JPY flows: More new lows, but getting overdone?

JPY hits another new low but positioning looking a little extended

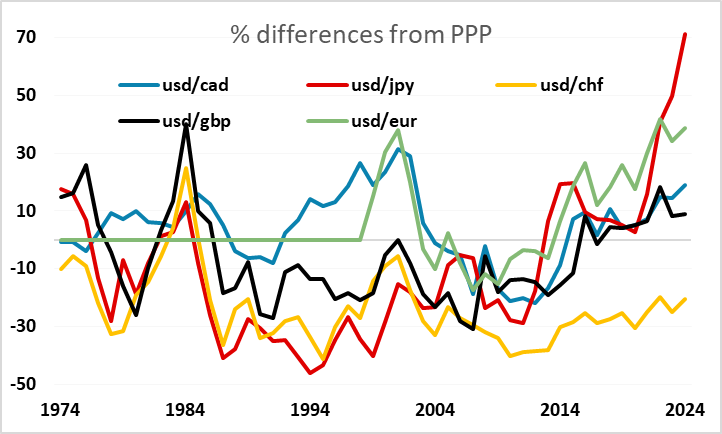

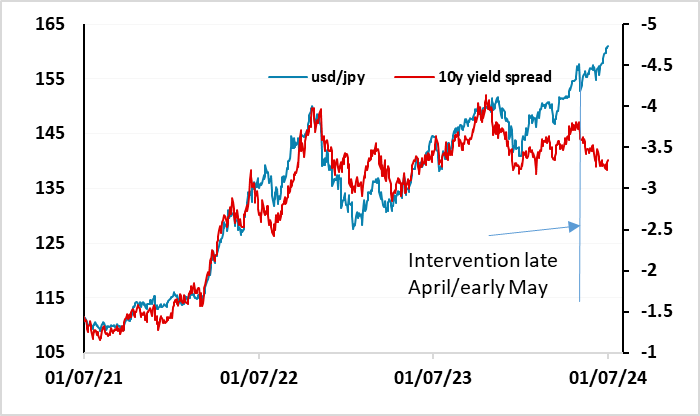

JPY weakness remains the main market theme, with the BoJ still refraining from intervention but the JPY reaching new all time lows almost every day. There has generally been little fundamental support for the JPY’s decline in recent weeks, but the overnight news of a significant downward revision to Q1 GDP (and H2 2023 GDP) provided some support for the JPY’s latest decline. At the margin, the revisions reduce the chance of early BoJ tightening, although it still seems that there is a good chance of a rate hike and reduction in JGB buying being announced this month. The market is currently pricing a 10 bp rate hike as slightly better than a 50-50 chance. And despite the news, yield spreads still support a significant JPY rally.

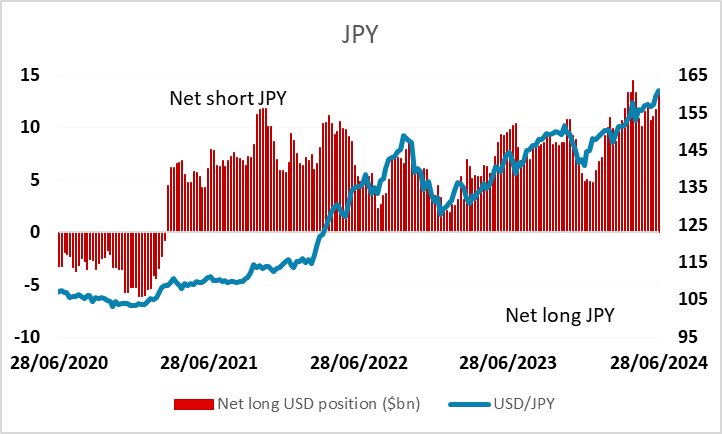

But momentum is the main market driver at the moment and it is difficult to oppose. Even so, the JPY’s decline is starting to look overdone. IMM data show net speculative sort JPY position at its highest since the intervention in late April. GBP/JPY is now in its 11 consecutive day of gains, a run that has only ever been seen once before in the last 35 years, in June 2022. A pause looks due, but the BoJ will probably need to do something more active if we are to see any sort of JPY recovery.

IMM net speculative positioning