FX Daily Strategy: APAC, January 4th

December German inflation to bounce, but less than expected

EUR/USD consequently vulnerable

GBP may weaken after strong gains on Wednesday

JPY weakness looks overdone medium term

December German inflation to bounce, but less than expected

EUR/USD consequently vulnerable

GBP may weaken after strong gains on Wednesday

JPY weakness looks overdone medium term

Preliminary French and German December CPI are due on Thursday, along with US ADP employment and the usual claims data. There is also UK money data and revised services PMIs.

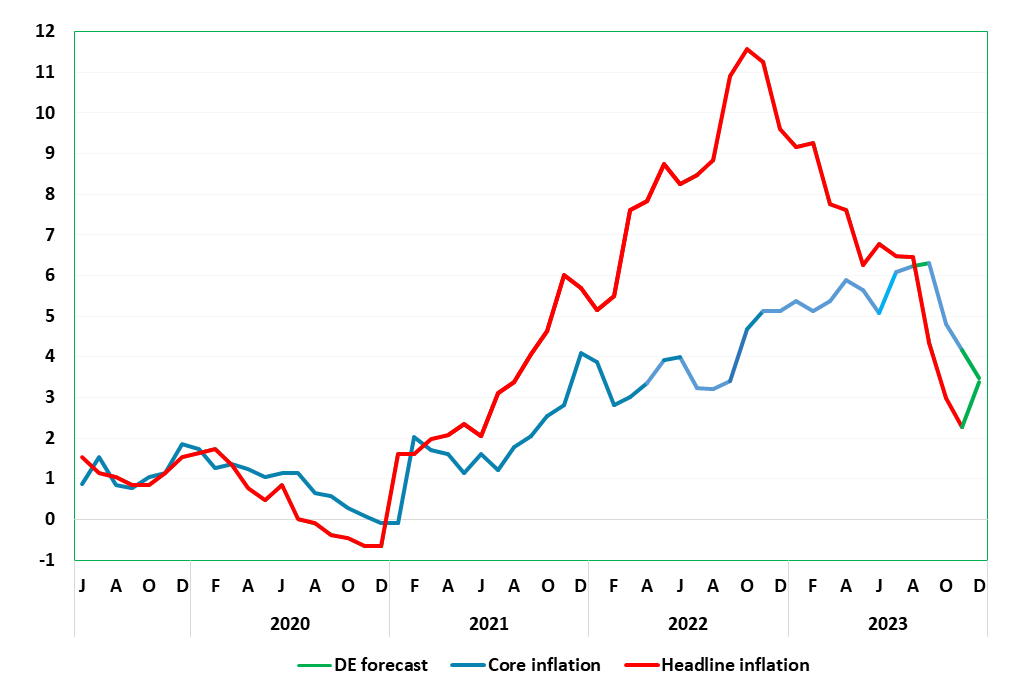

German headline CPI to bounce, but core to continue to decline

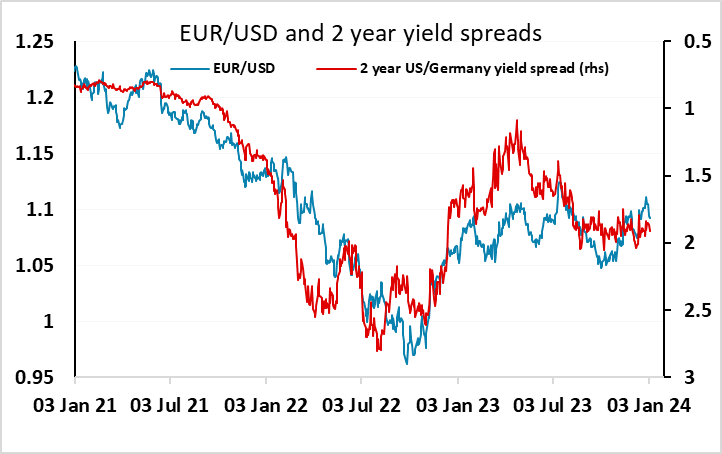

We have been highlighting repeatedly a clear and continued fall in overall German and EZ inflation pressures, initially evident in survey data but spreading to official numbers. This downtrend was evident in the softer-than-expected October and also the November HICP numbers. However, despite a further fall in fuel prices, recreation-sourced and particularly energy-related base effects are likely to push up the headline rate back to 3.3% in December but with the core stable. Regardless, the disinflation backdrop is underlined by an ever softer core seasonally adjusted data. Indeed, the headline y/y rate should resume a downtrend in the new year. And although we see a rise in the y/y rate in December, the market consensus is for an even larger rise, so the EUR risks look to be to the downside. But these risks are still relatively modest, as with 155bps of easing priced in for the next year, there is limited scope for further declines in short end EUR yields. But data in line with our forecast should be enough to push EUR/USD towards 1.0850.

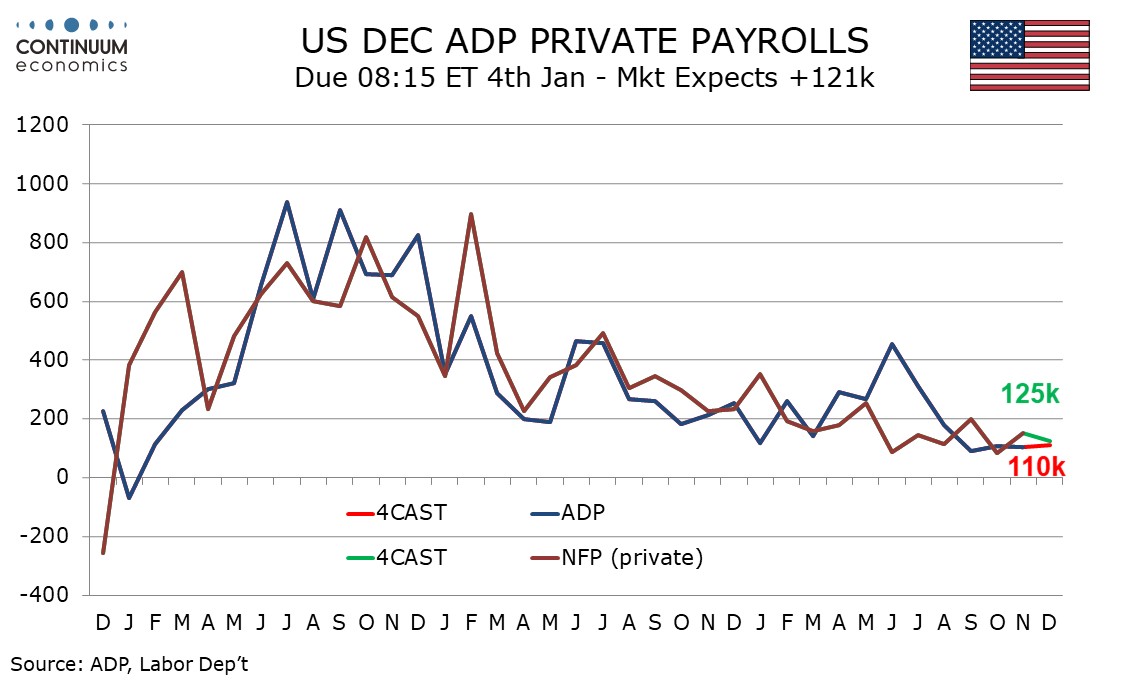

We expect a 110k increase in December’s ADP estimate for private sector employment growth, similar to if marginally stronger than the gains seen in the last three months, each of which was close to 100k. The trend in ADP data has slowed a little more than has that for the non-farm payroll, and we expect the ADP data to again modestly underperform. We are looking for private sector non-farm payrolls to rise by 125k with a 175k payroll increase overall. The market has a low level of trust in the ADP data, so we wouldn’t expect a big reaction. Our forecasts is marginally below market consensus, but not sufficiently to trigger any USD move.

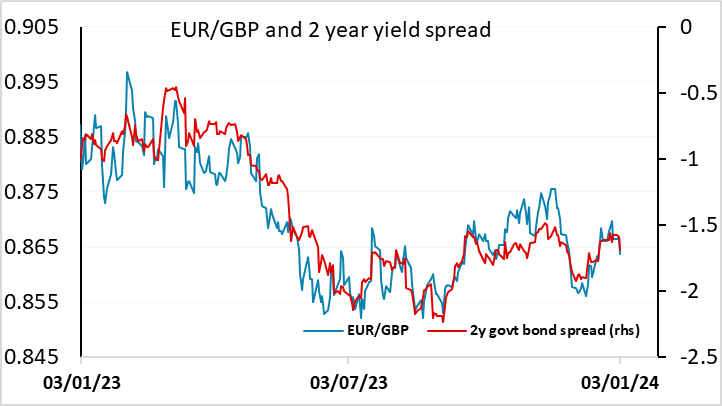

UK money data has been very weak through most of 2023, and we wouldn’t expect any major recovery, but the Eurozone data earlier this week showed some signs of stabilisation, so a similar outcome wouldn’t be a surprise in the UK. GBP made strong gains against the EUR through Wednesday, helped by some rises in UK short end yields, but the gains in UK yields may be slightly overdone, and if UK money data still shows evidence of weakness, there may be some upside for EUR/GBP.

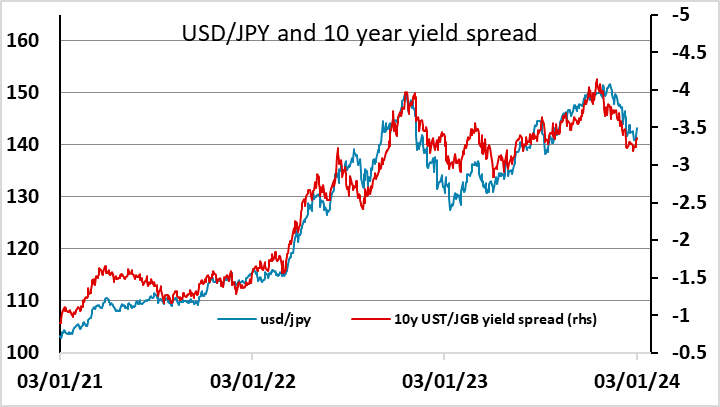

JPY weakness was once again a feature on Wednesday, but we feel JPY weakness is getting a little extended on the crosses in particular. Even against the USD, the latest move looks a little overdone relative to yield spreads. Part of the reason for JPY weakness may be that a lot of houses are seeing JPY strength as a theme for the year, and we are consequently seeing an early squeeze of these positions. But this may be creating good entry levels for medium term JPY bulls who see Japanese yields rising through the year while yields elsewhere are likely to edge lower.