FX Daily Strategy: Asia, November 8th

FOMC and Trump Trade Remains Spotlight

The Rebound in Overall Household Spending is needed for BoJ

Employment Changes Unlikely to Tilt the Loonie

FOMC and Trump Trade Remains Spotlight

The Rebound in Overall Household Spending is needed for BoJ

Employment Changes Unlikely to Tilt the Loonie

The FOMC decision will be announced in pre-Asia Friday and will guide the FX movement in the Asia session on Friday. The market widely expects another cut from the Fed where we see a 25bps cut and more uncertainty lies ahead. It may trigger a correction in the USD as it has strengthened significantly after Trump was elected as the U.S. president. However, the surprise maybe to the upside if the Fed suggest the path of future tightening to be uncertain and bring renewed speculation that the Fed will tighten slower than estimate. Moreover, the recent momentum from Trump trade has set the USD on fire. Further break out cannot be ruled out but any announcement of Trump policy will be critical.

Overall Household Spending will be released on Friday's Asia session. Consumption has been the laggard for Japan as household balance sheet are significantly limited by negative real wage. The latest wage data showed a decent 2.8% y/y to growth by real wage lingers slightly below 0 and may continue to limit private consumption. There are signs the wage/price setting behavior are changing in Japan, given the level of inflation, yet the pace maybe slower than BoJ's forecast. Another miss in household consumption will definitely alarm the BoJ because their trend inflation forecast will be too high. There will be further ground for the USD/JPY to gain if such happens. The verbal intervention from the BoJ did escalate but it is hard to see an actual intervention as the JPY has seen weaker days.

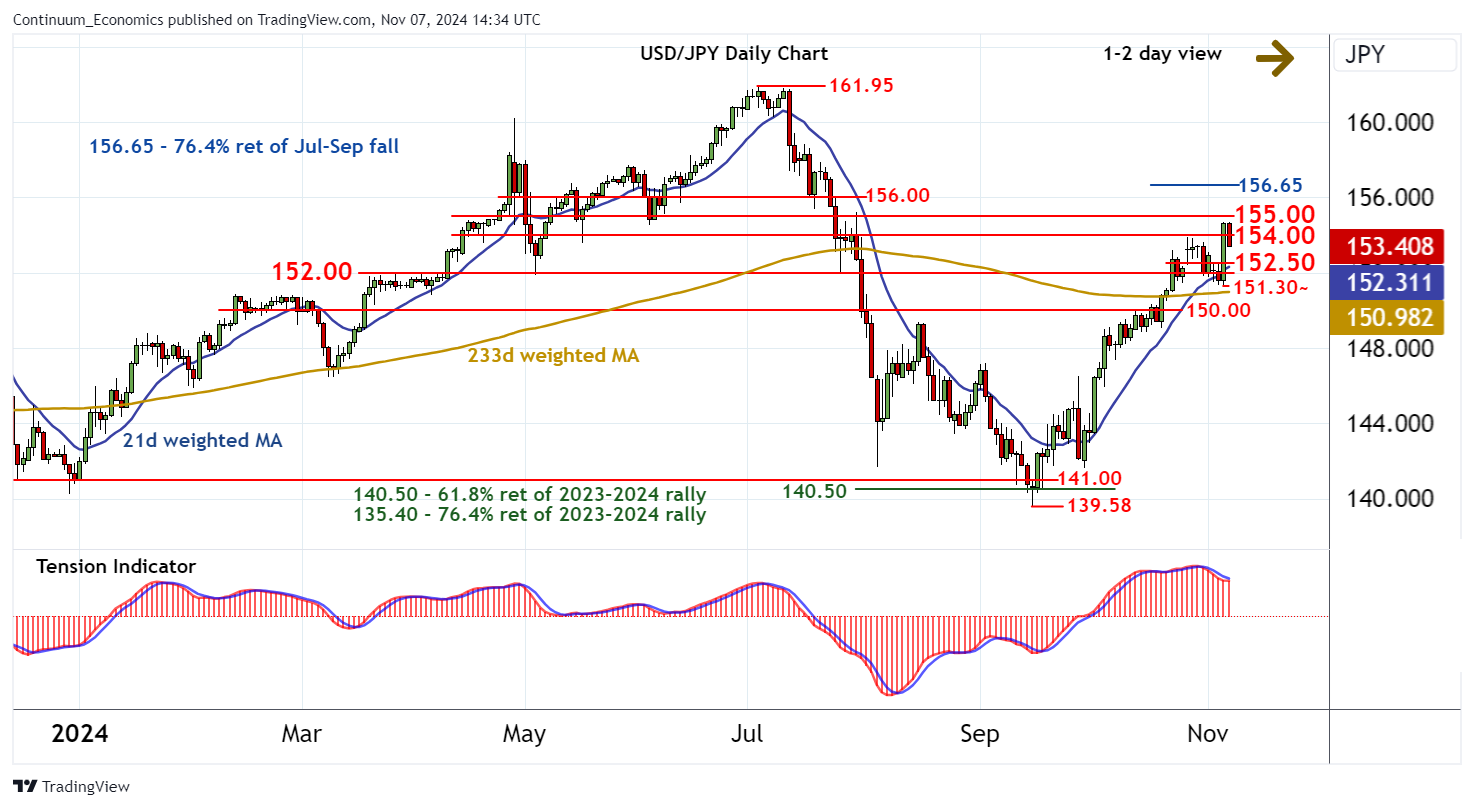

On the chart, the consolidation beneath congestion resistance at 155.00 is giving way to a pullback in both USD- and JPY-driven trade, with the break below 154.00 currently balanced around 153.50. Negative intraday studies highlight potential for further losses towards support within the 152.00/50 area. But improving daily readings and rising weekly charts are expected to limit any tests in fresh buying interest/consolidation. A close below the 151.30~ low of 6 November, if seen, would turn sentiment negative and extend losses towards 150.00. Meanwhile, a close above 155.00, not yet seen, would turn price action positive and extend September gains beyond congestion around 156.00 towards the 156.65 Fibonacci retracement.

The Loonie has lost against USD when compared to other major FX after the Trump led USD rally, mostly because from the close proximity of Canada to the United States. Thus, the development in the United States politics will affect Canada more than other countries. Employment data on Friday is expected to be softer than the previous month but may carry less weight than usual after the volatility earlier in the week.

On the chart, the anticipated break below 1.3850 has bounced sharply from above congestion support at 1.3800, in both USD- and CAD-driven trade, with prices currently consolidating the test of the 1.3958 current year high of 1 November. Intraday studies are mixed/positive, suggesting potential for a break above here. But negative daily readings are expected to limit initial scope in renewed selling interest towards the 1.3978 year high of 1 October. Broader weekly charts are positive, but any continuation beyond here should meet profit-taking towards critical resistance at the 1.4040 Fibonacci retracement. Meanwhile, support is raised to 1.3900. A close beneath here would turn sentiment neutral and prompt consolidation above 1.3850.