FX Daily Strategy: Europe, January 14th

US PPI unlikely to have much impact

USD risks now look to be mainly on the downside with good news largely priced in

Yield spreads and valuation suggest parity in EUR/USD unlikely to be threatened

AUD looks particularly underappreciated

US PPI unlikely to have much impact

USD risks now look to be mainly on the downside with good news largely priced in

Yield spreads and valuation suggest parity in EUR/USD unlikely to be threatened

AUD looks particularly underappreciated

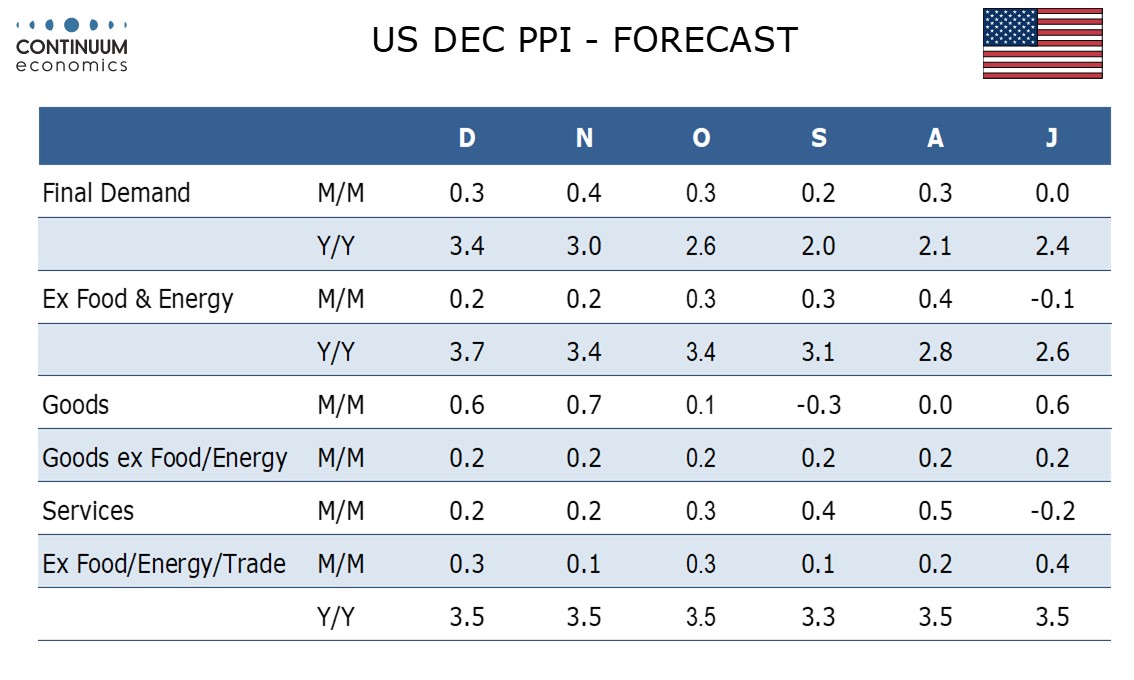

The Tuesday calendar is relatively quiet, with the main focus on the US CPI data on Wednesday. However, PPI has potential to have an impact, and has produced some unexpectedly large market reactions in the recent past, even when it has followed rather than preceded CPI.

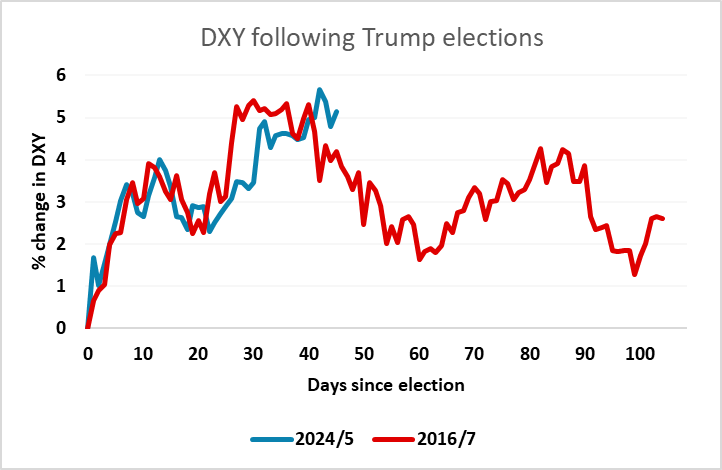

We expect December PPI to rise by 0.3% overall and ex food, energy and trade, though ex food and energy we expect a slightly slower rise of 0.2%, though trend appears to have regained momentum. Market consensus is slightly higher for the headline at 0.4%, but in line with our forecast for the core, so we doubt there will be any significant market reaction this time around. As well as PPI we have the NFIB and IBD/TIPP surveys, both of which hit 3 year highs in December, and while we don’t anticipate a reversal, the good news does look to be already in the market. So with the market now having priced out all but one of the expected Fed cuts for this year, the risks for yields and the USD look to be on the downside, given that there is nothing priced in until Q4, and the USD has made strong gains since the Trump election victory. Following that playbook, the USD may be peaking close to current levels. While it may well be different this time, the market psychology is similar, expecting substantial tax cuts and a strong US economic performance, and the risks are weighted towards the reality being somewhat less stellar than the expectation.

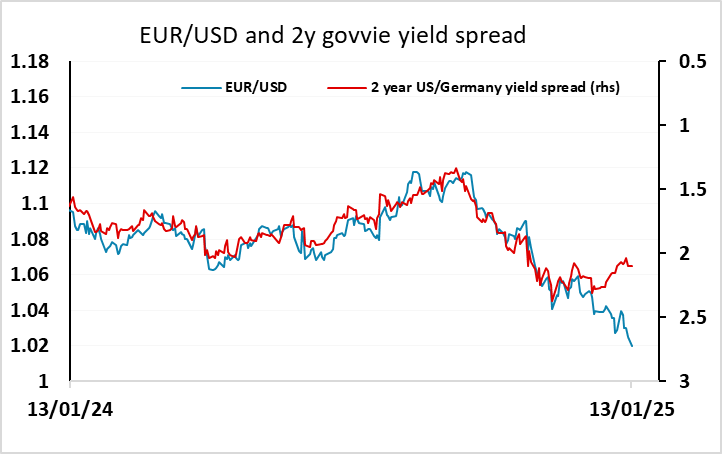

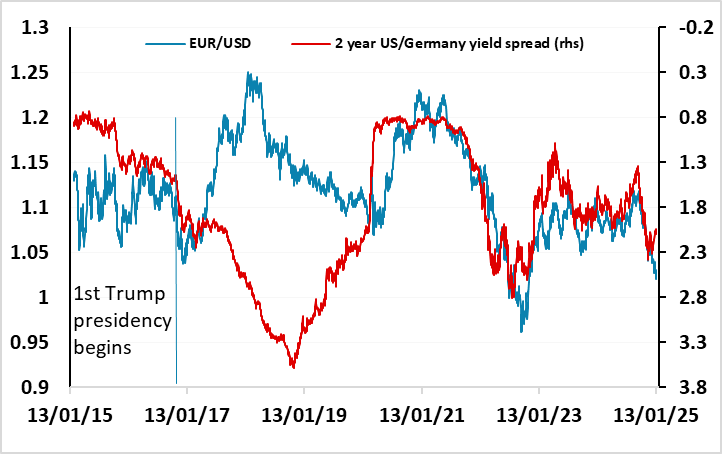

In Europe we have the ZEW survey, but this hasn’t attracted a lot of attention of late and we doubt it will be market moving. What is notable is that in spite of the narrative of a strong US and a lagging Europe, front end yield spreads have moved in the EUR’s favour this year as the market has priced out ECB (and UK) rate cuts. This looks to be a function of market positioning as much as genuine rate expectations, as there has been no real news to suggests that easing is likely to be less aggressive than expected in Europe. But the result has been that yield spreads have moved in favour of the EUR while the EUR has been falling against the USD. Interestingly, the opposite happened through 2017/18 after the first Trump election victory, albeit over a much longer period. This time around, we would expect the narrowing yield spreads and the initial high USD level to prevent any near term test of the parity level.

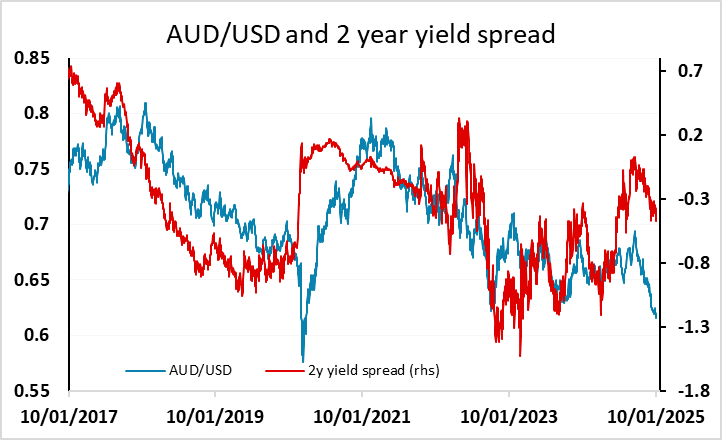

The general USD strength has been most pronounced against the AUD and NZD, which tend to be the highest beta currencies among the G10, but we find it particularly difficult to justify USD strength against the AUD. While yield spreads have moved in the USD’s favour in the last month or two, the opposite was the case for much of 2024 but the AUD failed to benefit. While the AUD may have been dragged lower to some extent by negative China sentiment, it is still the case that Australian growth has been impressive since the pandemic, and it is close to matching US growth since 2019, without the same degree of loose fiscal policy. Add to that the Australian current account surplus, and we find the AUD weakness very hard to justify. AUD/USD levels near 0.61 ought to represent a long term buying opportunity unless we see a much more clearly risk averse environment.