FX Daily Strategy: N America, April 3rd

EUR/USD testing the range

USD/JPY upside looks very limited

CHF the preferred funding currency

ISM services data to be the focus for the USD

Range likely to hold after EUR yield rise Tuesday

Some downside risks to EUR on Eurozone CPI

CHF remains the funding currency of choice

Wednesday sees the ADP employment data and non-manufacturing ISM from the US and Eurozone CPI, all for March.

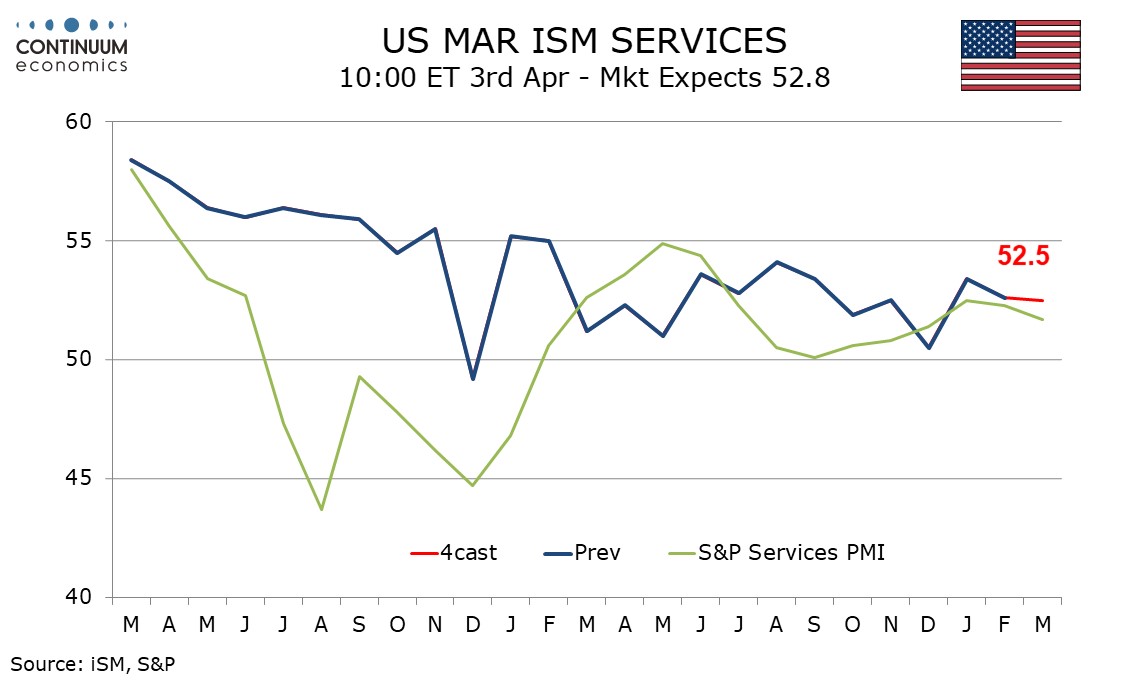

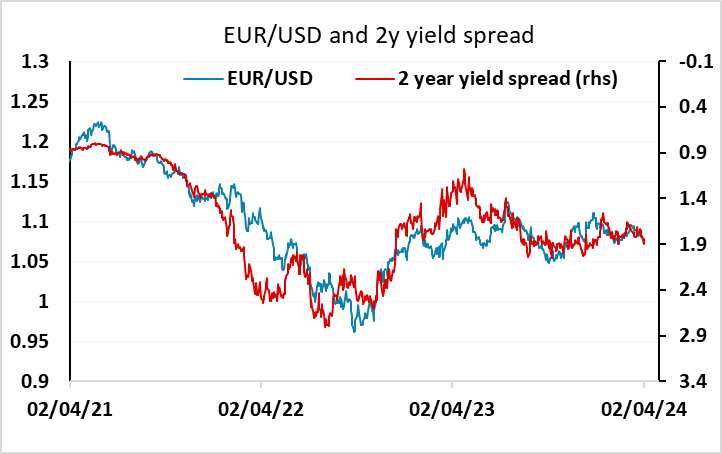

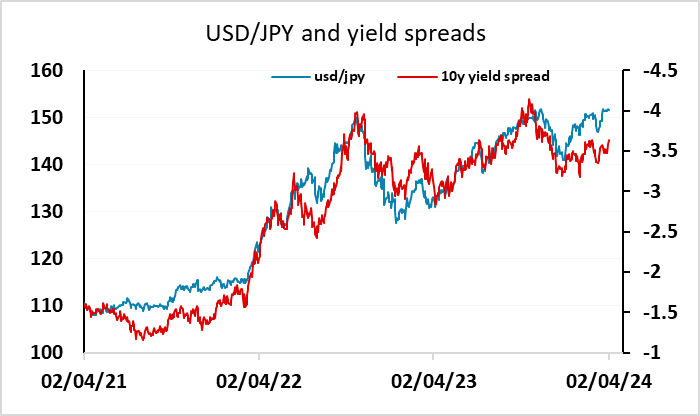

The USD got a boost on Monday, helped by the strength in the manufacturing ISM data, but the USD’s gains started before the data was released as US yields recovered from end of month related declines, and have been partially reversed as European yields have also recovered after a soft end to the month. However, the non-manufacturing ISM is nowadays probably seen as the more important release, given the greater importance of services in the economy, and there could consequently be scope for a USD impact. We expect March’s ISM services index to be almost unchanged at 52.5 from February’s 52.6, which looked like a return to trend after a stronger 53.4 in January corrected a weaker 50.5 in December. The S and P services index has seen two straight declines after four straight gains, but is not a reliable guide to ISM services data. If we see another strong number, back to January’s level or above, the USD could be expected to benefit, with the market potentially further scaling back rate cut expectations. However, after European yields rose on Tuesday, there is limited scope for a EUR/USD break lower, while the USD/JPY upside continues to be restricted by the threat of intervention.

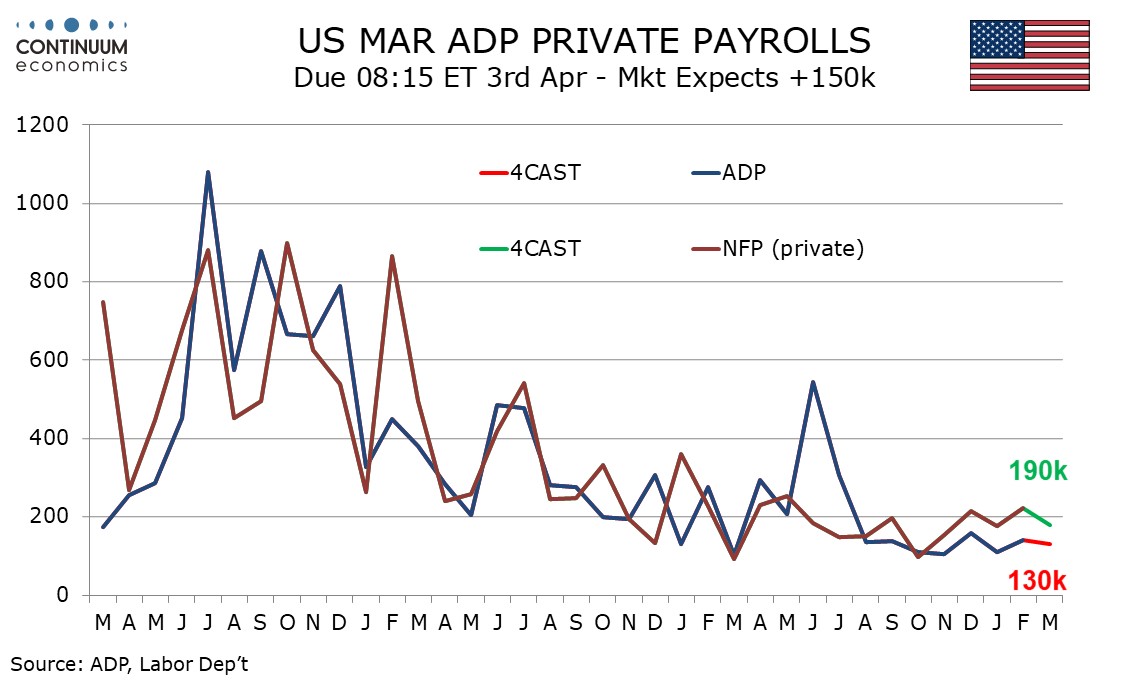

It is unlikely that the market will react to the ADP data, which has an inconsistent relationship with the official payroll numbers. We expect a 130k increase in March’s ADP estimate for private sector employment growth, which would be in line with recent trend, but an underperformance of our 180k forecast for private sector non-farm payrolls, which would also be in line with trend. We expect overall payrolls to rise by 230k.

The Eurozone CPI data wasn't much of a surprise, with the German, French, Italian and Spanish numbers already released over the last week. The published consensus of 2.5% y/y was probably higher than the market expectation after the German, French and Italian numbers all came in below consensus, so the 2.4% outcome was essenitlaly in line with expectations.

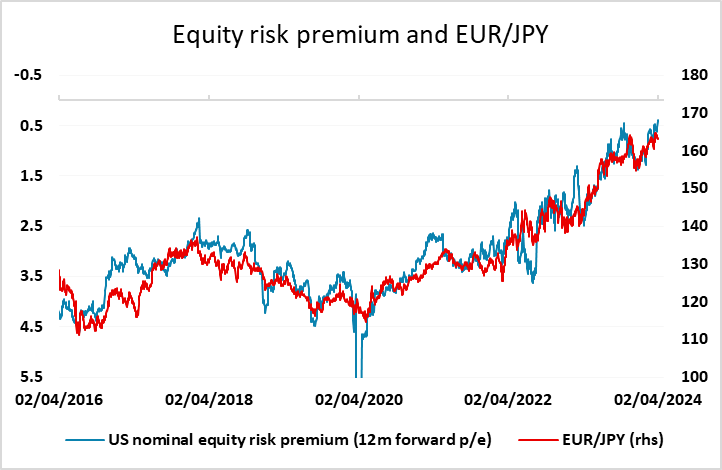

It was notable on Tuesday that even though equity markets were weak, the riskier currencies outperformed. This reflected the fact that equity market weakness was due to higher yields rather than any negative sentiment on growth. Equity risk premia continued to decline, and this has typically pointed to JPY weakness on the crosses. But with USD/JPY upside limited both by the fact that yield spreads point to lower levels and resistance from the Japanese authorities, this translates to upward pressure on the riskier currencies against the USD. The CHF was also weak – a little weaker than the JPY in fact – reflecting the fact that the SNB have already started their rate cutting cycle and are now much more tolerant of a weaker currency than the BoJ. Expect the CHF to remain the funding currency of choice.