USD flows: USD gains on court tariff decision

USD up vs safe havens as court rues reciprocal tariffs illegal

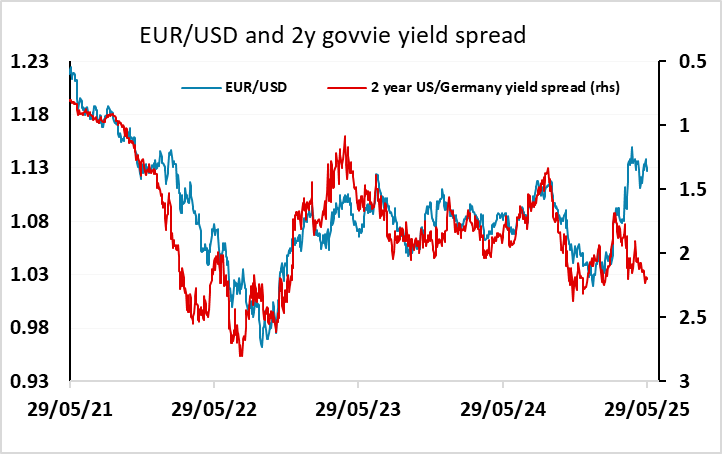

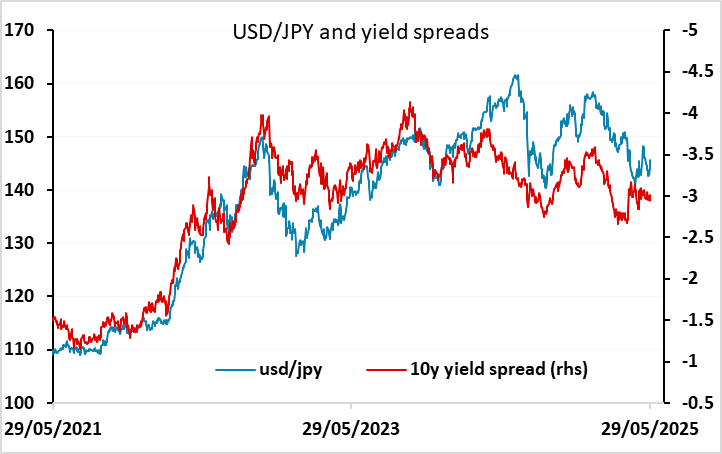

The USD has rallied overnight against the safer havens on the news that the US court for international trade had ruled Trump’s reciprocal tariffs illegal. S&P500 futures are on the verge of breaking above 6000, US yields are higher across the curve, and equity risk premia are pressing their 24 year lows recorded at the beginning of the year. In other words, most asset markets have effectively erased the impact of the tariff increase. However, while the USD has rallied, it is still substantially below the level seen at the beginning of the year. For USD/JPY, this is consistent with the moves we have seen in yield spreads, but the gains in EUR/USD have substantially exceeded the moves in yields. If all the tariff related moves are to be reversed, there is substantial downside potential for EUR/USD.

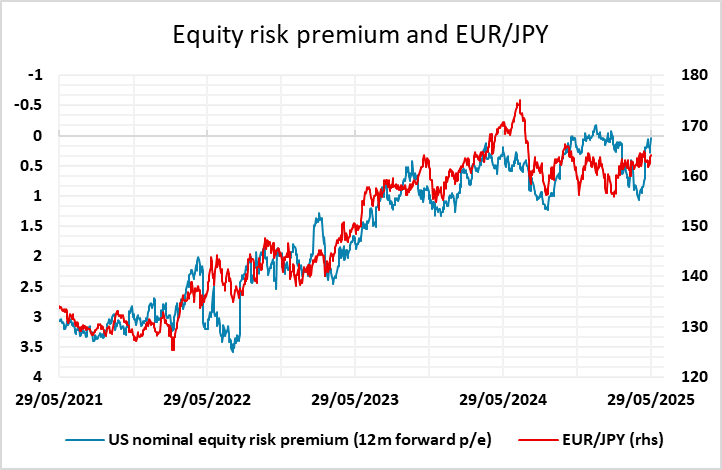

Having said this, EUR/JPY continues to correlate with the moves in equity risk premia, and as long as equities and bonds hold current levels implied risk premia will still suggest EUR/JPY and other JPY crosses will hold at current high levels. However, the White House is appealing the decision and for the moments the tariffs that are in place will stay, most likely until the whole issue of the legality gets examined by the Supreme Court. Many see this as more Trump friendly than lower courts, so there is still a strong possibility that the existing tariffs will remain in place. But the decision probably makes it less likely that threats of higher tariffs will be followed through.

We therefore still see a case for broad USD weakness relative to earlier in the year, both because there is already some evidence of slowdown in the US economy, and because there will still be a high degree of uncertainty about tariff policy for at least the next few months. Decisions to reallocate funds away from the USD made by both private and sovereign financial institutions in the last few months are unlikely to be quickly or fully reversed. We also see current equity market levels as stretched and the decline in the JPY in the last week as overdone, both against the USD and on the crosses.