FX Weekly Strategy: January 6th-10th

USD remains firm going into US employment report

US data unlikely to provide a reason for a weaker USD…

…but recent USD strength starting to look overdone

Japanese cash earnings data may impact the JPY

Strategy for the week ahead

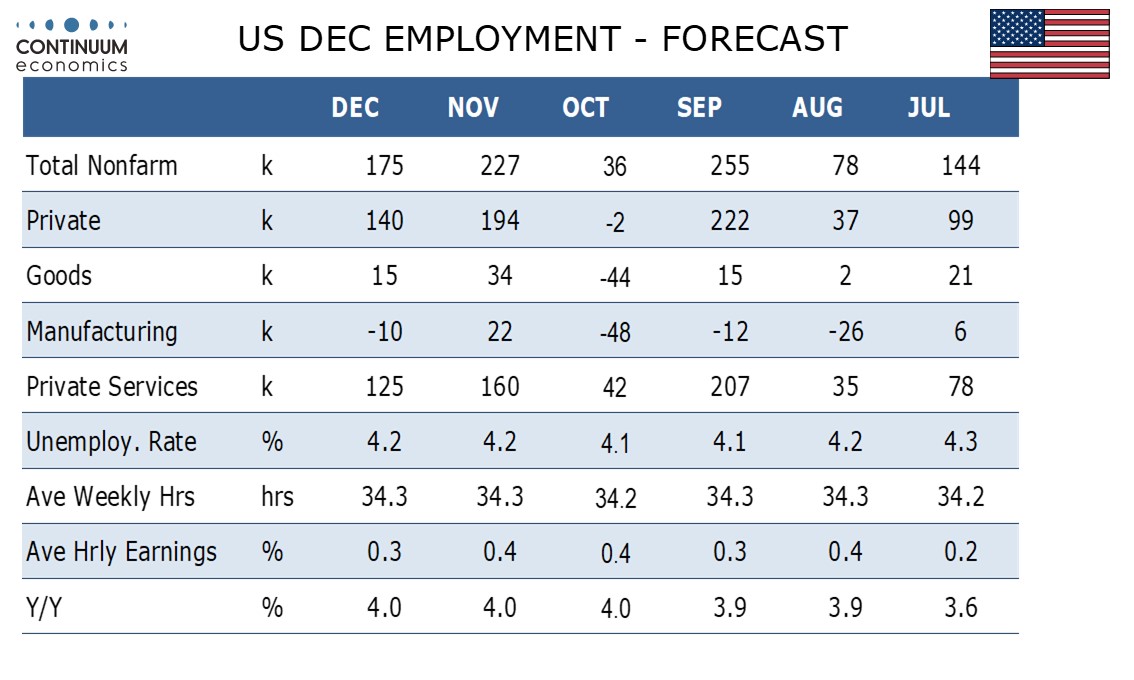

The US employment report will be the main focus of the coming week, and there is no reason to expect it to show any significant weakness given the solid claims data in recent weeks. We expect 175k increase in December’s non-farm payroll, with 140k in the private sector, a number that should be closer to underlying trend than a strong November and a weak October. We expect unemployment to be unchanged at 4.2% and average hourly earnings to slow to a 0.3% increase after two straight gains of 0.4%. These numbers are slightly on the strong side of expectations, but not so much as to have a significant impact on US yields.

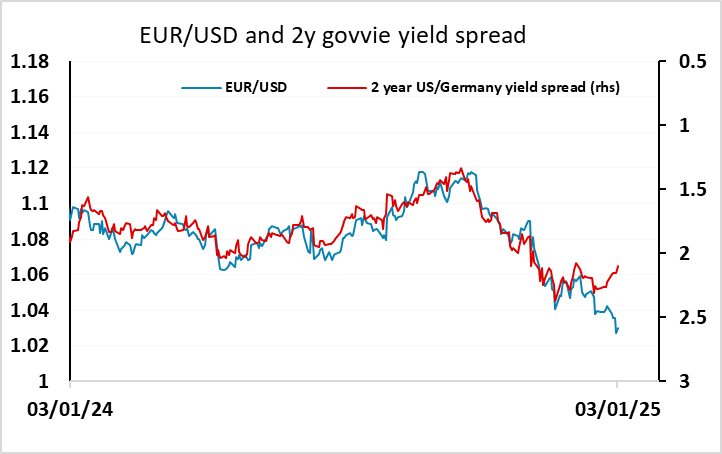

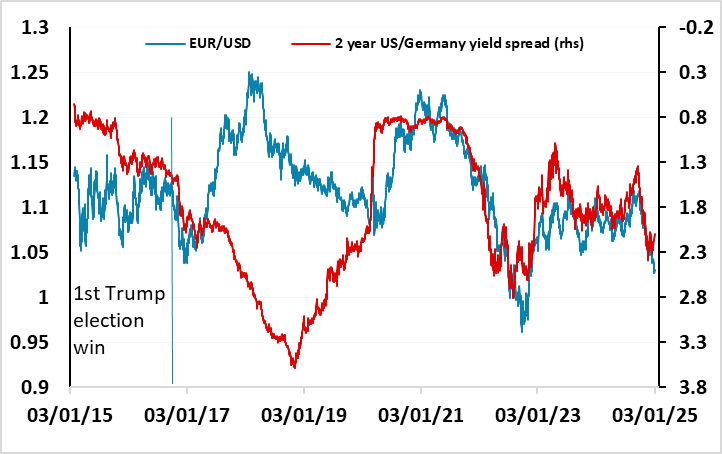

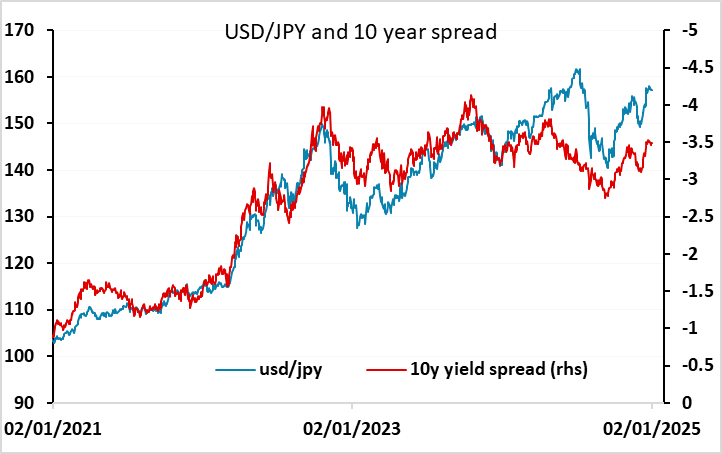

From an FX perspective, the USD has been trading on the strong side relative to yield movements at the beginning of the year, with the EUR in particular underperforming relative to its 2024 behaviour. Having said this, the AUD and NOK had significantly underperformed yield moves through 2024, and the JPY has also fallen further than yield spreads would have suggested, so the Eur’s slippage to some extent mirrors the weakness seen in other currencies last year. With the employment data likely to remain supportive of a USD positive view, it’s hard to oppose USD strength, as there is no obvious trigger for a reversal.

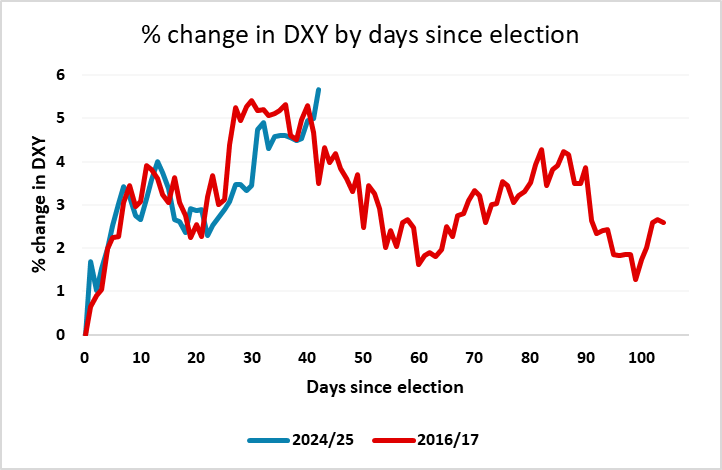

However, we would be cautious about following the USD uptrend. The USD is already very expensive against almost all currencies, both on any fundamental measure of fair value and relative to yield spread moves. There is optimism related to the expectation of a less dovish Fed due to Trump tax cuts and tariff increases. But a lot of this is in the price, with DXY up more than 5% since the election from an already elevated level.

There is also uncertainty about whether the tariff increases will materialise, and if they do, whether they will mean tighter Fed policy, or potentially lead to easier Fed policy due to a negative impact on growth and equity sentiment. Add to this the fact that after an initially similar 5% gain after the Trump election victory in 2016, the USD fell through most of the next 2 years, despite yield spread moves in its favour. Add to all this potential BoJ resistance to further USD/JPY gains and USD gains here look hard to sustain.

Other than the US data, we have German preliminary December CPI on Monday, Eurozone CPI Tuesday and Swedish and Australian CPI Wednesday. We aren’t looking for big impact from these numbers as the beginning of the year looks likely to be more focused on big picture issues and it would take something a long way from consensus to change the market expectation of 25bp rate cuts from the ECB at the next 3 meetings.

Japanese labour cash earnings data is the most significant data out of Japan, and could influence the chances of BoJ action at the January meeting. The market is currently pricing in a 10bp hike, which could go up towards 25bp on strong data or down towards 0 on weakness. While the big picture for USD/JPY depends more on US events than Japanese, as the US economy and rates show a lot more volatility, this data could have an impact on the JPY on Friday and into the following week.

Data and events for the week ahead

US

Monday January 6 sees November factory orders. Tuesday January 7 sees November’s trade balance, November’s JPLTS report on labor turnover, and December’s ISM services index, which we expect to bounce to 55.5 from 52.1. On Wednesday January 8 we expect a 140k increase in December’s ADP estimate of private sector employment. FOMC minutes from December 18 follow as does November consumer credit. Weekly initial claims and November wholesale trade are due on Thursday January 9. The key release of the week is December’s non-farm payroll on Friday January 10, for which we expect a 175k increase, 140k in the private sector, with unchanged unemployment of 4.2% and a slightly slower 0.3% increase in average hourly earnings. The preliminary January Michigan CSI follows.

Canada

PMI Services data is due on Monday January 6. Tuesday January 7 sees November’s trade balance. The most significant Canadian release will be December employment on Friday January 10. November building permits are also due.

UK

The BoE will release its Decision Maker’s Survey on Thursday, while the following day sees the first MPC speech of the year from Dep Gov Sarah Breeden. Final PMI data (Mon) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Tue) may reveal.

Eurozone

The week has several PMI updates, including final composite numbers (Mon) and the even weaker construction equivalent (Tue). European Commission survey data will provide an alternative insight (Wed), but equally soft. Unemployment data (Tue) may show fresh signs of a rise in joblessness. Published alongside, HICP data saw higher energy costs, mainly base effects, as the main factor behind the rise back in November, and these factors may appear again in December data with a rise to 2.3%. Regardless, shorter-term price momentum data already suggest that core and even services inflation are running around target. Indeed, the core rate may drop another 0.1 ppt in December partly driven by softer service price pressures. The ECB Consumer expectations survey also is die Tuesday. As for Germany and its HICP, we see the core down a further 0.1 ppt in the preliminary December data (Mon) but where energy base effects may pull the headline y/y rate up to 2.6%, a move already flagged in December’s Spanish CPI data. An update on the consumer is due Thursday with a key focus on whether the October drop in retail sales is sustained or not.

German industrial production (Thu) is likely to see a further m/m correction back as may manufacturing orders numbers the day earlier as there is a likely reversal in bulk orders that boosted September numbers.

Rest of Western Europe

There are key events in Sweden, most notably on Friday which sees the monthly GDP indicator and related data, albeit numbers that have not proved authoritative of late. Flash December CPI data (Tue) may see the targeted CPIF y/y rate drop a notch from 1.8% while CPI ex-energy may slip back toward 2.2%.

Norway has high-profile CPI data (Fri) and where the targeted inflation measure (CPI-ATE) may edge down to 2.9%, a little above the Norges Bank’s projection of 2.8%.

Finally, in Switzerland, CPI may see the December outcome steady at 0.7%, thereby chiming with the SNB Q4 projection made in December.

Japan

Labor cash earning on Thursday and overall household spending on Friday would be the only critical release for Japan next week. Labor cash earning will likely be steady above 2% but in order to persuade the BoJ to continue with its tightening, we will need to see the pace to be closer to 3% y/y. Overall household spending would also need to improve, at least back to expansion, to see a better economic growth of Japan.

Australia

We have the monthly CPI on Wednesday and is expected to stay below 3%, potentially around the middle target range. However, as the RBA tilted towards the RBA trimmed mean in call for early easing, its impact maybe relatively muted unless there is a big miss. Trade and retail sales would be of less importance on Thursday.

NZ

No important release.