FX Weekly Strategy: Oct 13-17

Powell speech to be watched, equity market in focus

JPY weakness hard to justify, especially since new PM now unclear

GBP at risk from weaker UK data

Strategy for the week ahead

Another week without official US data will put the focus on Powell’s speech on Tuesday. With a rate cut at the FOMC meeting on October 29 already 95% priced in, it’s hard to see Powell having a significant market impact unless he creates some doubt over this move. It’s also hard for him to be definitive about much given the current lack of data from the US. The private sector releases out this week are hardly likely to change market views of the economy either. But as long as there is no real evidence of a significant US downturn, it will be hard to oppose the recent strength of the USD. One risk from Powell is any warning he might give about the level of the equity market. The IMF and the ECB have both recently indicated concern about the possibility of a sharp reversal from current overvalued levels, and any comments from Powell along those lines could trigger a correction.

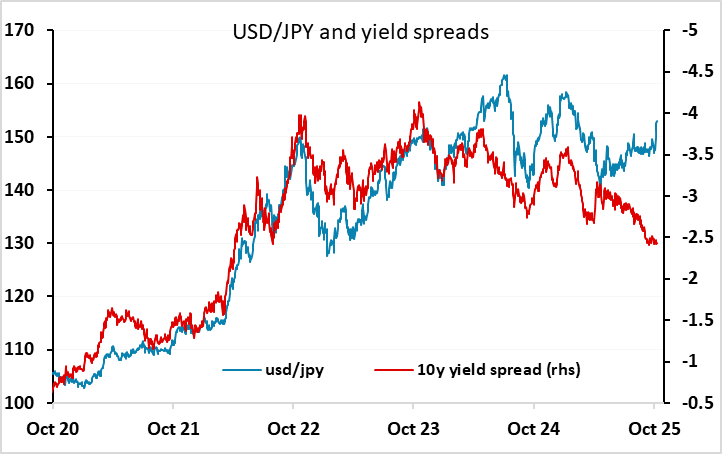

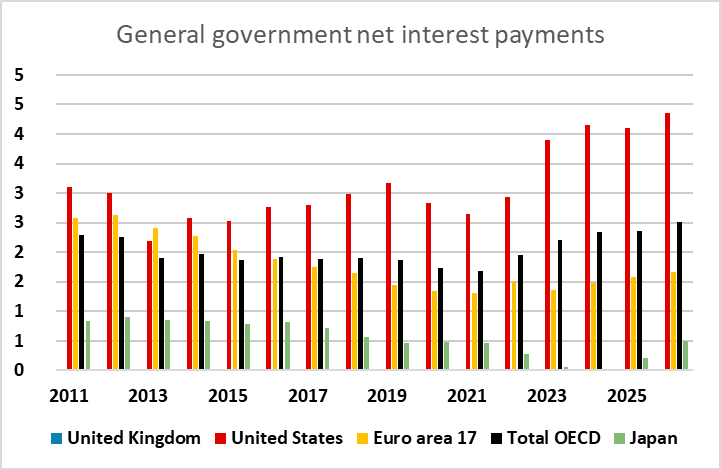

The USD has been generally firm in recent weeks, but the biggest gains have come against the JPY, which has suffered from the surprise election of Takaichi as the new LDP leader. USD/JPY has risen more than 5 figures in response to the election, but the rationale for JPY weakness is not entirely clear. Some have suggested that Takaichi’s adherence to “Abenomics” will lead to easier monetary policy as well as easier fiscal policy, and there was a small decline in front end JGB yields after the election. But longer term yields moved slightly higher, and the moves aren’t sufficiently large to justify the weakness of the JPY. It is also unlikely that the BoJ will accept being directed towards easier monetary policy by the government if the government is pursuing more expansionary fiscal policy. Others see the Takaichi threat as similar to the risk presented by the election of Liz Truss in the UK, when the markets protested her easy budget by selling off both GBP and gilts. But the Japanese situation remains very different to the UK, as although government debt is high, debt service is very low and the current account remains in substantial surplus. So we don’t see a strong rationale for JPY weakness, especially since the comments from Takaichi and Finance minister Kato at the end of last week suggested they were not seeking a weaker JPY.

However, with the defection of the LDP’s coalition partners Komeito last week, there is also now some risk that Takaichi won’t become PM, with suggestions that an opposition coalition may be formed, perhaps under Constitutional Democratic Party leader Yuichiro Tamaki. If so, the JPY’s weakness seen since Takaichi’s election is likely to be at least partially reversed. In any case, her lack of support in parliament makes it likely that her policies will have to be toned down to some extent. Risks of a JPY recovery have increased with Komeito’s exit, but in the absence of a trigger USD strength remains hard to oppose. Possible triggers for a turn include a potential failure for her to become PM at the vote later this month, more general USD weakness due to either an indication of dovish Fed policy, or a risk negative turn due to weakness in equity markets.

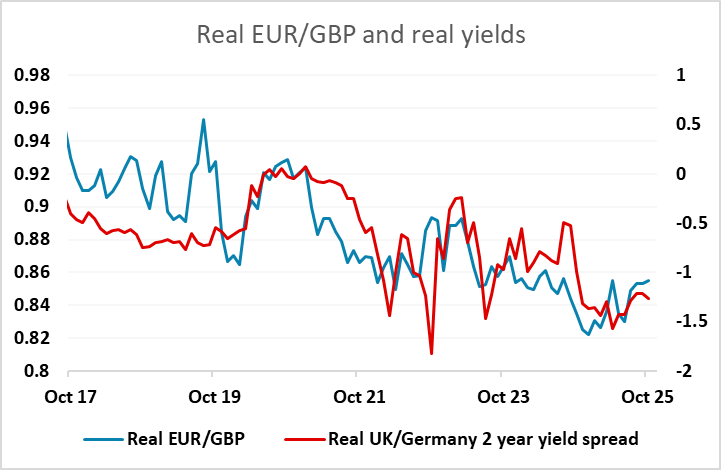

Otherwise, GBP may be something of a focus with the UK labour market data and GDP data due this week, especially given the lack of significant data from elsewhere. EUR/GBP popped back above 0.87 at the end of last week after dipping lower on the resignation of French PM Lecornu. Any further news on French politics will also be of interest, but the risks on the UK data look to be on the GBP downside given the lack of easing priced into the UK curve, with the next rate cut not fully priced in until April. We still look for UK real rates to converge with Eurozone real rates in the longer run, and that suggests EUR/GBP upside risks from here.

Data and events for the week ahead

USA

Data releases that will not be delayed due to the government shutdown are September’s NFIB survey on small business optimism on Tuesday, October manufacturing surveys from the Empire State on Wednesday and Philly Fed on Thursday, and October’s NAHB homebuilders’ survey on Thursday.

The most significant event of the week may be a speech from Fed’s Powell to the NABE on Tuesday. Other Fed speakers scheduled are Paulson on Monday, Bowman, Waller and Collins on Tuesday, Miran on Wednesday, Waller again on Thursday and Musalem on Friday. The Fed’s Beige Book is due on Wednesday and may fill some of the gaps caused by the lack of key data.

Before the shutdown some key releases were scheduled but even if there is a resolution before the release dates some delay is likely. September CPI is scheduled on Wednesday and we expect a 0.4% increase, 0.3% ex food and energy, and we expect matching gains from September’s October PPI scheduled on Thursday. For September retail sales due on Thursday we expect a third straight rise of 0.6%, with a matching rise ex autos. On Friday September housing starts and industrial production are scheduled. We have not yet forecasted either because the delayed non-farm payroll provides useful insights on both. The industrial production report actually uses the non-farm payroll as an input. Despite being a Fed release, past shutdowns saw this release postponed when the non-farm payroll was absent. Once the shutdown ends, the September non-farm payroll will be one of the first releases to appear. Despite the negative ADP report, we continue to expect a modest increase of 45k.

Canada

Canada will release August building permits on Tuesday, September existing home sales on Wednesday and September housing starts on Thursday. August manufacturing and wholesale sales are due on Wednesday. Preliminary data looks for declines of 1.5% and 1.3% respectively.

UK

The coming week sees several important economic updates. Possibly, most high profile, Tuesday sees ever-more important labor market numbers where apparent wage resilience has perturbed some MPC members. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data and are now officially accredited) is likely to see little further but modest drops in the official earnings data, at least in this release. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so, such data possibly taking greater precedence than CPI numbers for some MPC members. In this regard, there is a whole host of MPC appearance this coming week, including BoE Governor Bailey speaking from Washington (Tue), while arch hawk BoE Chief Economist Pill speaks at the Institute of Chartered Accountants annual conference (Fri). And what should be a neutral outcome, the BoE Credit Conditions Survey may suggest some reaction by banks to added downside economy risks.

Thursday sees August GDP numbers. Although officially a flat m/m GDP outcome for the July data, the actual outcome was a small m/m fall (before rounding). We see this being repeated in the August numbers with a 0.1% drop. This would leave the less volatile three-month rate at 0.2% but we think this overstates what is very feeble momentum, which may actually be nearer zero if not weaker at least according to some business survey data, especially once construction weakness is incorporated. Even so, at this juncture, the strong June outcome of 0.4% has created a solid backdrop for the last quarter GDP to support the BoE’s 0.3% Q3 forecast – even successive 0.1% m/m declines would still leave the quarter up 0.1% in q/q terms, that is without what may still be likely revisions but this remains our projection.

Eurozone

We see little change in what may be the added insight into how companies have actually reacted to the EU-U.S. trade ‘deal’ this coming via the German ZEW update (Tue), but where responses are also likely to be affected by the poor German production numbers. Indeed, Wednesday sees EZ industrial production figures, probably showing some marked fall due to the German data. Otherwise, final HICP data (Fri) will offer little new as may Thursday’s EZ trade figures and Thursday’s construction data.

Rest of Western Europe

There are no key events in Sweden over and beyond what have been weaker labor market data (Fri), albeit very volatile of late and where final CPI data will flesh out the drop seen in the flash reading.

Japan

Pretty clear week for Japan next week. We do have industrial production and Machinery order on Tuesday and Wednesday but market focus will likely be on remarks from the coming PM and BoJ. So far, we knew the coming PM is in favor of fiscal spending and accommodative monetary policy but we have not seen a direct comment towards BoJ’s policy yet. The BoJ also did not react towards the change in PM and could provide more cues on their thoughts. Although market has almost eliminated the hope of an imminent hike, we still see a slim chance for the BoJ to tighten in 2025 if JPY continue to weakens significantly with unchanged inflationary trajectory.

Australia

RBA meeting minutes on Tuesday is likely a none event as forward guidance points toward data dependency and Australia is in no rush to double cut like the RBNZ. The labor data on Thursday would carry slightly more weight after disappointing prior month. There are also business condition and confidence on Tuesday.

NZ

Apart from Business PSI on Monday, tier two data is scattered across the week for NZ.