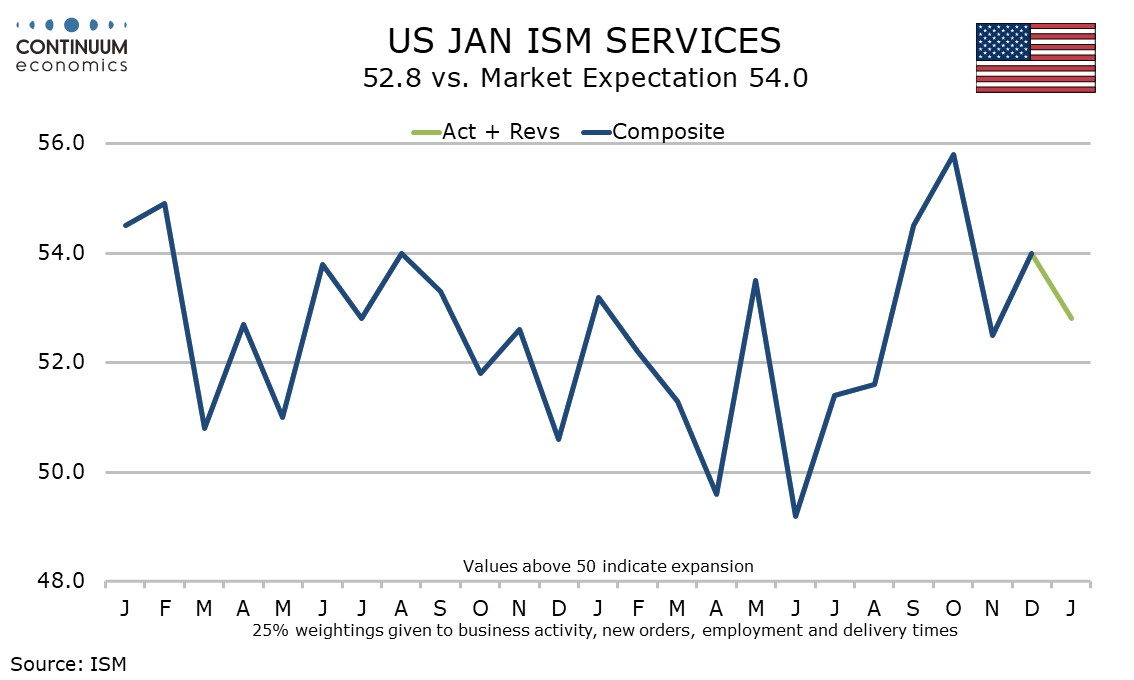

U.S. January ISM Services - Dip may be weather-related

January’s ISM services index at 52.8 from 54.0 is weaker than market expectations though consistent with the S and P services PMI released earlier. It is possible bad weather, with very cold weather in much of the country probably more significant than the localized Los Angeles fires, restrained the data.

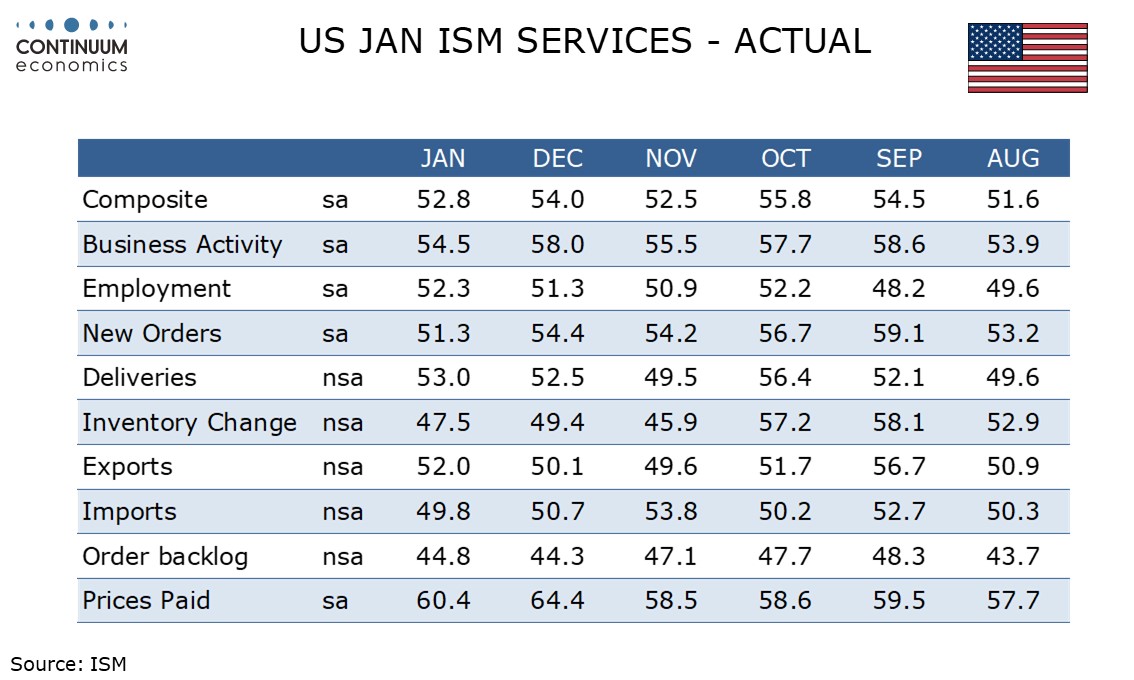

Two of the four components that make up the composite slipped, business activity to 54.5 from 58.0 and new orders to 51.3 from 54.4. However, employment saw an increase to 52.3 from 51.3, reaching its highest since June 2023, while deliveries also increased to 53.0 from 52.5. The slippage in business activity and new orders may be weather-related.

Prices paid do not contribute to the composite. January’s reading of 60.4 is a significant dip from December’s 64.4, but still stronger than every month from February 2024 through November 2024.