FX Daily Strategy: N America, July 23rd

Quiet calendar allows medium term adjustments

JPY still has some upside scope with U.S. Japan Trade Deal

CHF remains overvalued

NOK has scope for recovery

Quiet calendar allows medium term adjustments

JPY still has some upside scope with U.S. Japan Trade Deal

CHF remains overvalued

NOK has scope for recovery

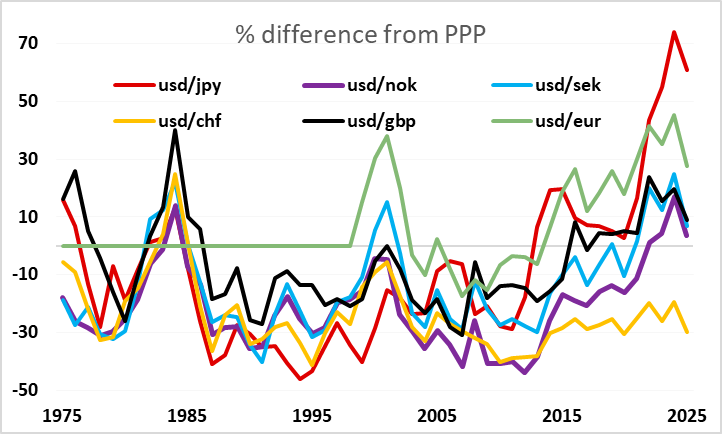

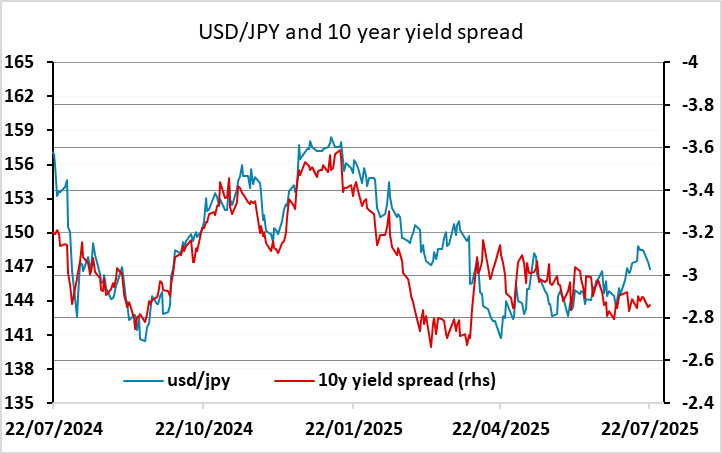

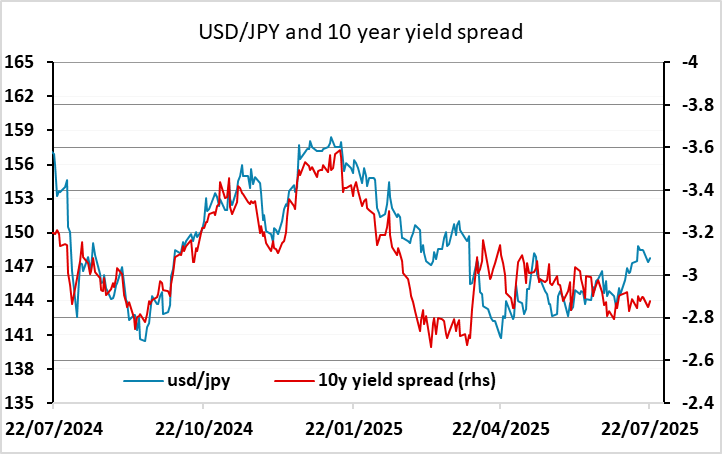

Another quiet calendar on Wednesday, with no data or events likely to move the market. In such circumstances, there is scope for longer term considerations to come to the fore. So far this week this has meant a stronger JPY, as JPY weakness has been overdone in the past couple of months, and the lack of news provided an opportunity for a correction. Both the USD/JPY correlation with yield spreads and the EUR/JPY correlation with risk premia suggested the JPY had overshot, and we had seen eight consecutive weeks of EUR/JPY gains up to last week. There is only one instance of nine consecutive weeks of EUR/JPY gains in the history of the EUR, and it came from nearly 50 figures below current levels. The announcement of the US/Japan trade deal overnight initially gave the JPY a further boost, but the positive impact on risk sentiment has limited JPY gains for now.

Despite the positive risk response to the US/Japan deal, there is still sufficient uncertainty around tariffs, the status of Powell at the Fed and the high valuation of the equity market to justify JPY gains continuing. Yield spreads suggest USD/JPY has scope to 144 just to reconnect with even the most USD favourable version of the yield spread relationship, while EUR/JPY has scope sub-170 to move back in line with risk premia. This doesn’t mean we are necessarily going to see a restart of a positive JPY trend. That will likely require more negative risk sentiment and either lower US yields or lower equities (or both). We do expect this in the longer run but for now the move is corrective.

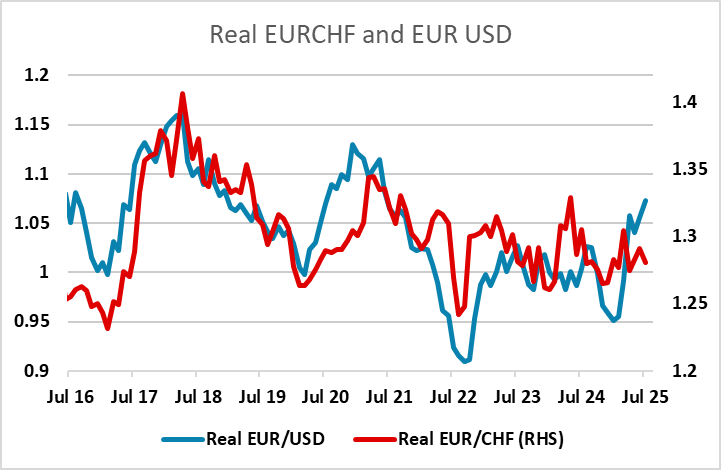

The other major misvaluation looks to be the CHF. The CHF historically tends to act as a safe haven, but despite the strength of equity markets and the low level of risk premia, EUR/CHF remains close to recent lows. Part of this reflects the relatively low level of Swiss inflation, so that EUR/CHF is less weak in real terms than it appears in nominal terms. Even so, it is close to its real term lows and the bottom of the range seen since the break lower in 2015. Historically, there is a tendency for EUR/CHF to rise with EUR/USD, but this time around it has lagged behind. The problem for CHF bears is that the CHF will still no doubt react positively in a risk negative environment, and there appears to be little scope for any further decline in risk premia. But from a value perspective it looks inferior to the JPY as a safe haven, as the SNB may stand in the way of any further appreciation.

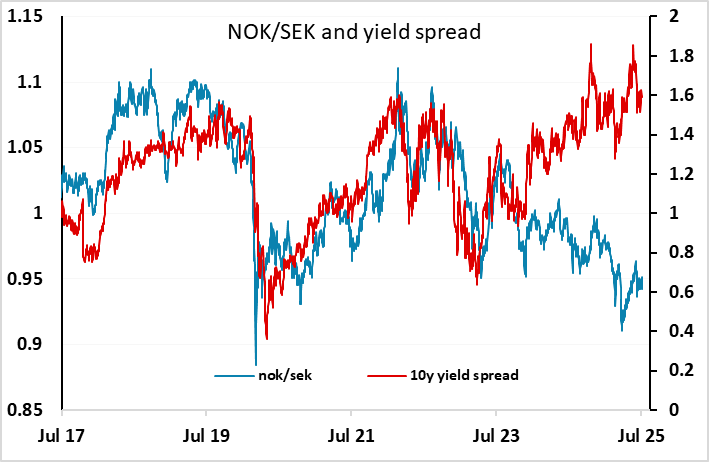

The other main anomaly in the G10 looks to be the NOK, which has hugely underperformed yield spreads in the last year, notably against the SEK. This may reflect a big picture valuation story, as the NOK has always tended to trade on the strong side relative to PPP, largely due to Norway’s huge budget and current account surpluses. These have not gone away, but the NOK has reverted to something close to PPP relative to the SEK. Even just accounting for the yield spread attraction, the NOK should be trading higher than this, and has long term scope for gains against the EUR, SEK and CHF.