USD flows: US-China trade progress fails to impress

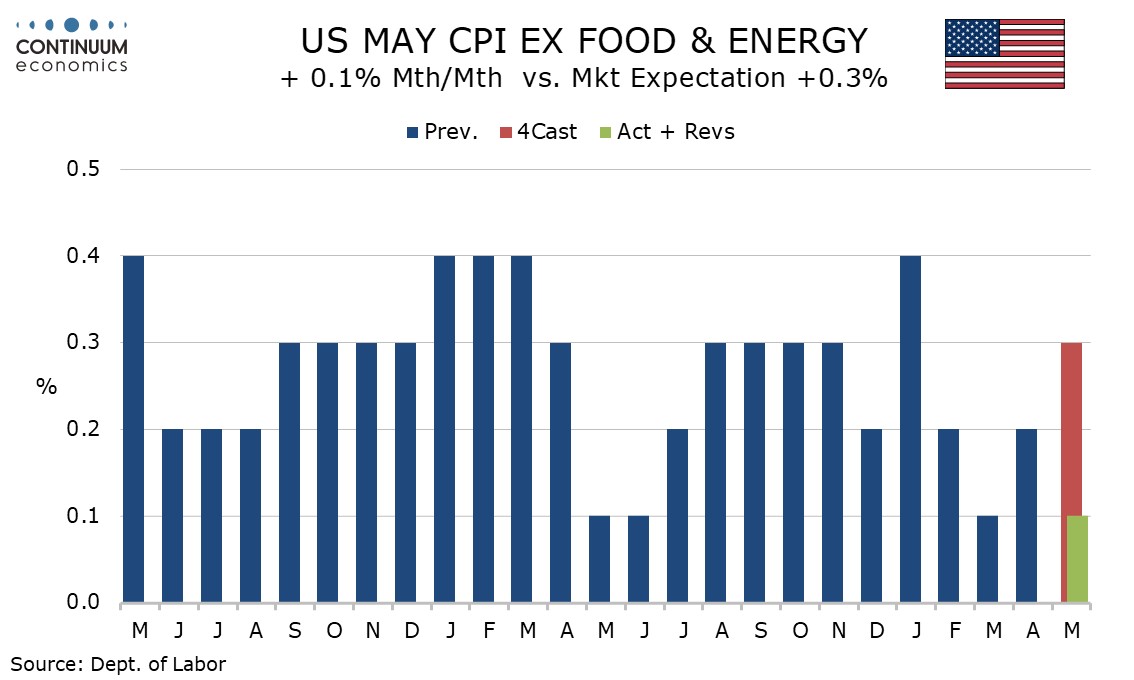

Even with a surprisingly subdued CPI to welcome, equities have not been as positive on the US-China trade progress as was Trump, with China’s 6-month limit on rare-earth export licenses suggesting they wish to maintain some leverage. USD weakness has resumed after the post-CPI dip was followed by a significant correction.

Trump’s statement that the US would have 55% tariff on China while the US would face tariffs of only 10% from China reflects 25% tariffs already imposed on China in the first term, a 10% minimum global reciprocal tariff and an extra 20% on China due to fentanyl. Also on the subject of tariffs, an appeals court has allowed Trump’s reciprocal tariffs to remain in place pending a hearing on July 31, while Treasury Secretary Bessent has stated countries negotiating fairly may avoid a reinstatement of the original reciprocal tariffs currently scheduled for July 9. Bonds are focused on the CPI. While it is unclear how long this will persist, and a June Fed easing is unlikely to be discussed, that tariffs have seen only a limited pass-through so far is welcome. 10 years supply got a decent reception despite Bessent warning over looming risks over the debt ceiling.