FX Weekly Strategy: February 26th - Mar 1st

Inflation data the main focus this week

Further declines likely, suggesting stronger equities

USD and JPY likely to struggle as a result

NZD may suffer if RBNZ stay on hold

Strategy for the week ahead

Inflation data the main focus this week

Further declines likely, suggesting stronger equities

USD and JPY likely to struggle as a result

NZD may suffer if RBNZ stay on hold

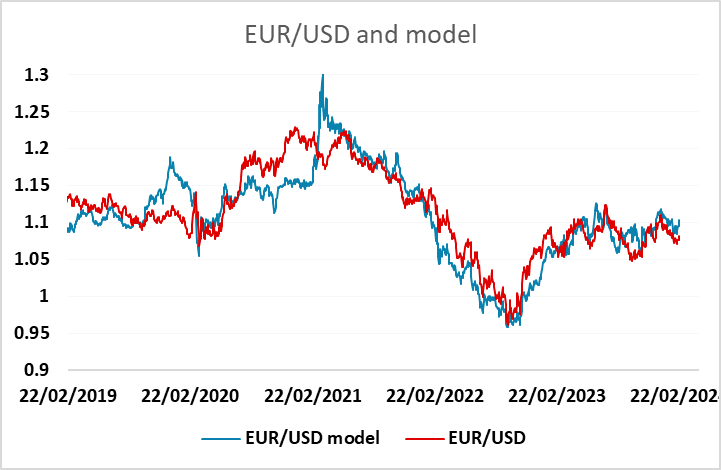

Inflation numbers are the main data this week, but don’t come until the end of the week, with Eurozone HICP on Friday, following the German CPI data and the US PCE deflator on Thursday. We are looking for generally soft numbers, with the PCE deflator coming in at 0.3%, slightly below the market consensus of a 0.4% rise, while we are in line with the consensus expectation for Eurozone HICP to fall to 2.5% headline and 2.9% core on a y/y basis. This further evidence of slowing inflationary pressures should be supportive for equities and likely negative for the USD, both because it allows expectations of a May or June Fed rate cut to be sustained and because of the negative USD correlation with equities.

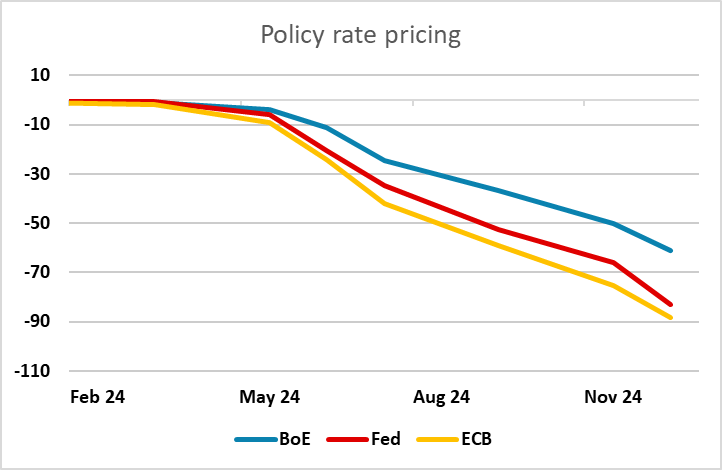

In practice, it is unlikely that we will see the Fed cut as early as May. As it stands, the market is only pricing this as around a 20% chance, with an 80% chance of a June cut, but soft PCE inflation numbers should mean these probabilities hold at these levels or move higher. There is a little more chance of an earlier cut from the ECB. A June ECB cut is near enough fully priced, but an April cut remains an outside chance at around a 35% chance. Despite some hawkish comments from Bundesbank president Nagel last week, who indicated he wanted to see Q2 data before thinking of lower rates, the latest ECB account suggested that there will be discussions of a rate cut at the March meeting, opening potential for a cut in April. The possibility of faster ECB cuts might be seen as EUR negative, but this isn’t 100% clear given the impact of equity markets on the USD. While there is some scope for widening of spreads in the USD’s favour, earlier rate cuts driven by lower inflation will tend to mean better equity market performance, particularly in Europe, which is typically EUR supportive. For now, we tend to favour the EUR upside in a declining inflation, rising equity market environment.

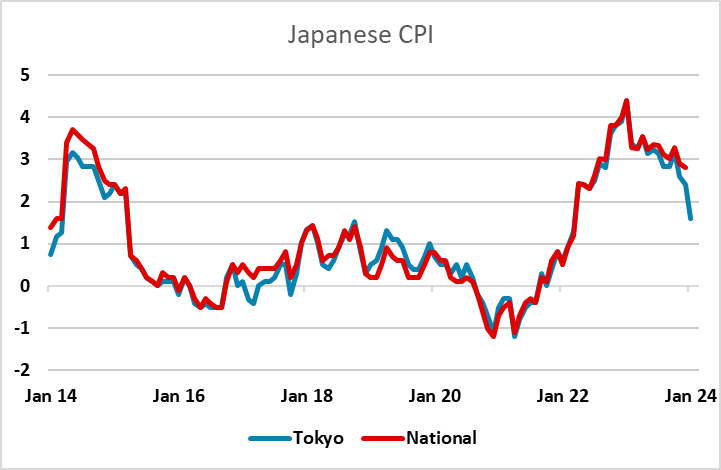

However, the inflation data doesn’t come until the end of the week and there isn’t much on the calendar to excite the market ahead of these numbers. While we do have Japanese national CPI on Tuesday (Japan time), the Tokyo CPI data typically provides a strong lead on the data, and this was very weak in January, with the headline falling to 1.6% from 2.4%. A sharp decline is consequently also likely in the national numbers, but the market may be looking for a slightly less precipitous decline. JPY weakness was a theme in the last week, and another weak CPI number is unlikely to halt that trend. The main hopes of a JPY recovery rest on either tighter BoJ policy, weaker equities, or lower yields elsewhere. The CPI data are unlikely to lead to expectations of a tighter BoJ, so the JPY is likely to remain soft ahead of the Eurozone and US inflation numbers later in the week. While there is some sensitivity to the strength of USD/JPY, with some jawboning from the MoF suggesting intervention is a possibility, there is probably more scope for the JPY to move lower on the crosses, particularly if equities remain firm. The EUR/JPY post-GFC high of 164.30 form November is a target.

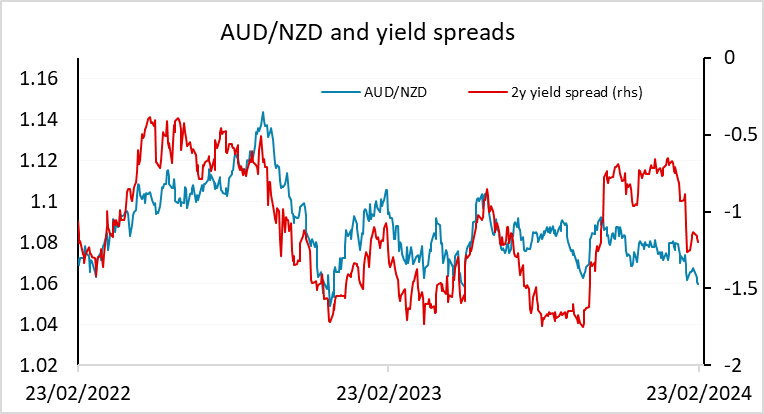

On Wednesday morning we have the RBNZ decision, which the vast majority of forecasters expect will produce no change in rates. ANZ is the only one of the 28 forecasters surveyed by Reuters to look for a 25bp hike, but the market is pricing in a more significant risk, with a hike priced as around a 30% chance. We don’t expect a move, and given the pricing this suggests there are some downside risks for the NZD, which may halt the recent decline in AUD/NZD and trigger a bounce back above 1.06.

Data and events for the week ahead

USA

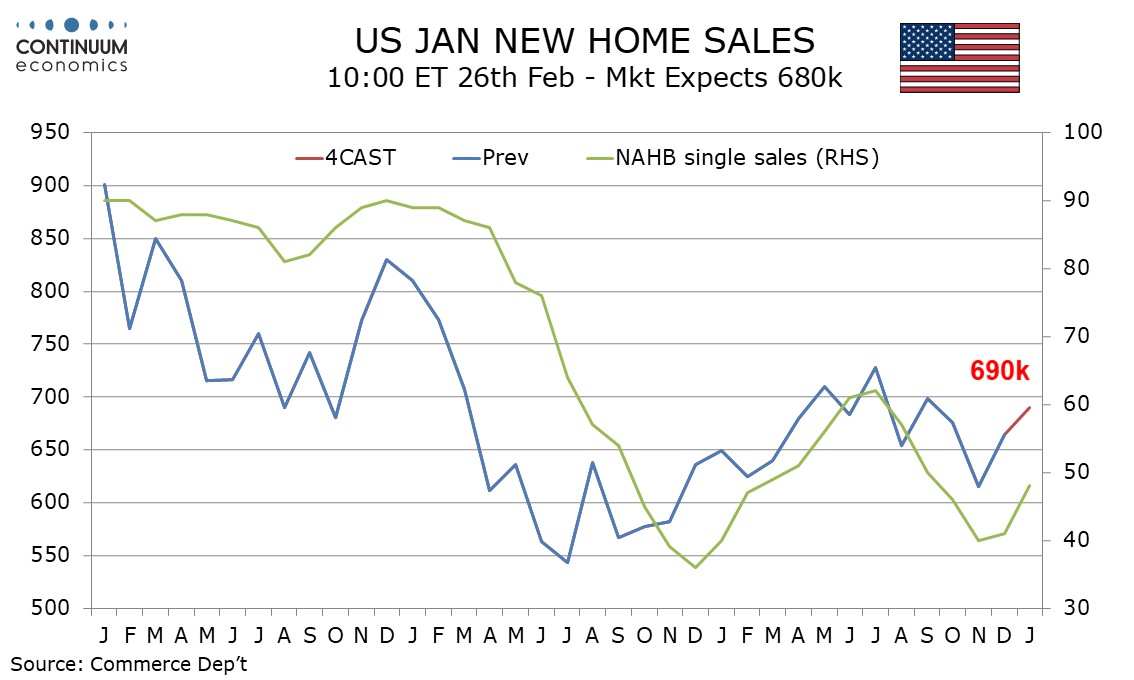

In the US, Monday sees January new home sales where we expect a 3.9% increase to 690k. On Tuesday we expect aircraft to lead a 6.5% fall in January durable goods orders though we expect ex transport orders to be unchanged. Also due on Tuesday are December house price data from FHFA and S and P Case-Shiller and February consumer confidence. On Wednesday we expect only a marginal revision to Q4 GDP, to 3.2% from 3.3%, and a wider advance January goods trade deficit of $89.2bn from $87.9bn. Fed’s Bostic, Collins and Williams are all due to speak.

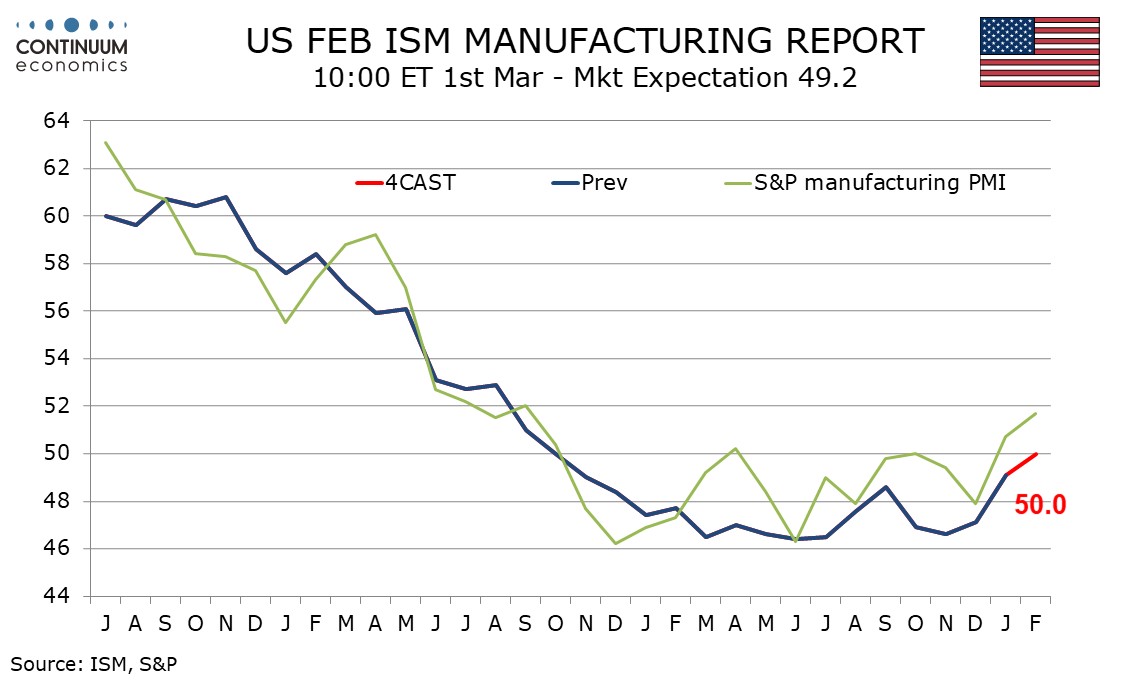

The week’s most significant release may be Thursday’s core PCE price index for January, where we expect a rise of 0.3%, stronger than recent trend but not as strong as the 0.4% January core CPI. We expect subdued gains of 0.2% in personal income and 0.1% in personal spending. Weekly jobless claims are due at the same time. January pending home sales follow, while Fed’s Goolsbee and Mester are due to speak. On Friday we expect February’s ISM manufacturing index to rise to a neutral 50.0 from 49.1. January construction spending and the final February Michigan CSI are also due while Fed’s Williams and Daly are due to speak.

Canada

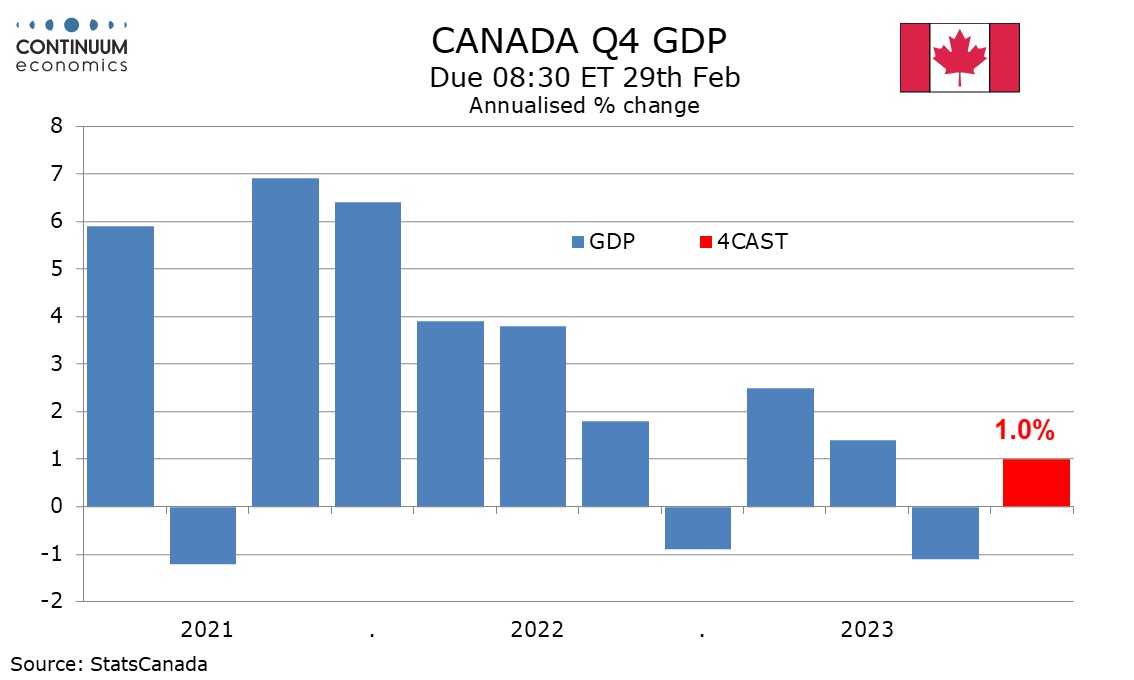

Canada releases Q4 current account data on Wednesday and Q4 GDP on Thursday. We expect Q4 GDP to rise by 1.0% annualized, largely reversing a 1.1% decline in Q3 and exceeding a flat BoC projection made in January. We expect monthly data to show December matching November’s 0.2% increase.

UK

The data highlight this week is on Thursday with fresh BoE-compiled money and credit data that may be of increasing importance. Firstly, they will show the extent to which cash-strapped households are still turning to borrowing to fund everyday spending. But secondly, they will highlight how BoE balance sheet reduction is having a wider impact, given the drop in bank deposits that has occurred if late, the question being to what extent is this adding to downward pressure on private sector credit.

Eurozone

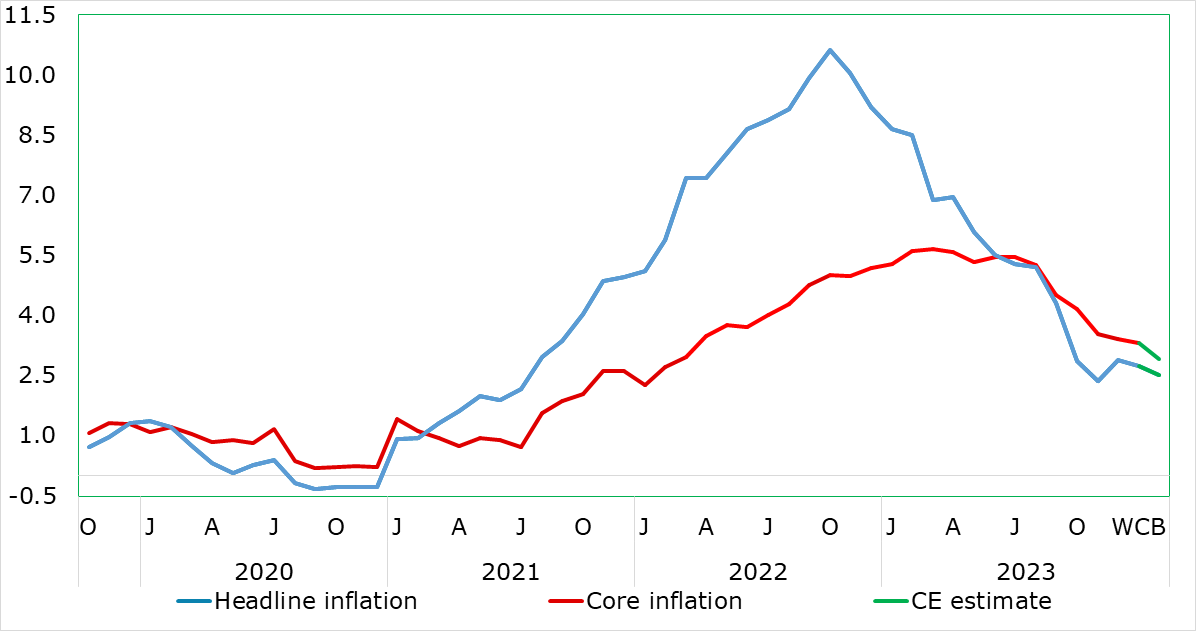

Datawise, the main event is the HICP figures on Friday. Underlying inflation is falling faster and more broadly than had been ECB thinking, now encompassing not only falling core rates but also softer persistent inflation signals, the latter a key consideration for the ECB. This continued in the January numbers, albeit with the 0.1 ppt drops in both headline and core being less that most anticipated. Indeed, the core fell a notch to 3.3%, a 22-month low and very much on course to meet the ECB Q1 projection of 3.1%, if not undershoot it. This may be even more likely if our February HICP projections prove anything like accurate; we see the headline down to a 31-month low of 2.5% and the core down to a 22-month low of 2.9%, the latter encompassing softer y/y services inflation. German inflation data precede the EZ numbers arriving on Thursday. We see the HICP rate easing further in the February data, to a 32-month low of 2.7%, probably with core down too as services inflation succumbs to base effect.

Headline and Core Inflation Falling Together Again

Source: Eurostat, Continuum Economics

Otherwise, European Commission survey data (Tue) may paint a still sobering message, perhaps less wary about price pressures than the PMI figures suggested – final manufacturing PMI are due on Friday. Tuesday also sees the next batch of EZ money and credit data, where there signs that both credit and deposits weakness is less marked. As for the ECB, no major speeches are due.

Rest of Western Europe

There are key events in Sweden, with Q4 GDP details on Thursday to be preceded the day before by the Economy Tendency Survey, the later again likely to be weak. Norway sees consumer confidence figures (Tue) these hitherto very much suggesting household negativity. Finally, Swiss Q4 GDP data (Thu) may show no change in q/q terms.

Japan

National CPI on Monday, Feb 26 head the Japanese calendar. Both the headline and less fresh food CPI has been moderating more than expected while less fresh food & energy being stubborn. We forecast the headline figure to continue to moderate at a steady pace with less fresh food and energy very likely to be slowing at a slower pace. We will also have retail trade on Wednesday, Feb 28. This data is getting more important in assessing Japanese growth given the contraction in private consumption two quarters in a row. The jobs report on Thursday, Feb 26, will be less important.

Australia

Monthly CPI on Tuesday, Feb 27 and Retail Sales on Wednesday, Feb 28 are the only important release from Australia next week. The monthly CPI is expected to show a minor rebound but we do not see it to be enough to tilt RBA’s rate decision unless it is a upside surprise of more than 0.5%.

NZ

RBNZ Interest rate decision on Tuesday, Feb 27 would be critical as we have certain banks expecting the RBNZ to resume tightening in the coming two meetings. However, we do not see such call to be supported by data. The biggest surprise, if any, would be inflation revision, though we feel the likelihood is minimal.