FX Daily Strategy: Asia, March 7th

ECB likely to hold the hawkish line for now…

…suggesting potential for a modest break higher in EUR/USD

But USD probably reacted too negatively to Powell testimony

GBP still looks vulnerable with little to cheer in UK Budget

ECB likely to hold the hawkish line for now…

…suggesting potential for a modest break higher in EUR/USD

But USD probably reacted too negatively to Powell testimony

GBP still looks vulnerable with little to cheer in UK Budget

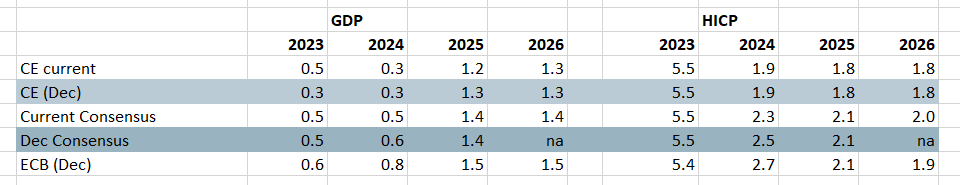

Modest ECB Forecast Downgrade Expected from December Forecasts (below)

Source: Bloomberg, ECB, Continuum Economics

The ECB meeting will be the main focus on Thursday. Once again the ECB meeting verdict will be notable not for what the Council does (save for downward tweaks to its projections) but rather what is said. A fourth successive stable policy decision is unambiguously expected. This will come alongside a reaffirmation that rates will be maintained for a sufficiently long duration at levels that will return inflation to target. But ‘sufficiently long’ and ‘as long as necessary’ remain vague and thus does provide the ECB some policy flexibility to be data dependent as it will again boast it is. Last time around, the Council regarded to it premature to discuss easing, but this was only by consensus, implying a minority wanted such a debate. That minority may be larger and more vocal this time. They may even be persuasive enough to leave open the possibility of the first cut at the April meeting, albeit with the majority leaning more to the first move not before June and perhaps more explicitly so, possibly citing alleged evidence of economic recovery and price resilience.

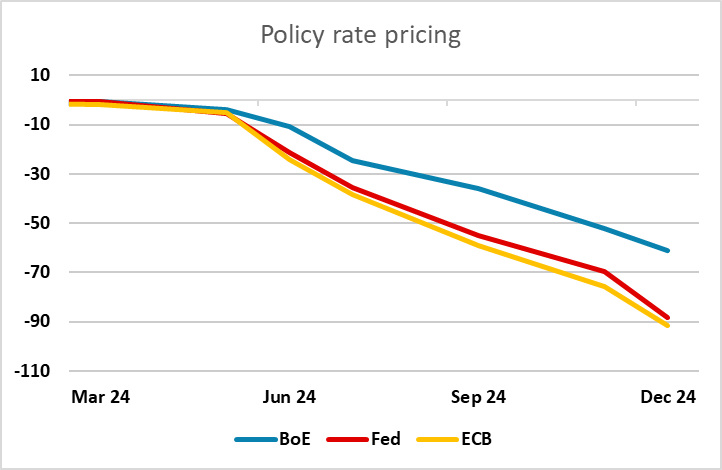

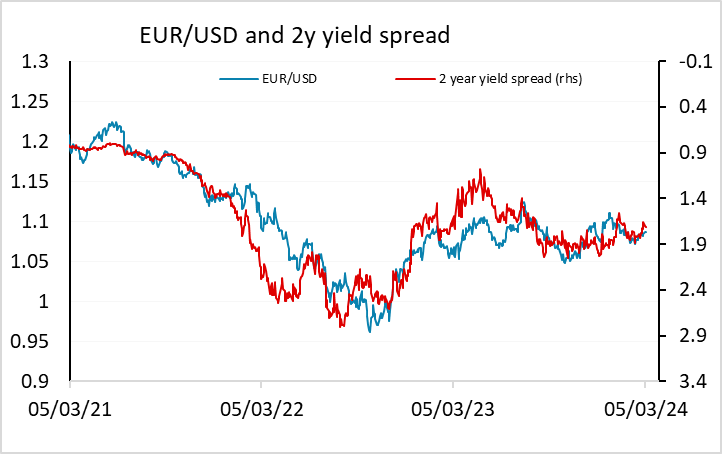

As it stands the market is pricing around a 20% chance of an ECB easing in April, with June near enough fully priced for a 25bp cut. If Lagarde were to indicate that an April ease was a live possibility, the EUR could consequently be expected to fall back fairly sharply. However, we see it as more likely that she will maintain a mildly hawkish stance suggesting no rate cut in April, and this would be likely to be slightly EUR positive, as the market pushes rate cut expectations further out. As it stands, EUR/USD is already edging up to test the 1.09 ceiling of the recent range, and a slightly hawkish statement might be enough to penetrate that level, although we doubt there would be scope as far as 1.10.

There isn’t a great deal else on the calendar on Thursday, other than the usual US jobless claims numbers. It was notably that he market took the Powell comments as mildly USD negative on Wednesday. We didn’t see them that way. With the market already nearly fully pricing a June rate cut and 2 ½ further cuts for the year, the indication that a cut is likely on 2024 is hardly a dovish comment. Conversely, the indication that the inflation battle was not yet certain to be won can be seen as hawkish. As it stands, the trajectory for Fed and ECB cuts priced by the market for this year is now nearly exactly the same. Current yield spreads and the solid equity market tone suggests some mild upside EUR bias, but we doubt there will be much change in rate differentials from here to increase the scope for EUR gains.

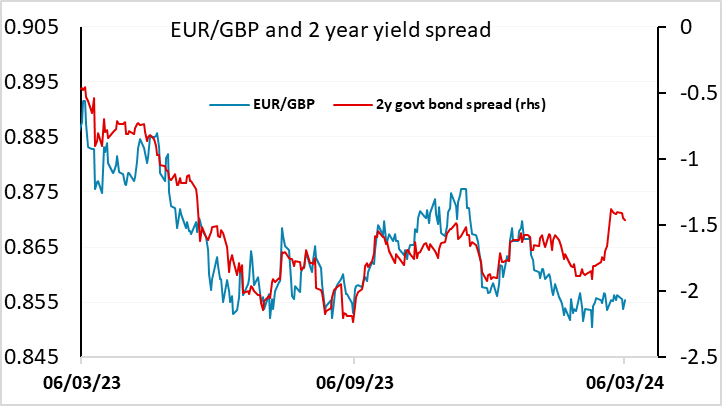

The UK Budget as expected failed to produce anything particularly surprising, with the 2ppt cut in NI contributions largely funded by other hikes in taxes, so that there was little net fiscal change. In any case, the freezing of tax thresholds in recent budgets has meant increased fiscal drag, so disposable income growth will remain anaemic. GBP didn’t really react significantly, although it was marginally lower. Underwhelming UK growth forecasts and a lack of room for any fiscal expansion in the future makes it hard to be optimistic about the UK’s prospects, and we would continue to see GBP risks as being on the downside against the EUR, as suggested by recent yield spread moves.