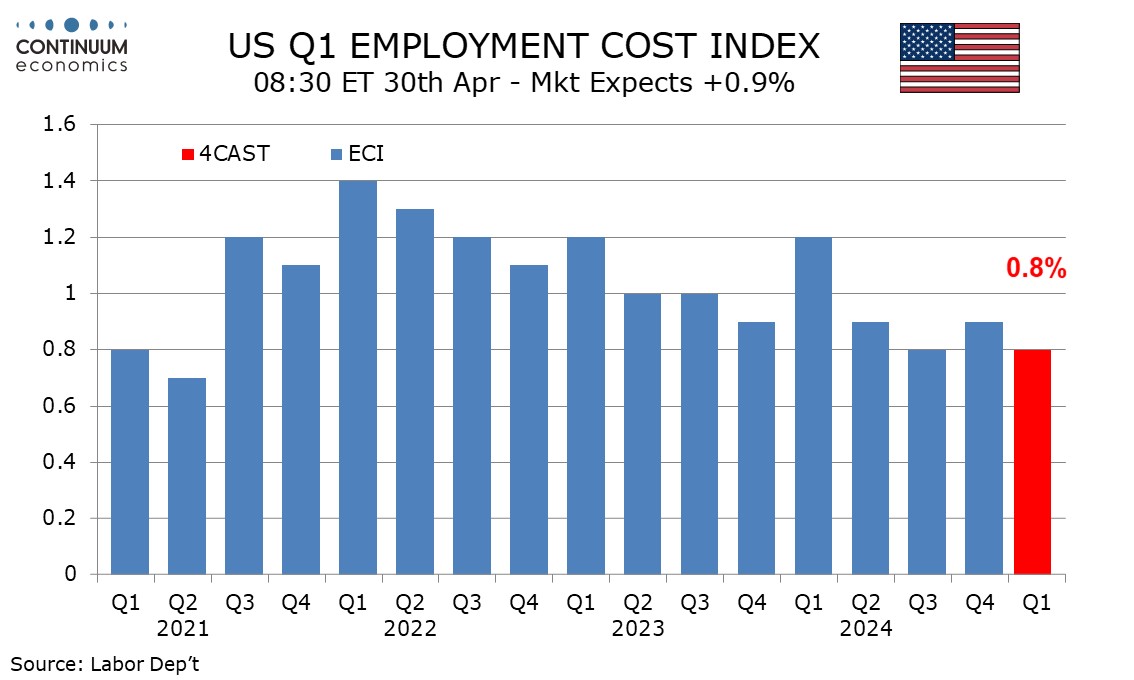

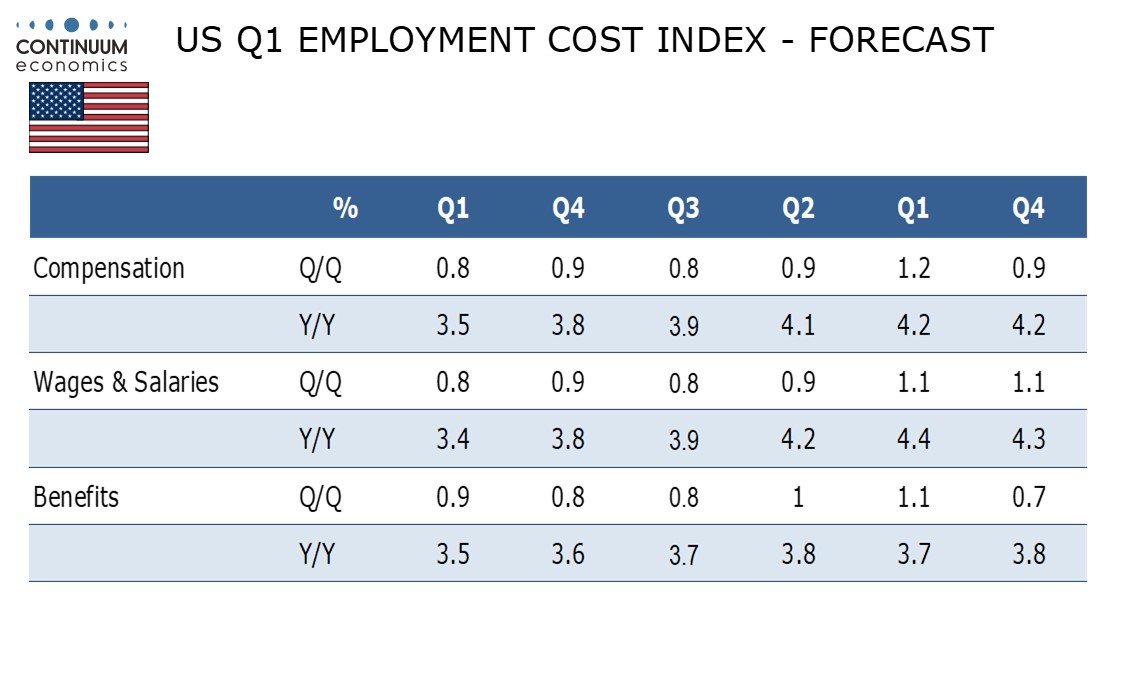

We look for the Q1 employment cost index (ECI) to increase by 0.8%, on the low side of recent trend. This would see yr/yr growth slow to 3.5%, the slowest since Q2 2021, from 3.8%.

Yr/yr growth peaked at 5.1% in the Q2 and Q4 of 2022, but remains above a sub-3.0% trend seen during the pandemic. Still, inflationary risks are not being led by the labor market.

Payroll average hourly earnings saw a strong January but subdued February and March data, leaving a modest slowing in the quarter. We expect wages and salaries to rise by 0.8% after a 0.9% increase in Q4.

Annual updates of health insurance premiums means more scope for an out of trend number from benefit costs, but medical care CPI data is giving no strong signals. The last three Q1s saw benefit costs above trend, but we expect only a marginal acceleration this Q1, to 0.9% after two straight gains of 0.8%. Wages and salaries have a larger weighting than benefit costs.