FX Weekly Strategy: November 11th-15th

Market unlikely to move sharply without more detail of Trump plans

USD still likely to remain well supported

GBP strength to be sustained unless labour market data is weak

Little reason for a significant EUR recovery

JPY could benefit further if we see solid Japanese Q3 GDP data

Strategy for the week ahead

US CPI will be the main data of the week, but it is hard for markets to move decisively until there is more clarity on the detail of Trump policies.

In his post-FOMC press conference Powell stated that in the near term the election will have no impact on policy as the timing and substance of any policy changes are unknown. However it is likely that Trump, even if not fully meeting his promises, will seek to cut taxes beyond simply extending the 2017 tax cuts, and that will provide support for the economy. That is likely to be done fairly quickly. Aggressive tax cuts will add to the budget deficit, probably sufficiently to cause some concern in the bond markets, and Trump’s most obvious method to raise revenues will be tariffs. He has few serious ideas on cutting spending. If tariffs are raised substantially, inflation is likely to receive a lift, and that is likely to be apparent in the data by 2026.

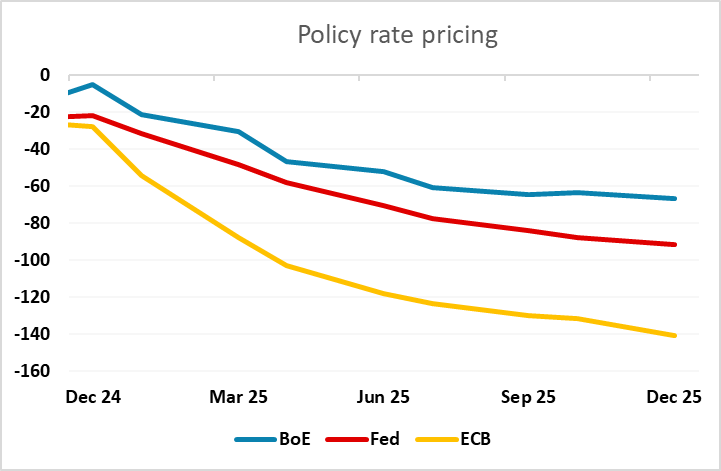

We continue to expect rates to end 2024 at 4.25% to 4.5%, 25bps lower than currently. Previously we had expected rates to fall to 3.0-3.25% by end 2025. A more expansionary fiscal policy has us now predicting only 75bps of easing in 2025, taking rates to 3.5-3.75%, with two 25bps moves in Q1 and one in Q2. As inflation rises, we expect tightening to resume in 2026, taking rates to 4.5-4.75% by Q3, after which we expect rates to stabilize with the economy likely to be then losing momentum after a strong 2025.

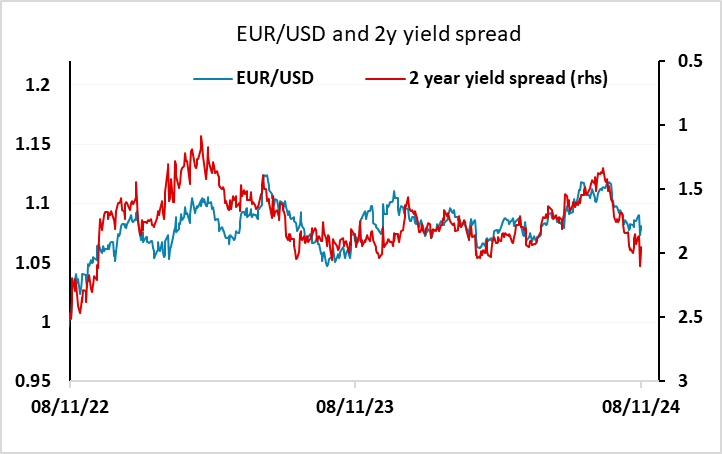

This outlook is already priced into the US curve to the end of 2025, although at this stage there is no rise in rates priced in for 2026. It is unlikely that any such rise will be priced in to any great extent, as markets rarely price in turning points of this sort a year or more out. But from current levels we see some mild upside risks for US yields, and that suggests the USD will remain well supported. Our CPI forecast is in line with consensus, so we see short term risks as evenly balanced, but wouldn’t expect the reaction to CPI to determine the medium term direction.

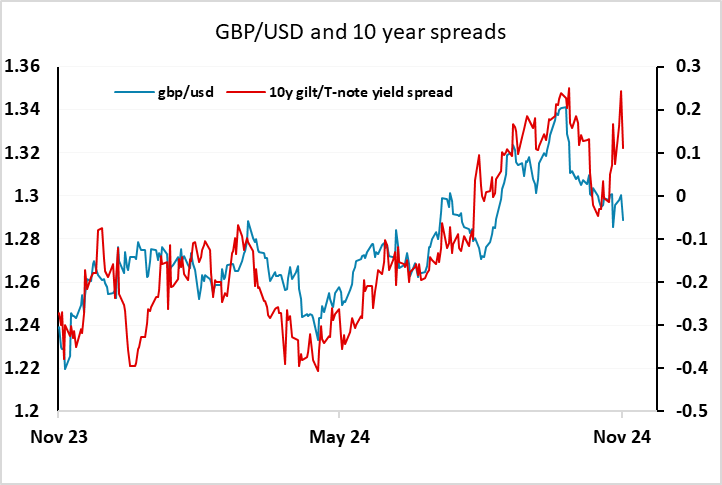

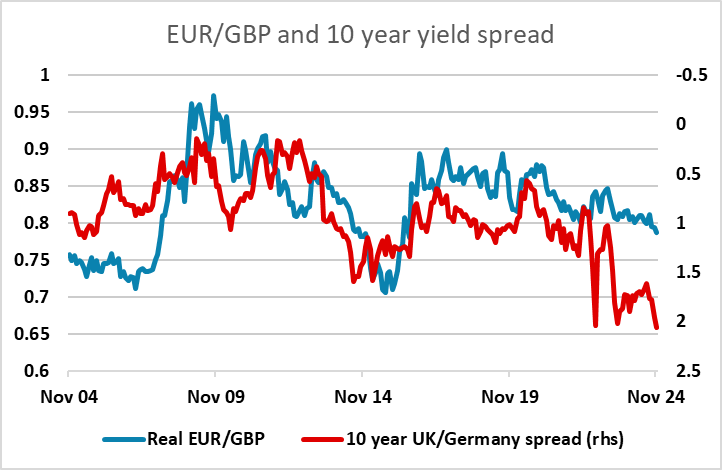

Elsewhere, UK yields rose significantly after the BoE meeting last week, and helped to take GBP back close to the highs of the year against the EUR. But we are wary of forecasting further GBP gains purely on the basis of yield spread moves, as GBP fell after the Budget despite a yield spread move in its favour, suggesting rising yields reflected some loss of confidence and couldn’t be seen as a clear GBP positive. GBP also remains at high levels against the EUR in real terms, albeit somewhat lower than might be expected on the basis of the historic correlation with yield spreads. Even so, the post Budget reaction may have reflected one off selling of UK assets rather than an underlying change, so for the moment we would tend to see the more hawkish BoE tone from last week as likely to maintain some upward pressure on the pound. But this week’s labour market and GDP data could affect the BoE’s and market thinking. If the labour market is on the soft side as we expect, it is likely that EUR/GBP will push higher from 0.83.

There isn’t much news due from the Eurozone, but the EUR has generally lost ground in the last week with the Trump victory being perceived as a negative for the Eurozone economy. In reality we think this is unclear. While higher US tariffs may be negative for all, some simulations (notably from the LSE) show the impact on the Eurozone being quite mild, much less than the effect on the US and China. Even so, the current EUR curve is broadly in line with our view of ECB policy, and doesn’t suggest any significant EUR recovery is likely given an upward bias to US yields.

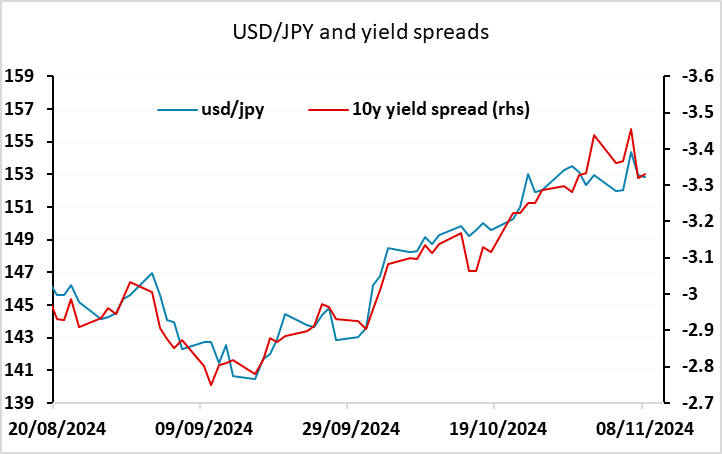

While EUR/USD remains somewhat lower than it was pre-election, USD/JPY is essentially back to pre-election levels helped by a rise in JGB yields. This week’s Japanese Q3 GDP data may be important in determining whether the BoJ will have any interest in raising rates at the December meeting. If we see further gains in consumption, thus may be seen as a green light, and we suspect the BoJ will be keener to move given the low level of the JPY. But weak GDP, particularly weak consumer spending, could deter any near term tightening. There isn’t much priced into the market, so the impact on the JPY is unlikely to be large, with greater upside risks form strong data.

Data and events for the week ahead

USA

The US calendar is quiet on Monday. Tuesday sees October’s NFIB survey and the Fed’s quarterly Senior Loan Officer Opinion Survey of bank lending practices. Fed’s Barkin, Kashkari and Harker speak on Tuesday.

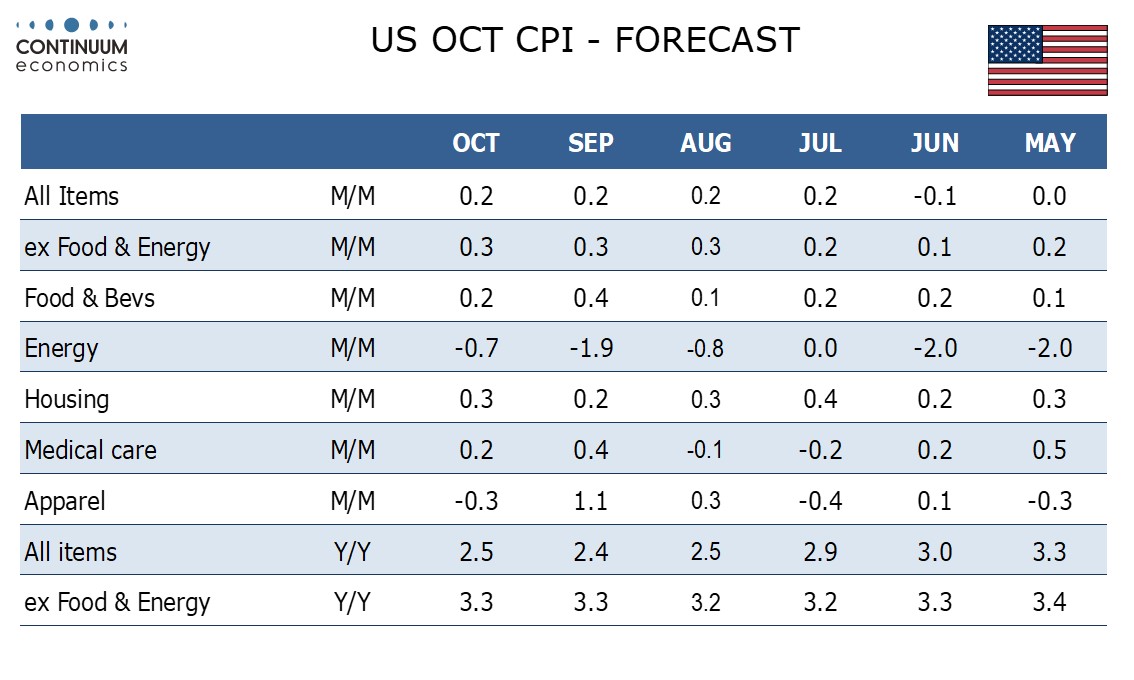

Wednesday’s October CPI is the key release of the week, and we expect a 0.2% rise overall and a 0.3% increase ex food and energy, similar to the two preceding months. Fed’s Logan, Musalem and Schmid speak on Wednesday. On Thursday we expect October PPI to look similar to the CPI, with a 0.2% increase overall and a 0.3% increase ex food and energy. Weekly initial claims are also due and Fed’s Barkin and Williams will speak.

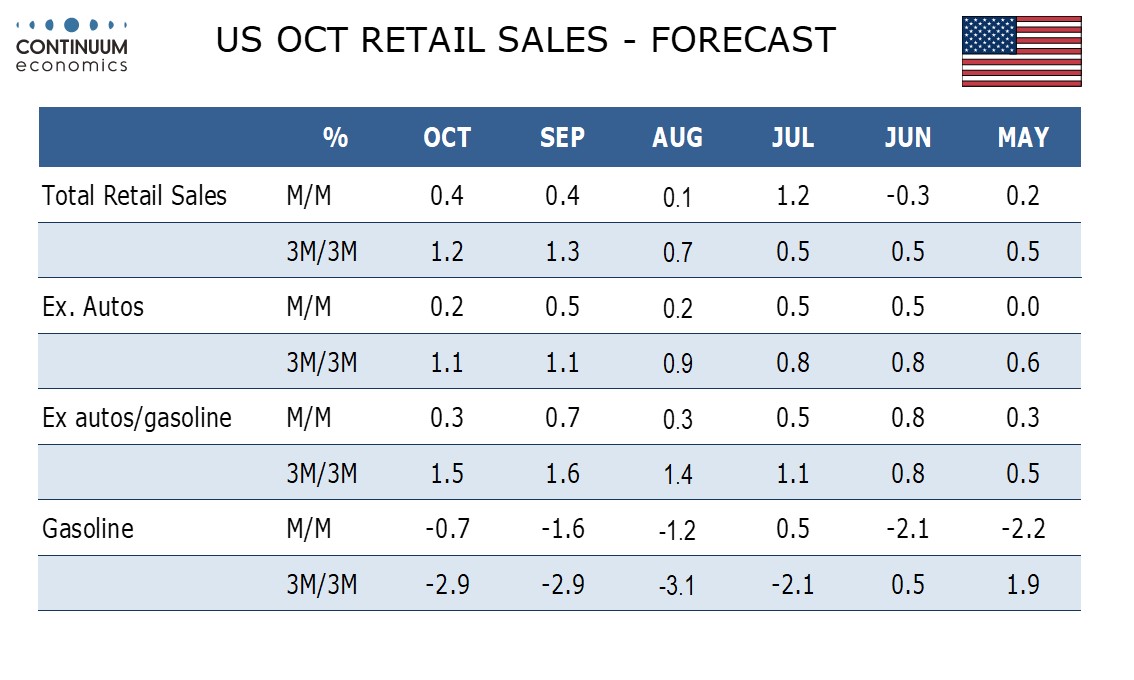

On Friday we expect a 0.4% increase in October retail sales, with a 0.2% increase ex auto and a 0.3% increase ex autos and gasoline. October import prices and November’s Empire State manufacturing survey will be released with the retail sales report. October industrial production follows, which we expect to be unchanged overall but with a 0.3% decline in manufacturing. September business inventories and sales follow, with current data implying gains of 0.1% in both series.

Canada

Canada releases September building permits on Tuesday. Friday sees September manufacturing and wholesale sales, for which preliminary estimates were for a fall of 0.8% and a rise of 0.9% respectively. October existing home sales are also due.

UK

Tuesday sees key labor market data which may show a fresh rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested a clearer slowing in private sector employment, if not an actual contraction – something PMI data are now echoing. However, the average earnings figures will be the most closely watched. We see a further slowing in both regular pay growth (3 mth mov avg) down to 4.6% and the headline rate down to around 4.3% on base effects.

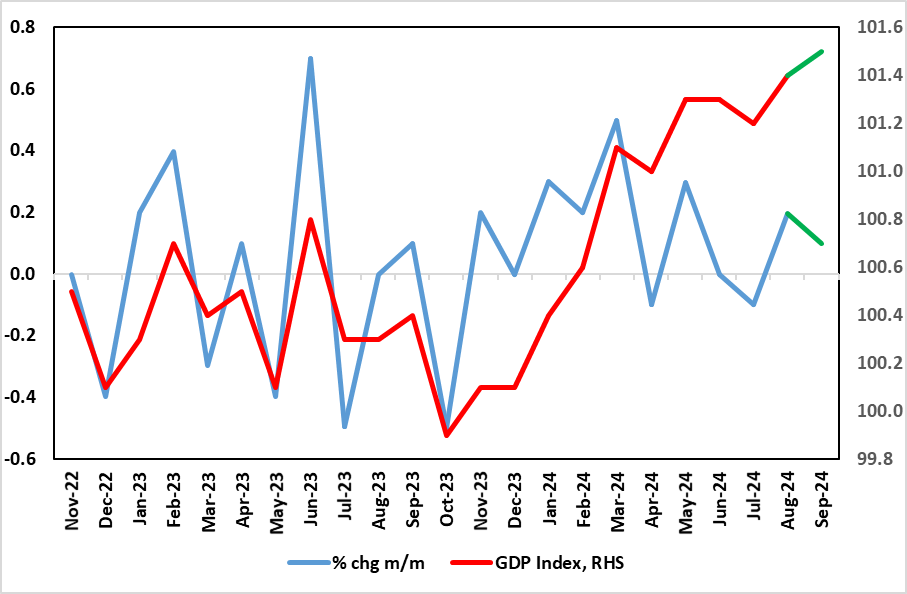

Notably, this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Indeed, the jobs data conflict with the headline pick-up in recent GDP growth, albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted. Friday sees updated GDP numbers, with a 0.1% forecast both for the m/m September figure and the same for the q/q Q3 reading, the latter undershooting BoE thinking.Momentum Ebbing?

Finally, retail sales data (also Fri) may be down partly due to poor weather which was unsettled through October as well as Budget apprehension.

Eurozone

ECB thinking may be shaped by Q3 negotiated wage data (Wed). The week also sees a confirmation of flash Q3 GDP numbers (Thu), this coming alongside what may be more very weak industrial production numbers.

Rest of Western Europe

There are key events in Sweden. After a fourth successive rate cut the minutes to Riksbank meeting are due (Thu). In Norway, CPI data Mon) may continue to show inflation pressures easing.

Japan

Preliminary Q3 GDP will be released on Friday. We are forecasting a more moderate growth with possibility that private consumption continues to contract and the below average growth to be supported by trade and government spending. It may derail Boj’s plan to tighten. The magnitude of consumption changes will be critical as it contributes to BoJ’s forecast of trend inflation, so far we expect such to be modest and generally below BoJ’s forecast. We also have the BoJ summary of opinion on Monday, yet unlikely to provide much cues.

Australia

Wage price Index and Employment data will be released on Wednesday and Thursday. RBA has so far downplayed the moderation in headline CPI from government subsidies on energy. To see an early easing than mid 2025, the wage growth needs to slow though unlikely given the solid labor market.

NZ

RBNZ inflation expectation on Monday would be more important than other tier two data through the week