FX Weekly Strategy: Asia, February 16th-20th

U.S. Q4 GDP seen at 2.6%

And a Slate of U.S. Data

UK Core CPI to Hit New Cycle-Low

Canada January CPI Little change from December

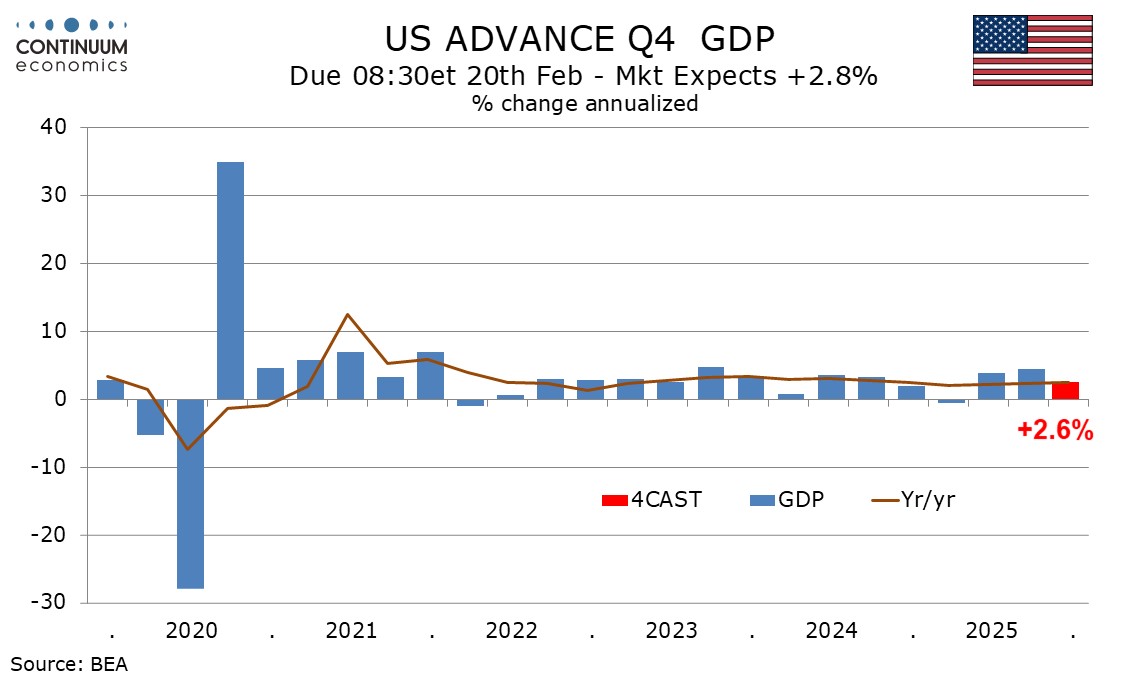

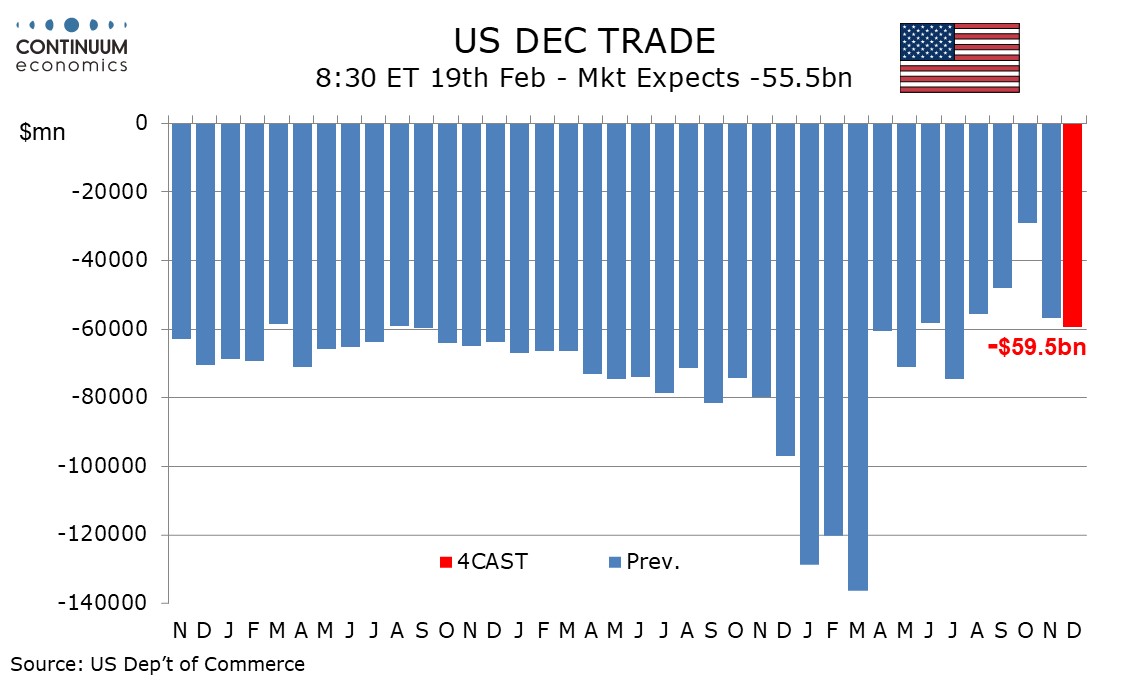

We expect a 2.6% annualized increase in Q4 GDP, well above a flat forecast we had entering the quarter, but off a peak estimate of 3.6%, with weaker November trade and December retail sales data having trimmed the forecast. December trade data, due on February 19, remains a significant source of uncertainty. We also expect core PCE prices to ruse by 2.6% in Q4. We are assuming a slight increase in December’s trade deficit, though Q4 is still likely to see a positive contribution from net exports due to a sharply narrower deficit in October. We expect exports to increase by 4.1% and imports to fall by 2.5%, with net exports adding 0.9% to Q4 GDP.

As a consequence of trade policy shifts, net exports have been a major source of volatility within recent GDP data. However under our forecasts, for 2025 as a whole, exports would be up a modest 2.1% and imports up by a similar 2.0%. We expect inventories to take off a marginal 0.1% from GDP for a second straight quarter, declining at a similar pace to Q3 in a continued correction from a surge in Q1 ahead of April’s tariff announcement.

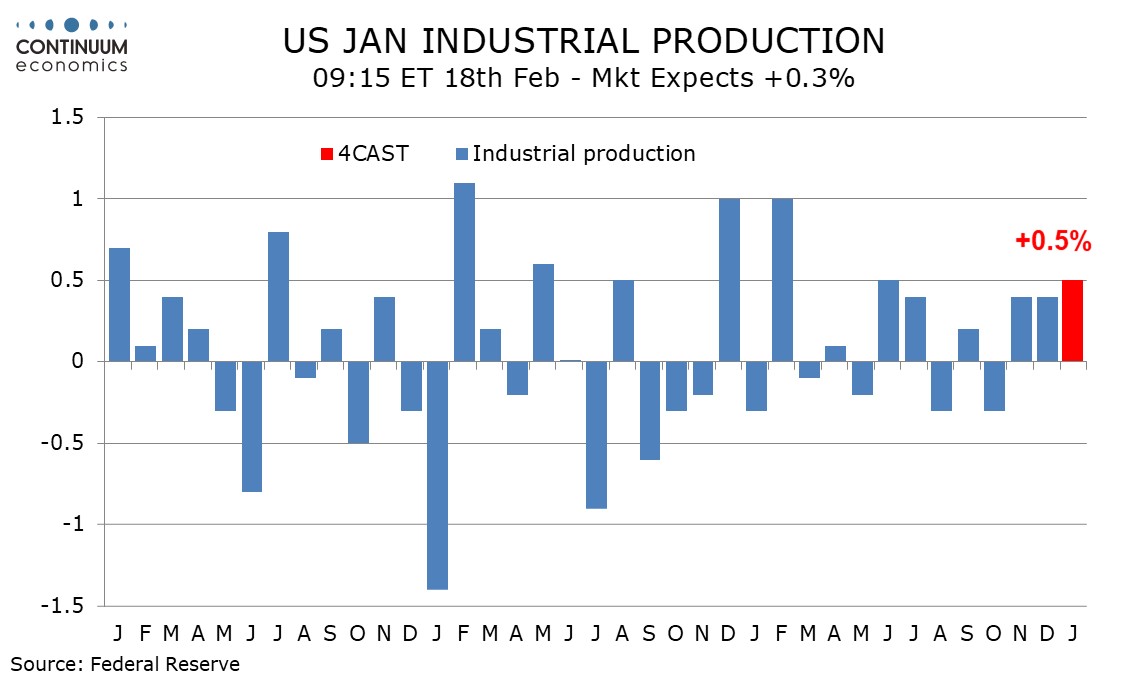

We expect a 0.5% increase in January industrial production, with ISM manufacturing and manufacturing payrolls suggesting stronger data, though there is some downside risk from bad weather late in the month.

We expect a December trade deficit of $59.5bn, which would be the widest since August and up moderately from November’s $56.8bn. It would be up sharply from October’s $29.2bn which was the lowest since June 2009 but heavily influenced by temporary factors. The data may bring some fine tuning to expectations for Q4 GDP which is due on February 20.

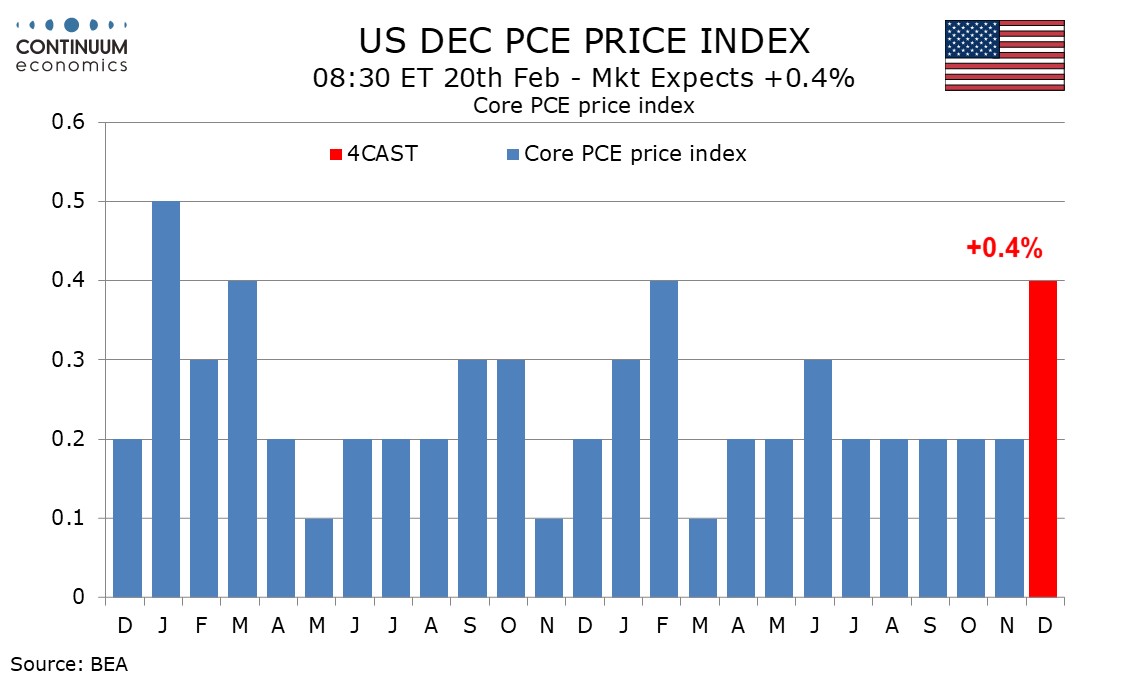

December’s personal income and spending report may be overshadowed by Q4 GDP data released at the same time, but is likely to see a strong core PCE price index increase of 0.4%, the highest since February. We expect personal income to rise by 0.3%, underperforming a 0.4% rise in spending, with both series soft in real terms.

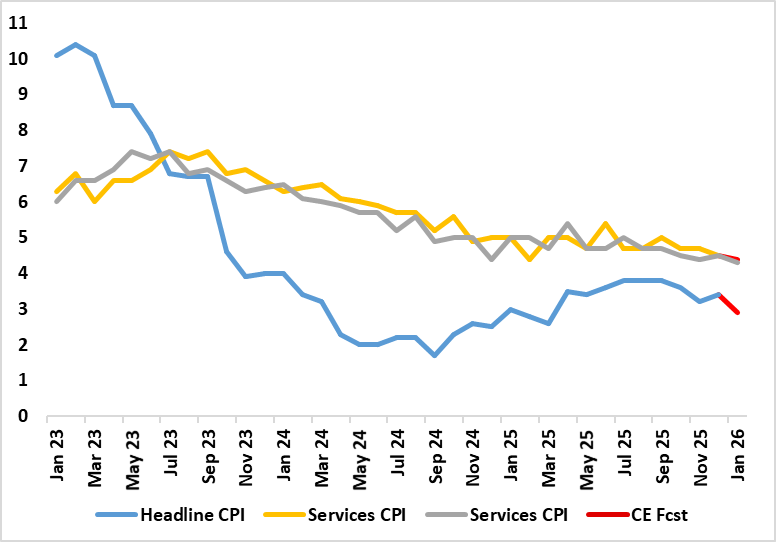

Figure: Headline and Core Further To Fall Clearly

UK policy makers may not be able to say they have won the war against inflation, but a clear victory may be seen in the batter likely in the next few months with a likely return to the 2% target by April These projected falls are likely to commence with the looming January numbers where airfare distortions which pushed up the December outcome should unwind, and where base effects may reduce food inflation. As a result, we see the headline CPI rate falling from December’s 3.4% to 2.9% (as does the BoE) and also where services and the core should fall by around 0.3 ppt to 4.2% ad a new cycle low of 2.9% for the latter. Notably such declines have been signalled for some time by adjusted m/m data (Figure 2), with already-soft wage figures likely to result in lower underlying inflation ahead. Such data should encourage further speculation that the BoE will ease afresh next month.

Although we have been flagging a fall in CPI headline inflation rate down to the 2% target sometime in the spring, this line of thinking is becoming more widespread, helped by some recent Budget measures. Notably the BoE is now suggesting that inflation will fall to 2.1% by April, partly reflecting base effects and largely stay there through Q2. We see a similar drop but (unlikely the BoE’s anticipated more modest drop) also that this will be accompanied by a fall in the core rate to just over 2% by mid-year.

For some time and for a variety of reasons, UK CPI inflation has been higher than other parts of Europe and often higher than expected. At the current juncture, that in part reflects unusually large increases in administered prices such as Vehicle Excise Duty and higher water bills last April, thereby creating favourable base effects for later this year as they are contributing around 0.5 percentage points to current inflation. Moreover, food, and tobacco inflation is estimated to be contributing a further 0.5 percentage points to current inflation and this should unwind although PPI data do not yet suggest this is likely to occur imminently.

Other factors are also likely to weigh on inflation, and only partly due to the weak demand backdrop that we think is currently evident. Indeed, partly reflecting the energy bills package announced in last November’s Budget, which, alongside a fall in wholesale gas prices, is expected to result in a decline in the Ofgem price cap by up to 8% in April, enough to knock some 0.3 ppt off the headline rate.

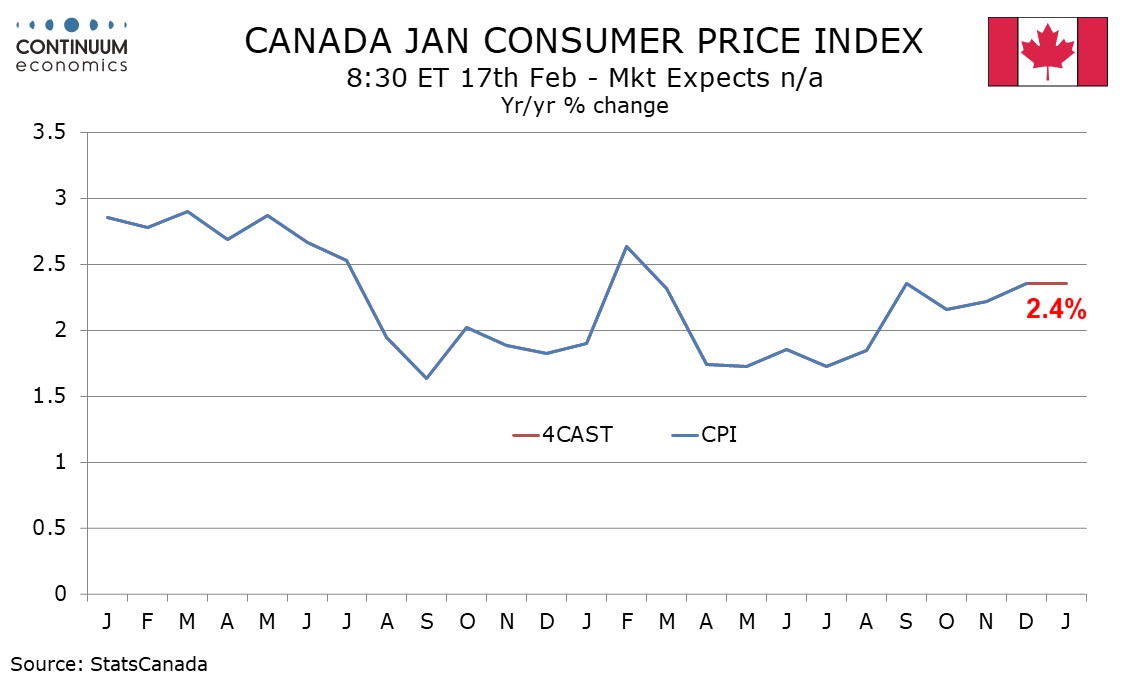

We expect January Canadian CPI to be unchanged at 2.4% yr/yr, with both December and January at 2.36% before rounding). We expect the Bank of Canada’s core rates to be on balance softer, with CPI-Trim and CPI-Common both slowing, but CPI-Median stabilizing after a sharper fall in December. Yr/yr rates will see some upward pressure from a sales tax holiday which lasted from mid-December in 2024 through mid-February in 2025, meaning the maximum boost to the yr/yr rate will come in January. However, underlying prices were increasing at a faster rate in January 2025 than they are now, weighing against the boost to yr/yr growth coming from the tax shift.

On the month we expect CPI to rise by 0.2% both overall and ex food and energy seasonally adjusted, though unadjusted the ex food and energy rate is likely to show seasonal weakness with a 0.1% decline, partially offset by a seasonal increase in gasoline, seeing overall CPI up by 0.1% unadjusted. The seasonally adjusted ex food and energy pace will be following an above trend 0.3% rise in December that rebounded from a below trend 0.1% increase in November. December’s gain was inflated by a sharp rise in air fares which is unlikely to be repeated. On a yr/yr basis we see the ex food and energy rate at 2.4% (2.43% before rounding), down from 2.5% in December.

For the Week Ahead

JP

Q4 Preliminary GDP will be release on Monday, where we expect both headline and annualized GDP to return to expansion. It will be a dovish surprise if GDP remain in contraction. Followed by trade balance on Wednesday and National CPI on Friday. The later would be more important as we have been seeing moderation throughout headline and core CPI. It will be critical to know if the moderation persist and starts affecting core-core.

AU

The RBA minutes on Tuesday may capture more attention than usual after the RBA exit their easing cycle and turned towards hiking. The idea behind two more hikes, if mentioned, would be important for market participants to understand. Wage Price index on Wednesday may capture eyeballs if wage growth is mentioned in the meeting minutes. Labor data may carry less weight than wage on Thursday.

NZ

The RBNZ decision is on Wednesday where market is expecting no change to rates. CPI has edged higher but the RBNZ does not seem to be interested in hiking, compared to the RBA as they see such overshoot to be transitory. Apart from trade balance on Friday, there is just tier two data throughout the week.

USA

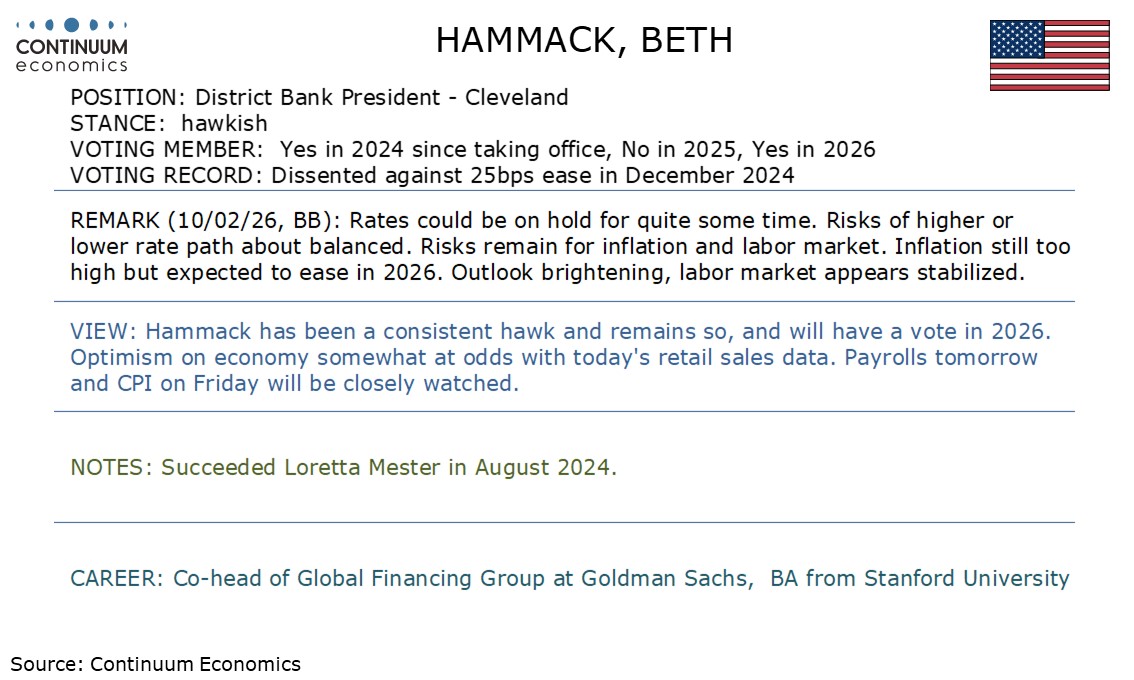

The US sees the President’s Day holiday on Monday. On Tuesday February surveys from the Empire State on manufacturing and the National Association of Homebuilders are due, and Fed’s Daly is due to speak. On Wednesday we expect a 5.0% decline in December durable goods orders after a 5.3% November increase but a second straight 0.4% increase ex transport. Housing starts and permits for both November and December are also due. For starts we expect a rise of 8.3% in November to 1350k to follow a decline of 4.6% in October, with a more moderate 1.5% increase to 1370k in December. For permits we expect moderate gains of 0.6% in November, to 1420k, and 1.4% in December, to 1440k. For January industrial production we expect a 0.5% increase, with manufacturing also up by 0.5%. FOMC minutes follow and may show a variety of opinions on the economic outlook, and when further easing may become appropriate, but few are likely to be in a hurry to act.

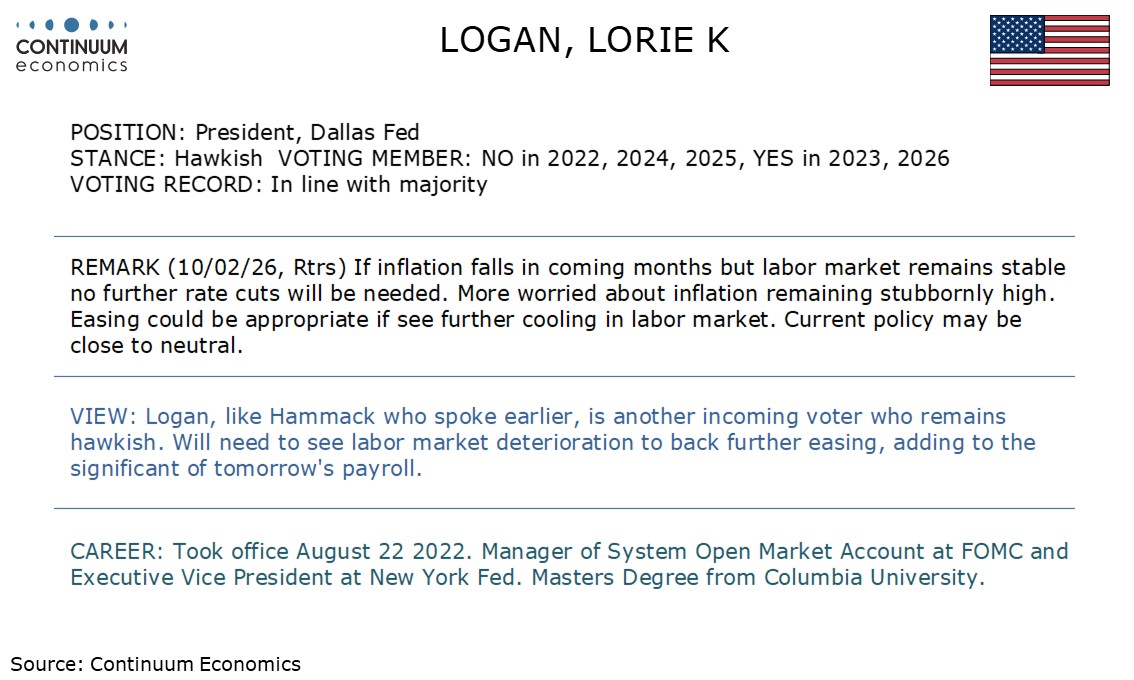

Thursday sees weekly initial claims and February’s Philly Fed manufacturing survey, as well as December’s trade deficit, which we expect to increase to $59.5bn from $56.8bn. January pending home sales, which fell sharply in December, follow. The key release of the week is likely to be Q4 GDP on Friday, where we expect a 2.6% annualized increase, with core PCE prices also up by 2.6%. GDP forecasts may be influenced by durable goods and particularly trade data for December released earlier in the week. December’s personal income and spending reports may be overshadowed by the GDP release, which is due at the same time., We expect December gains of 0.4% in core PCE prices and personal spending, with a 0.3% increase in personal income. Later final February Michigan CSI data and new home sales for both November and December are due. We expect gains in new home sales of 1.1% in November, to 745k, and 1.3% in December, to 755k. Fed’s Logan is also due to speak.

CANADA

The key release in Canada will be January CPI on Tuesday, where we expect the yr/yr rate to remain at 2.4% but with the Bank of Canada’s core rates on balance slightly softer. December data for manufacturing shipments on Monday, wholesale sales on Tuesday and retail sales on Friday will have some impact on Q4 GDP expectations. Respective preliminary estimates were +0.5%, +2.1% and -0.5%. December’s trade balance on Thursday will also be significant. Also due are January housing starts on Monday, January existing home sales on Wednesday, and on Friday January’s IPPI and RMPI.

UK

The coming week sees several important economic updates looming, most notably the CPI (Wed). These January numbers will be important where airfare distortions (which pushed up the December outcome) should unwind, and where base effects may reduce food inflation. As a result, we see the headline CPI rate falling from December’s 3.4% to 2.9% (as does the BoE) and also where services and the core should fall by around 0.3 ppt to 4.2% and a new cycle low of 2.9% for the latter.

Contributing to the BoE debate, Tuesday sees ever-more important labor market numbers. Apparent wage resilience has perturbed some MPC members but where even the hawks are starting to re-think. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data and are now officially accredited) is likely to see further and clear drops in the official earnings data, at least for private sector regular earnings which may fall (possibly well) below 3.5% on the official 3-mth rolling basis measure. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so as far as the private sector is concerned, while its pay data already suggest a slowing to under 3% has occurred.

Friday sees monthly public borrowing numbers which are running below year-before levels. Friday also sees January retail sales data where a further m/m correction is seen with it unclear if wetter and cooler than average weather may have affected spending adversely. Earlier that day, GfK consumer confidence data may show still subdued sentiment as may CBI industry numbers (Thu). But as far as survey numbers are concerned, the PMI flashes (Fri) take precedence at least in market eyes, especially after the perkier outcome last time around which we think will be reversed in this February update, the data still suggesting falling private sector employment.

Eurozone

With some eyes on the German ZEW survey (Tue), and EU/EZ consumer confidence (Thu) the focus will be on the flash PMI data (Tue). In January, the Composite PMI fell from 51.5 in December to 51.3 in January, thus again indicative of a weak rate of growth, and one that was also the slowest since last September. This weakening of growth was driven by the service sector, underlying data showed, more than nullifying a fresh expansion in manufacturing output. We see little change but underscore that the composite measure ignores what still looks like recession bound construction.

As for the ECB, some insights into its thinking will be evident from its Economic Bulletin (Thu) and where the central bank will publish its update on negotiated wages (Fri).

Rest of Western Europe

There are a key events in Sweden, most notably revised CPI numbers (Fri), preceded by labor market figures (Mon). In Switzerland, Monday sees industrial production and flash adjusted GDP data both for Q4. We see only a small recovery after the 0.5% Q3 drop for the latter.

Recap of the Week

U.S. January Employment Stronger across the board, will keep Fed in no hurry to ease

This Week's Fed Speakers

BoC Minutes Show Steady policy dependent on economy evolving as expected

UK GDP Underlying Economy Fragility Does Continue

Landslide Victory for Japan LDP

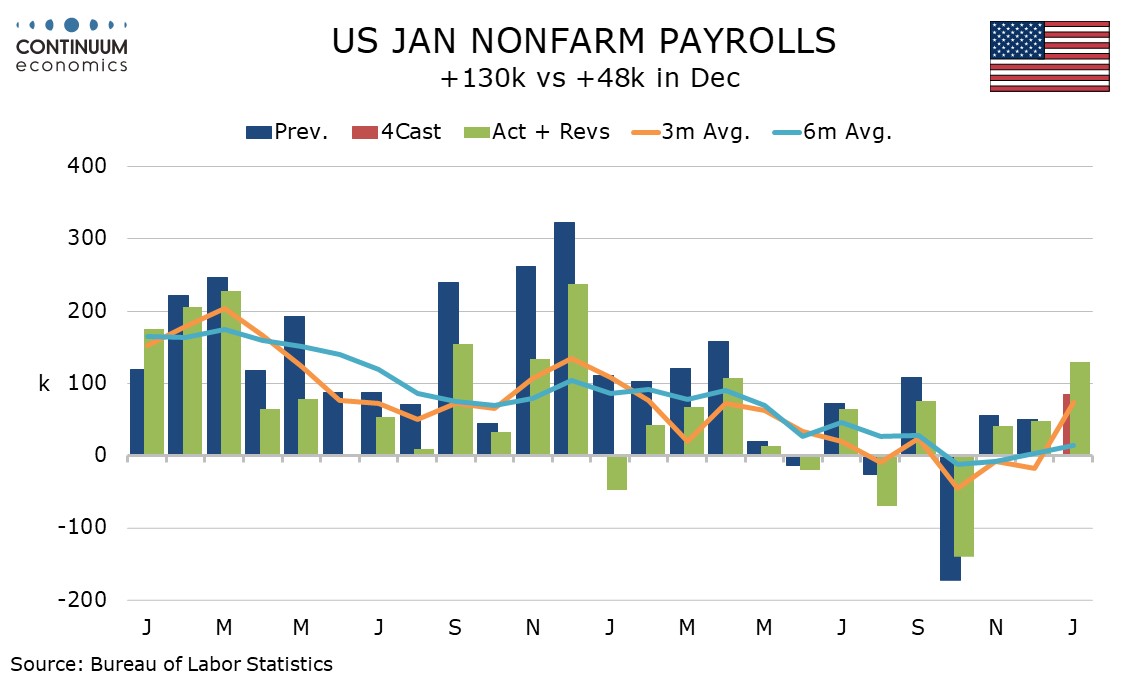

January’s non-non-farm payroll at 130k is significantly stronger than expected and even more so in the private sector at 172k. An above trend 0.4% rise in average hourly earnings, a rise in the workweek to 34.3 from 34.2 hours and a fall in unemployment to 4.3% from 4.4% leave the data as stronger than expected across the board. This should ensure the Fed remains in no hurry to ease. This report contains annual historical revisions with the March 2025 benchmark revised down by 862k, in line with signals already given by the Labor Dep‘t. Since March 2025 revisions are relatively modest, totaling a negative 131k, with 50k of that coming in April 2025. December’s data was revised down by only 2k to 48k with private sector data revised up to 64k from 37k. The revisions do not take much away from the surprisingly strong January detail.

January saw some severe weather late in the month but this came after the reference survey and did not impact the non-farm payroll. The payroll gain was more than fully explained by a 137k increase in education and health, the strongest sector in most recent payrolls but particularly strong this month. 123.5k of that came in health. Also above trend was construction at 33k while manufacturing managed a 5k increase, its first in over a year. Professional and business was above trend at 34k but financial was weak at -22k. Retail, a sector where we had seen upside risk after recent slippage, was almost unchanged, up by 1k. This follows a disappointing December retail sales report. Government fell by 42k, led by a 34k decline in Federal.

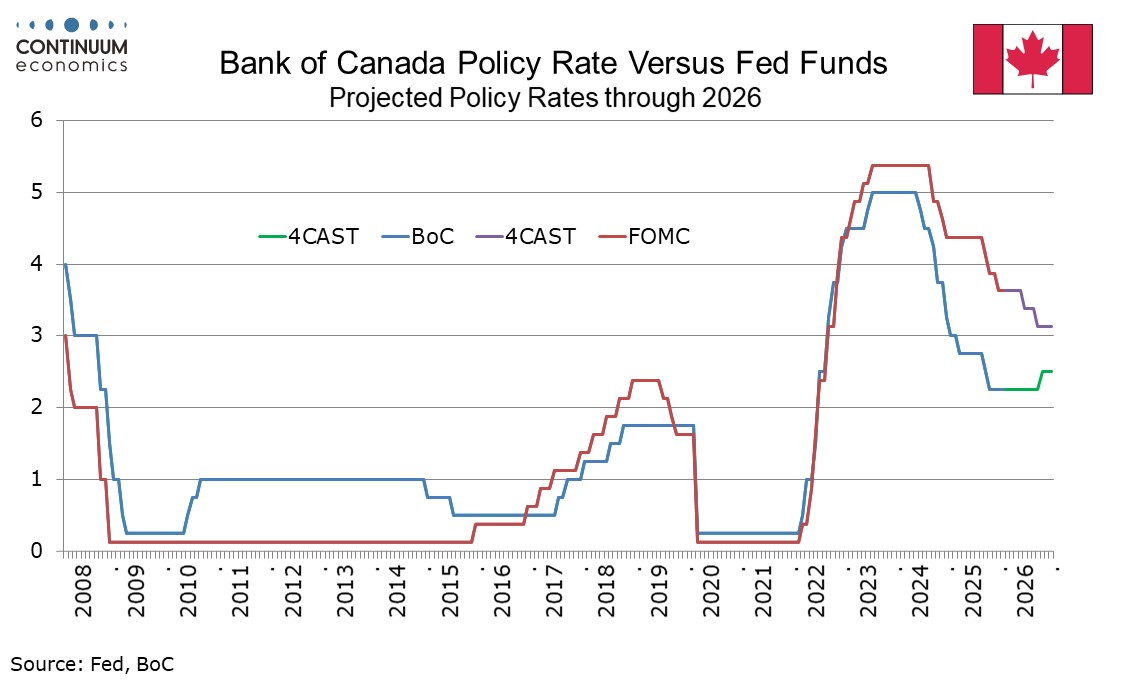

The Bank of Canada has released minutes from its January 28 meeting which provide no major surprises. The meeting saw rates left unchanged at 2.25% but noted heightened uncertainty, which the minutes also emphasize, with steady policy conditional on the economy evolving as expected. Most major economies were seen as proving resilient to US tariffs but were still seen as vulnerable to unpredictable US policy. The Canadian economy was seen as evolving largely as anticipated in October’s Monetary Policy Report. Domestic demand was expected to remain resilient but with investment soft through 2026. Fiscal policy was seen as supportive while the labor market continued to be soft. CPI was seen as evolving in line with expectations with the BoC’s preferred measure of core inflation falling to 2.5% in December from 3.0% in October.

Three broad areas of risk were discussed. Firstly geopolitical, including in Venezuela, Iran and Greenland, as well as threats to the independence of the US Federal Reserve, which added to uncertainty. The review of the Canada-US-Mexico trade agreement as seen as an important risk, and to the downside on growth, though with potential inflationary risk from any retaliatory tariffs. Finally the BoC discussed risks from ongoing trade disruptions and structural adjustments, concluding that risks around the outlook had moved higher.

Members agreed to hold policy given that it was already on the stimulative side and the projection remained in line with October’s, but agreed that holding policy at the current rate was conditional on the economy evolving in line with their outlook. The range of possible outcomes was seen to have broadened with assigning weighs to their probabilities unusually difficult, as was predicting the direction and timing of the next policy change. We expect the BoC to keep policy steady until a modest tightening in Q4, but if there is to be a move before then, it is more likely to be an easing, in response to downside risks materializing.

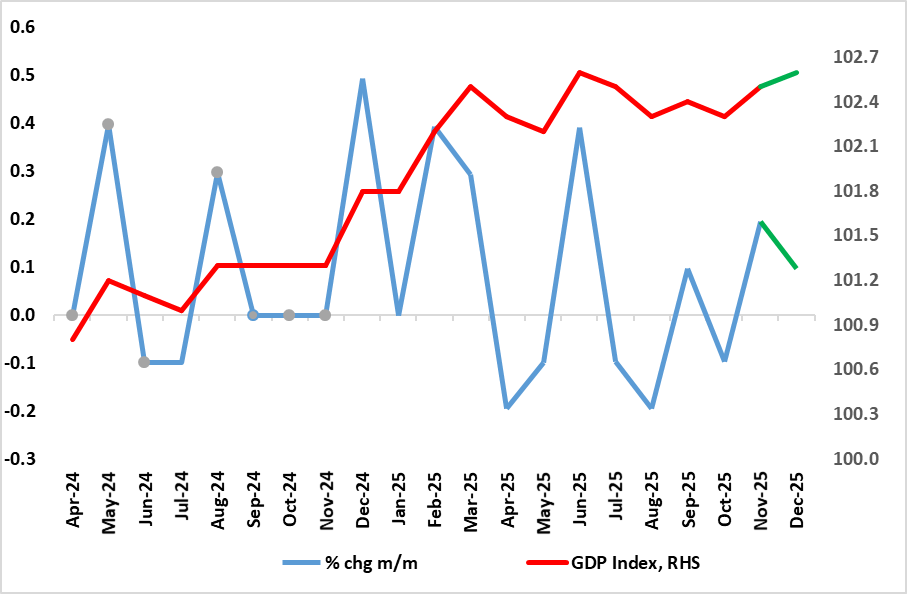

Figure: GDP Growth Volatile but Hardly Strong?

First the good news; the UK economy grew for a second successive month in December, something not seen for almost a year. But as is familiar with recent UK real economy data, there is a negative flip side with the 0.1 m/m December advance negated by downward revisions to previous figures (November pared back 0.1 ppt to 0.2) and September downgraded similarly. As a result, the economy grew by 0.1% q/q in Q4, less than consensus and BoE thinking but matching the feeble gain of the previous quarter with weakness in business investment occurring alongside another gain in imports. Activity in December was impaired by fresh weakness in manufacturing, utilities and construction. The data is likely to reinforce the demand worries of what now seems to be an emerging majority on the MPC; six members of the MPC appear worried about the disinflationary impact from a weak economy - four of whom actually voted for a 25bp cut at this month’s meeting.

Even given the surprisingly solid, but somewhat pared back November GDP release, December merely returns the level of GDP to where it was in June. Partly undermined by wet and warm weather through the month, GDP advanced by a mere 0.1% in December figure, half that of November. This means that Q4 saw a 0.1% q/q rise which would result in 2025 growth of 1.3%, two notches above that seen for 2024. But we still see no more than 0.8% this year; this actually and merely being a minor pick-up from the anemic growth seen in the last two quarters. Regardless, we remain wary about the GDP numbers, even given their relative weakness. Although there have been some better business survey numbers, other such insights provide still sobering reading (Figure 2) as do non-official employment indicators, the latter actually suggesting a worsening backdrop of late.

It is unclear how uncertainty (especially related to budget worries) affected activity in October and whether a degree of more fiscal clarity even ahead of the actual Budget may have helped sentiment in November. But businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025. These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies.

It is a landslide victory for Takaichi's LDP. The early result is showing the LDP winning 316 seats and the coalition has secured super majority with 352 seats in the 456 seats Lower House. The opposition, Central Reform Alliance, performed terribly and could see only 49 seats left. The result fits earlier polls but few it is expecting the LDP to get such a huge win. Market participants are reacting by renewed JPY offers, in fear of more fiscal irresponsibility.

In reality, we believe such fear has been exacerbated by neglecting the material changes in Japanese economic landscape compared to Abe's era. While PM Takaichi is definitely pro-stimulus, the business price/wage setting behavior has already substantially changed from a decade ago and the momentum does not look like to be slowing in a short term. Thus, there is no need of Abe's era massive stimulus policy to jumpstart the economy. PM Takaichi seems to be considering market sentiment by shelving food tax cut that was promoted in her campaign, in sight of fiscal irresponsible sentiment and rising yield. These factors lead to our expectation that any potential stimulus wouldn't be COVID era and rather be more targeted at cost relieve and strategic investment.

PM Takaichi's win could be partially attributed to her latest round of economic stimulus, but her strategic approach towards voters can not be neglected. She has taken a more lively approach in public imaging, where she appeared to be more attached to local culture including manga, band music and was not afraid to show that side of her. It is quite uncommon in Japanese politicians. Also distancing herself with old coalition partner Komeito, Takaichi seems to be able to grasp the heart of voters that the LDP is head towards a change.