FX Daily Strategy: N America, February 7th

EUR/USD vulnerable after German production but could settle into a range

JPY strength starting to show on the crosses – CHF/JPY the barometer

NOK/SEK has potential to break above parity

EUR/USD vulnerable after German production but could settle into a range

JPY strength starting to show on the crosses – CHF/JPY the barometer

NOK/SEK has potential to break above parity

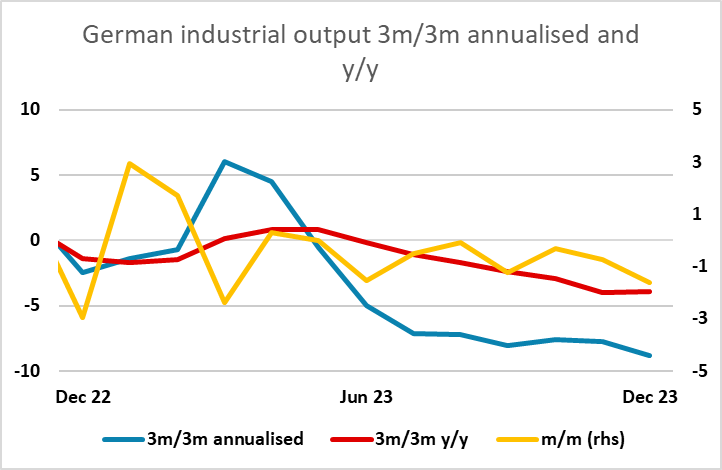

Very weak German December industrial production hasn’t initially had a negative impact on the EUR. Indeed, the EUR is starting the European session a little firmer, but the 1.6% decline in German production in December should be a concern as it suggests the trend is still deteriorating. While yesterday’s December orders data provided some grounds for optimism about the future, the orders data is volatile and there is no guarantee the sharp December rise won’t be reversed in January. The production data tends to show a more stable trend, and the near 9% annualised decline in the last 3 months underlines the weakness of the German manufacturing sector. This should increase the chances of an ECB easing in April, which is currently priced as around a 60% chance. EUR/USD risks are consequently on the downside, with the recent rise in front end yields following the US employment report looking hard to justify on the basis of European economics.

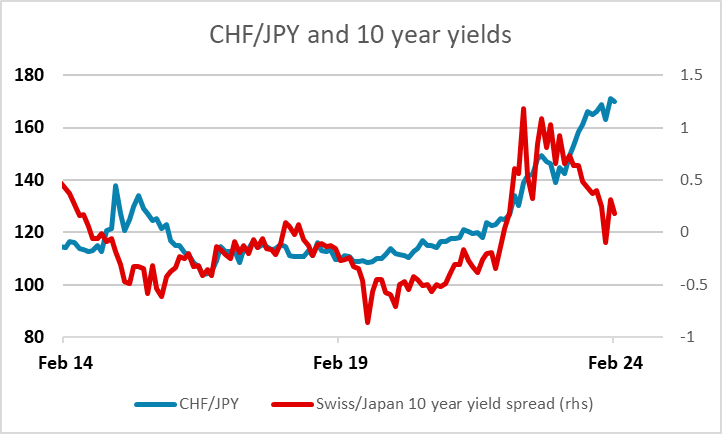

The JPY performed better through Tuesday as yields fell back in the US and Europe following the post-employment report surge. We continue to see CHF/JPY as the best barometer of the JPY’s long term fortunes, as this should be nearly a pure value play, with little spread between Swiss and Japanese yields, and similar risk characteristics between the CHF and JPY. The JPY has fallen more than 50 % in the last 4 years, and while this move was initially supported by a move in yield spreads, the spread move has now nearly completely reversed. CHF/JPY has been trading a narrow 169.50-171.50 range for the past month and was pressing the lower end on Tuesday. Longer term, there should be scope for a full retracement back to around 120, so a break below the recent range could be a trigger for a longer term move.

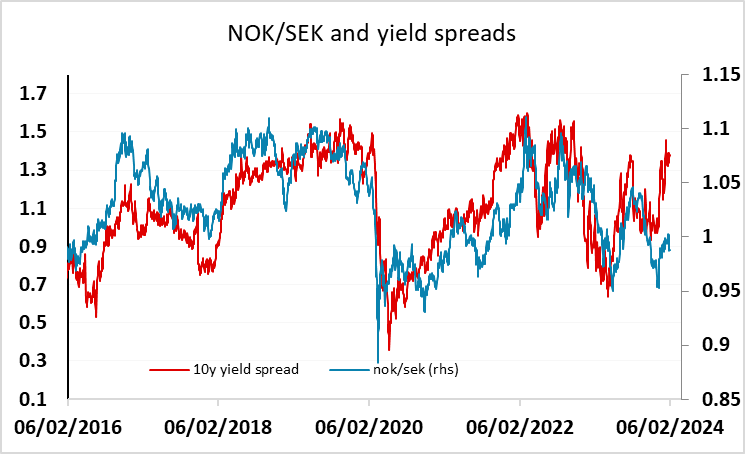

We did get the Riksbank monetary policy minutes this morning, and Swedish front end yields edged a little higher in response as deputy governor Jansson played down the chance of a March rate cut. However, he did indicate that May was a stronger possibility, and May is only priced as around a 60% chance at this stage, so there doesnt look to be alot of upside for Swedish front end yields, even though the 30% chance priced in of a March cut may be a little too high. We continue to look for a trigger for NOK/SEK to break back up above parity in line with the yield spread moves we have seen in the last month. The relationship with yield spreads has been strong and consistent over the years, so this looks like a move that will happen. However, EUR/NOK looks more out of line with spreads than EUR/SEK, so it may have to happen from the NOK side.