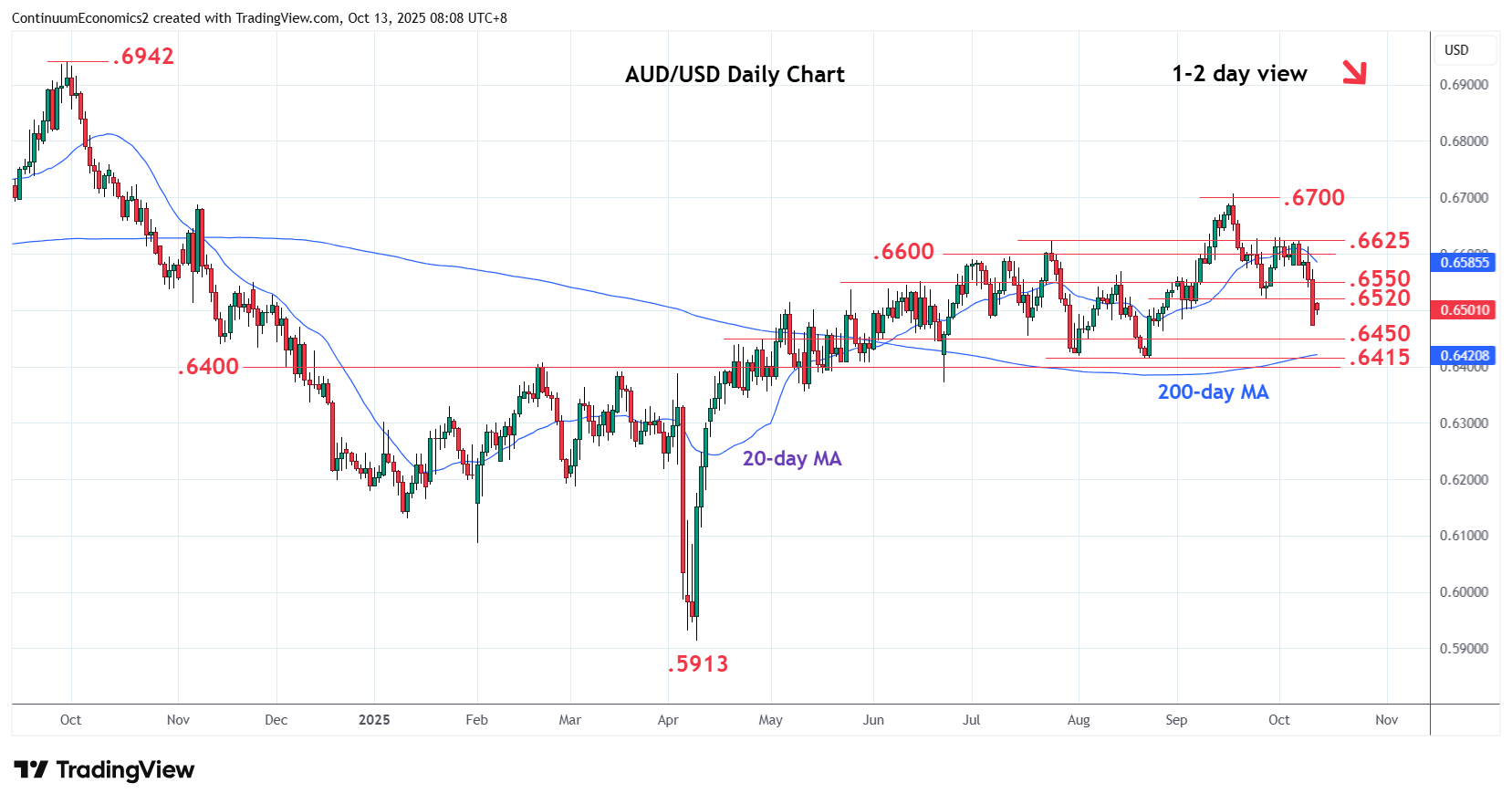

USD, JPY, AUD flows: USD and riskier currencies weaker after Trump comments

USD and riskier currencies weaker on Trump tariff threat to China, despite partial recovery in Asia

The calendar is usually quire bare on Monday and today is no exception, with the US shutdown ensuring there is unlikely to be much significant US data for the week. The main market driver over the weekend has been Trump’s comments on Chinese tariffs – initially threatening a 100%+ tariff on Friday before telling everyone to calm down at the weekend. US equity futures recovered half their Friday losses in Asia, but some jitters remain. Friday’s decline was the largest since the initial tariff announcement in April, and recent comments from the IMF, ECB and others about the risk of a sharp correction to the overvalued equity market underline that there are some significant risks. We doubt we will see similar comments from Powell later this week, but a more jittery equity market is likely to persist, and should have some consequences for FX.

Normally, weaker equity markets would lead to a stronger JPY against the riskier currencies, and we did see that late on Friday, with AUD/JPY in particular falling sharply and coming close to closing the opening gap from last week. But JPY gains on other crosses were much more modest, with Japanese politics still seen as a JPY negative factor. Nevertheless, we do see scope for further JPY gains across the board, as we still see the reaction to the LDP election as overdone. Although the comments from Komeito over the weekend make it more likely that Takaichi will be able to form a governing collation, she may be restricted in her policy choices, and a weak JPY is in any case not something she is likely to seek given cost of living concerns.