FX Weekly Strategy: February 3rd-7th

US employment report the main data focus

USD/JPY biased lower, EUR/USD more data dependent

CAD risks on the downside on tariff concerns

GBP has scope to weaken on BoE meeting

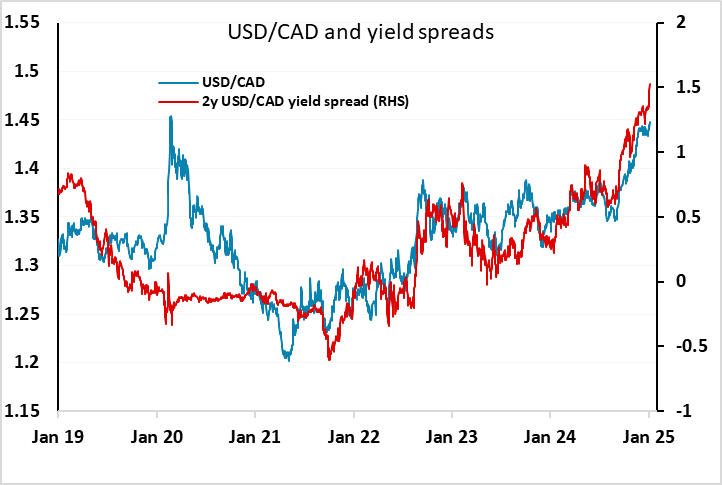

The US employment report will be the main data focus, while the BoE MPC meeting will provide the monetary policy interest. However, the main focus at the beginning of the week will be on whether tariffs have been imposed on Canada and Mexico. Going into the weekend, USD/CAD was well bid, but this was consistent with the widening front end yield spreads in favour of the USD. There didn’t appear to be any risk premium based on worries about tariffs and the negative impact on the economy that a 25% tariff on Canadian exports to the US would have. The Canadian economy already seems to be struggling in any case, with the November GDP decline of 0.2% helping to put further downward pressure on Canadian yields. The money market is pricing in two more rate cuts this year, and this might not change much if tariffs were introduced, as BoC governor Macklem has indicated that the BoC might not be able to react to the negative growth impact if Canadian retaliation led to higher Canadian inflation. However, the extent of Canadian retaliation is uncertain, so we would see the risks as being towards lower rates. In any case, a tariff/trade war could be expected to be more negative for Canada than the US, and the negative growth implications for Canada would suggest some risk premium on the CAD. As it stands, USD/CAD is if anything below the level that looks to be consistent with yield spreads, so the risks for the CAD look to be on the downside. Having said this, the knee-jerk reaction if there is a last minute change of hear from Trump would be CAD positive, but it’s hard to see sustained CAD gains with yield spreads unlikely to to move in the CAD’s favour.

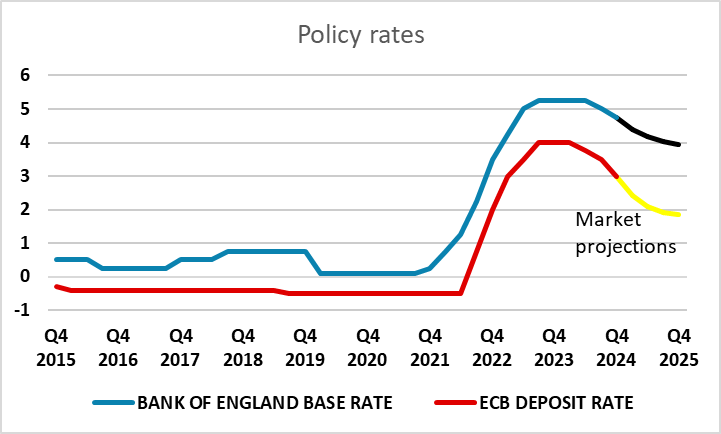

The market is pricing a 25bp rate cut from the Bank of England on Thursday as around an 85% chance, and we would see it as a near certainty. The market has slightly increased expectations of BoE easing in recent weeks, and is now looking for 3 rate cuts by year end, which is essentially the same as is priced in for the ECB. However, this doesn’t take account of the fact that the BoE is lagging the ECB’s easing, and this would still leave the BoE policy rate 2% above the ECB policy rate, with 1% a more normal differential. We therefore still see the risks as being towards lower UK rates relative to the ECB, and consequently there are some downside risks for GBP, particularly given EUR/GBP’s dip back in the last week.

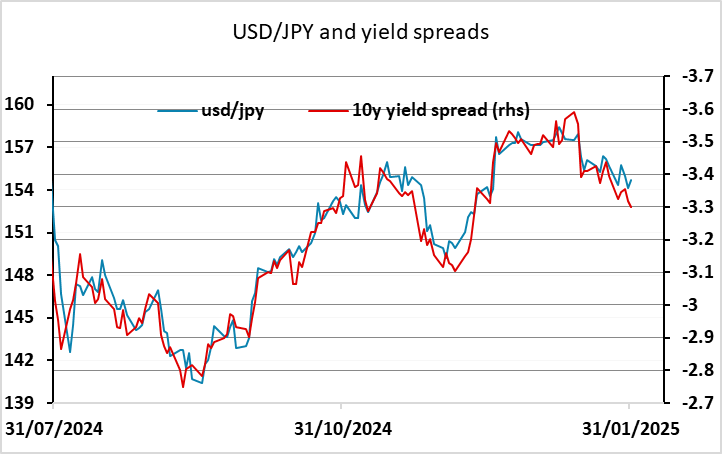

We also have Japanese cash earnings data in the middle of the week, an increasingly significant release for Japanese policy. As it stands, the market isn’t fully pricing another BoJ rate hike until September, but if we were to see a further increase in the wage data this week, the market might move this forward and provide a further boost to the JPY, In practice, it’s unlikely we will see much change in wage trends until the next wage round in the spring, but even at current yield spreads the JPY looks attractive, with the correlation that has held for the last 6 months or so suggesting scope for USD/JPY to move a couple of figures lower based on current yields.

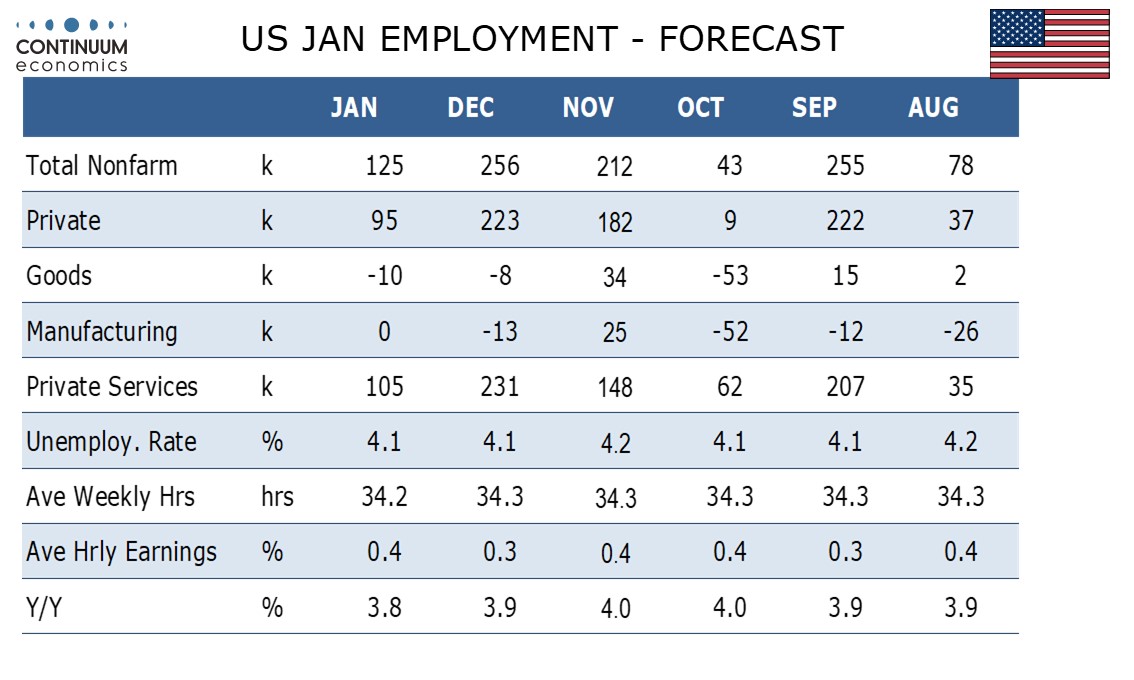

As far as the US employment report is concerned, the risks to employment may be to the low side of consensus, largely due to weather effects, but we anticipate average earnings growth of 0.4%, which should offset any concerns about slower non-farm payroll growth. It still looks hard for the market to shift far from the two Fed rate cuts priced in for the year, and if anything the risk is towards the market pricing in less easing as weak data can be explained away by the weather. However, we suspect the equity market will struggle with any rise in US yields from here, and this will tend to mean that any USD gains on strong data are more likely to come against the riskier currencies. EUR/USD is both sensitive to front end yields and positively correlated to equities – particularly European equities. Higher US yields and lower equities would consequently be EUR negative. But USD/JPY is more linked to longer term yields and negatively correlated with equities, so will be less inclined to rise on strong US data. Conversely, we doubt equities will do well on weak data either. This suggests USD/JPY remains biased lower while EUR/USD risks are also more on the downside.

Data and events for the week ahead

USA

The key release of the week is January non-farm payrolls on Friday. We expect bad weather to restrain growth to a below trend 125k overall and 95k in the private sector, though we expect unemployment to be unchanged at 4.1% and average hourly earnings to rise by 0.4%, slightly above trend. We expect ADP’s Wednesday report on private sector employment to be less sensitive to weather, delivering a 145k January increase. Other labor market indicators due in the week are December’s JOLTS report on job openings on Tuesday, while Thursday sees weekly initial claims and the Q4 productivity and costs report.

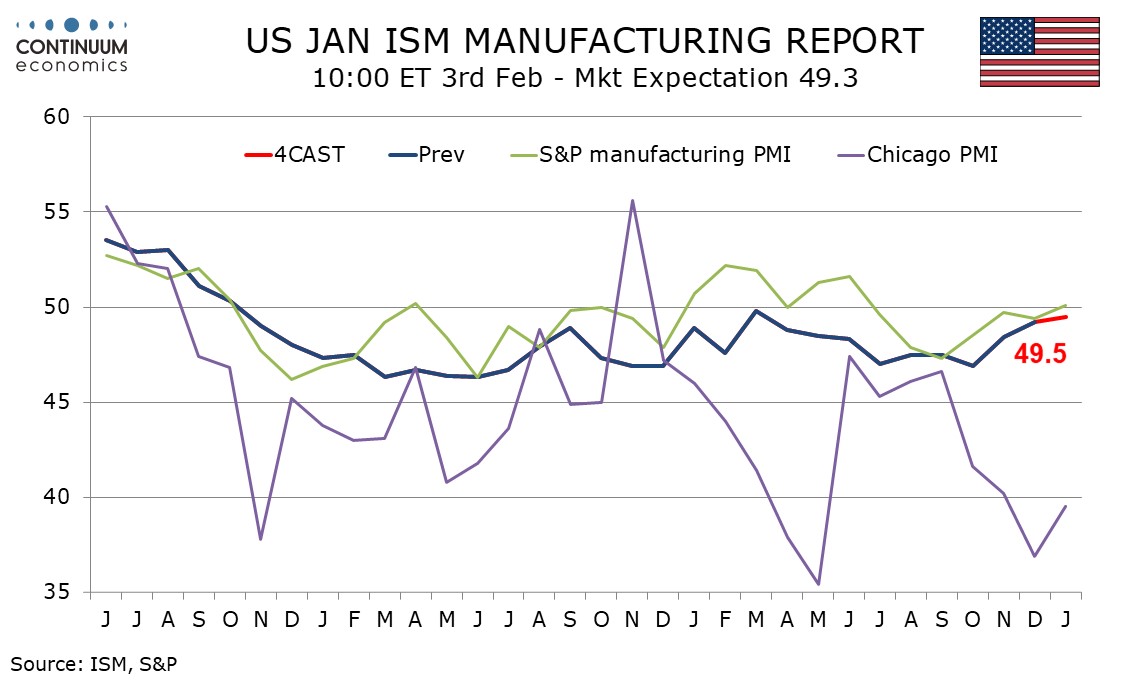

For the January ISM reports we expect Monday’s manufacturing index to edge up to 49.5 from 49.2 but services on Wednesday to slip to 52.5 from 54.0. December construction spending is due on Monday with December factory orders following on Tuesday. On Wednesday we expect December’s trade deficit to rise sharply to $98.0bn from $78.2bn. After payrolls, Friday sees January’s Michigan CSI, December wholesale trade and December consumer credit. Fed speakers scheduled are Bostic and Musalem on Monday, Bostic again and Daly on Tuesday, Barkin and Goolsbee on Wednesday and Waller on Thursday.

Canada

Canada’s key release is January employment on Friday. Canada also sees January PMI data, from S and P manufacturing on Monday and services on Wednesday, while the Ivey manufacturing index is due on Thursday. Wednesday also sees December’s trade balance.

UK

The BoE will release its Decision Maker’s Survey on Thursday, this coming alongside the MPC decision and Monetary Policy Report (MPR) update. Of late, some members of the MPC have suggested policy restrictiveness needs to be eased, making a further 25 bp move next week very much a done-deal. But with weaker real economy and inflation data coming alongside market rate expectations still some half a ppt higher than in the previous projection it does seem likely as if the updated forecasts will be consistent with a series of cuts this year at least as large as in the last MPR. Chief Economist Pill may expand on this is speech (Fri). Otherwise, final PMI data (Mon, Wed) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Thu) may reveal.

Eurozone

The week has several PMI updates, including final composite numbers (Mon, Wed) and the even weaker construction equivalent (The). Published on Monday, flash HICP data may again see higher energy costs, but where a belated fall in services inflation may see the headline slip back down to 2.3%. Indeed, shorter-term price momentum data already suggest that core and even services inflation are running around target all implying that the core rate may drop 0.2 ppt in January partly driven by softer service price pressures. Otherwise, an update on the consumer is due Thursday with a key focus on whether the recent but fragile retail sales recovery is sustained or not. There are more updates from the ECB with comments from Chief Economist Lane (Wed) arriving the same day as updated ECB wage tracker figures.

German industrial production (Fri) is likely to see a fresh m/m correction back but manufacturing orders numbers the day earlier may bounce as there is a likely reversal in bulk orders that hit November numbers.

Rest of Western Europe

There are key events in Sweden, most notably on Thursday which sees the monthly flash CPI data which surprised on the downside in December. There are also the minutes to this months’ Riksbank Board meeting which may show the extent to which easing bias continues. Norway has high-profile Industrial production data (Fri) and finally, in Switzerland, Thursday sees labor market figures and consumer confidence data arrives the day after.

Japan

The critical labor cash earning will be released next Wednesday. The market has been brewing their expectation on more rate hike from the BoJ as inflation stays elevated. Another strong wage growth close to 3% will stimulate more anticipation. However, we are cautious about pricing in too much from BoJ official rhetoric with their historic credibility. Household spending is on Friday and could help gauge consumption rebound.

Australia

Retail sales on Monday and Trade Balance on Thursday are the more important economic data from Australia. We do not view those to be market moving. Else, there are some tier two data throughout the week.

NZ

The Q4 employment is on Wednesday but it is unlikely to tilt RBNZ’s easing cycle.