USD flows: USD lower as consumer spending revised down

USD lower as Q1 consumer spending revised down to just 1.2%

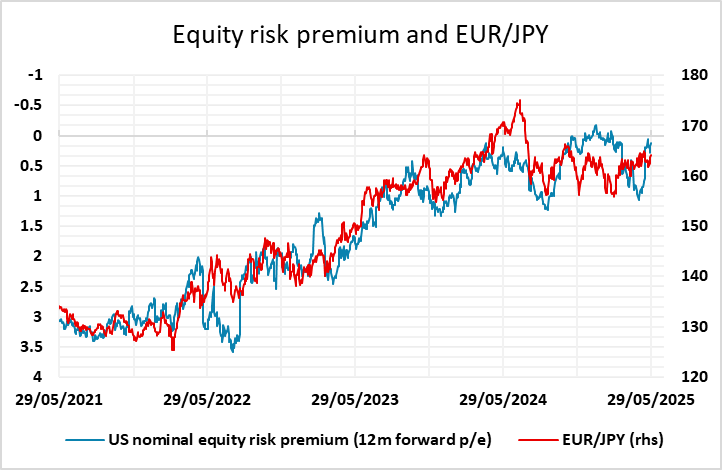

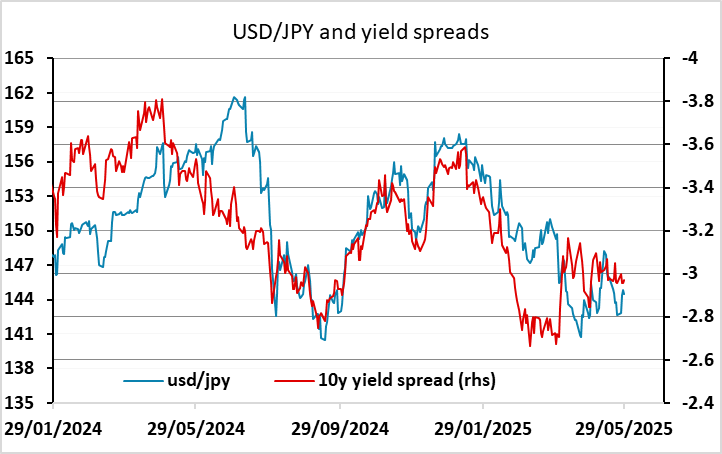

Despite the marginal upward revision in US Q1 GDP to -0.2%, the downward revision in real consumer spending to 1.2% from 1.8% is more significant. The decline in GDP is sill mainly due to the rise in imports, but this is likely to be reversed in coming quarters and in any case can’t be dismissed completely as it ought to have been offset by an increase in inventories if it was a purely timing related surge. The weaker consumer spending data has had the effect of brining US yields and the USD lower, with the EUR and JPY both now above their pre-court judgement levels against the USD. With the equity market also lower, there is a strong case for a further JPY recovery, especially since we anticipate a Trump reaction to the court judgement within the next week involving higher product tariffs or increased tariffs on surplus countries, both of which look more legally sustainable.