JPY flows: JPY opens firm in Europe

JPY gains strongly at European open without obvious trigger but US politics a focus

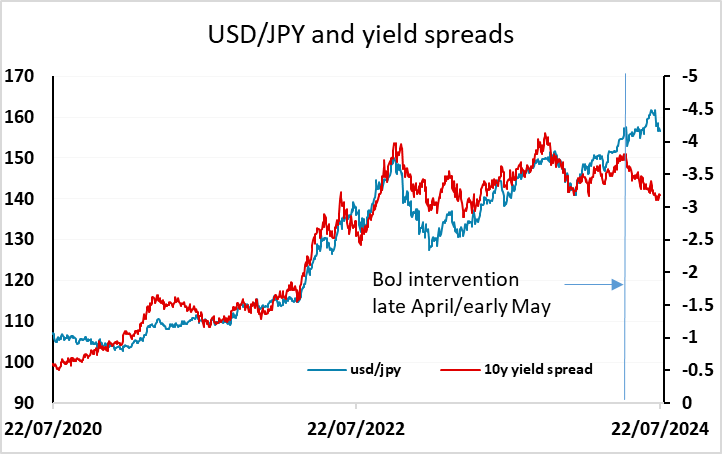

USD/JPY has dipped in late Asian/early European trading, without an obvious trigger, losing a big figure in the last couple of hours. Most other pairs are fairly steady, although the AUD has extended the decline seen overnight. Weak Chinese equities in spite of PBOC easing appear to be behind AUD weakness, and there may be some AUD/JPY cross trading behind JPY strength. There is little on today’s calendar to spur movement in the FX markets, and the focus may be on the Biden decision at the weekend to drop out of the presidential race, although there aren’t any obvious USD implications. Trump remains a heavy favourite to win the election, and may well pursue a weaker USD policy, notably against the JPY. If the new Democrat nominee gains in the polls, it might provide USD/JPY with some support, but in practice we see downside risks persisting. While a Democrat nominee is less likely to pursue a weaker USD or protectionist measures, the JPY is already heavily undervalued, and momentum is building for bigger JPY gains.