JPY flows: JPY firmer after BoJ

JPY firmer after BoJ meeting with Ueda comments suggesting tightening cycle will continue

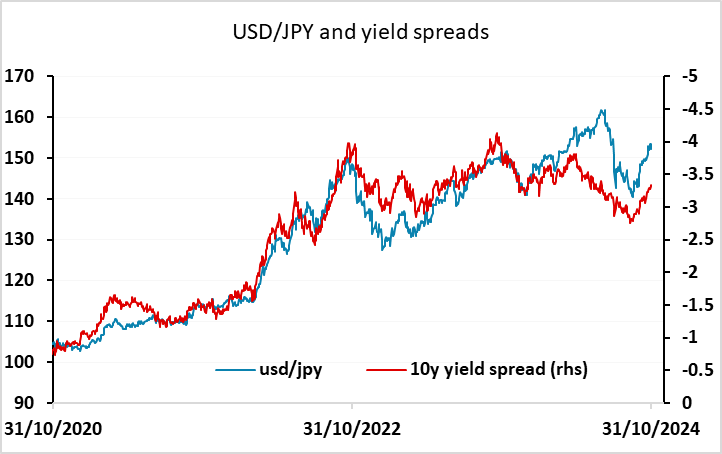

The JPY has firmed modestly on the back of the BoJ meeting and Ueda’s press conference. While there was no change to rates and no clear promise of a rate hike in December, Ueda did leave that possibility open if the US economy continued to show resilience. He indicated that wages and prices in Japan were moving up in line with expectations and were consistent with the monetary tightening cycle they anticipated, without setting any timeline. This suggests that the JPY should perform well in either scenario. If the US economy performs well, it will allow the BoJ to raise rates. If it doesn’t, US yields and equities are likely to decline and equity risk premia are likely to rise, all of which will be favourable for the JPY. The latter scenario would be more likely to trigger sharp JPY gains, but the former should provide the JPY with support as the market prices in earlier BoJ tightening. As it stands, the market is only pricing 7bps of tightening for December, and if the US, Japanese and world economy shows strength, there is potential for a 25bp hike.

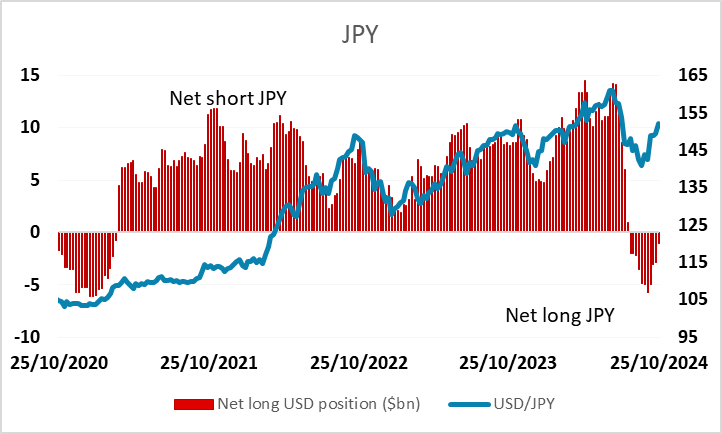

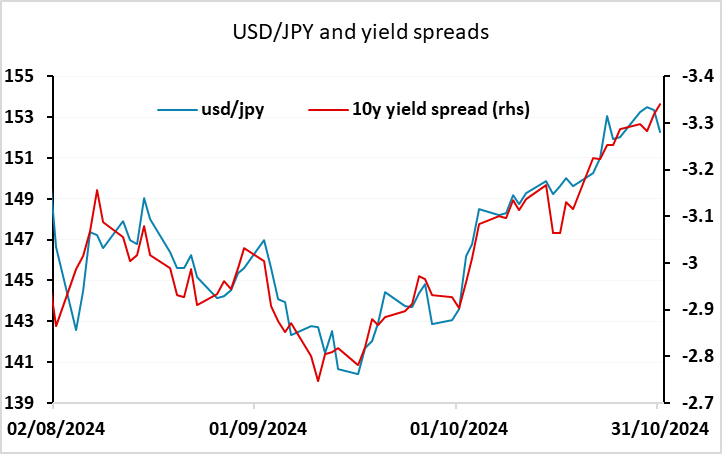

For now, USD/JPY is unlikely to fall far – the short term yield spread correlation suggests we may see a recovery back to yesterday’s highs, although longer term correlations still suggest downside risks. Obviously, there will be sensitivity to tomorrow’s employment report and next week’s US election. While CFTC data doesn’t indicate significant positioning, we would expect the short term market to be short JPY after the 10 figure USD/JPY rise in October, so there is some risk of position squaring favouring the JPY into the end of month.

Net speculative positioning in CFTC data