FX Daily Strategy: APAC, November 27th

EUR data likely to have minimal impact

Risk positive tone may fade, reducing USD and JPY weakness

AUD retains upside scope

GBP post-Budget strength looks flimsily based

EUR data likely to have minimal impact

Risk positive tone may fade, reducing USD and JPY weakness

AUD retains upside scope

GBP post-Budget strength looks flimsily based

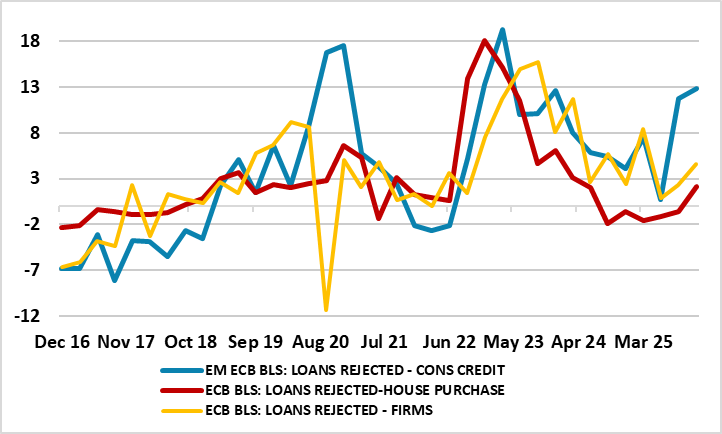

Thursday looks like a fairly quiet calendar. There is Eurozone money and credit data and the European Commission business and consumer survey, but neither of these looks very likely to change the impression of slow but steady growth and inflation in the Eurozone. Similarly, the account of the last ECB meeting is sure to indicate steady policy for the foreseeable future. We have some concerns about potential slowdown in the Eurozone credit data, with an increased loan rejection rate evident in the latest bank lending survey, particularly for consumer credit. But at this stage we doubt this is going to be very clearly evident in the lending data, so we doubt there will be a significant market impact.

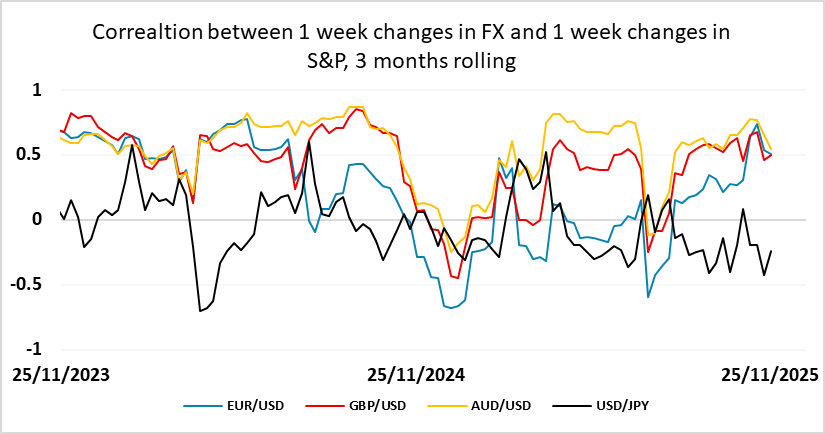

That the EUR has been firm this week reflects some increase in expectations of Fed easing and a risk positive tone in the equity market rather than any EUR specific news. The USD has been generally softer, with the riskier currencies particularly strong on Wednesday, helped by a less dovish tone from the RBNZ to accompany their rate cut and stronger than expected Australian CPI, but more generally by gains in equities. The JPY was left behind, and reversed all the gains on the crosses seen at the end of last week, despite rising expectations of a BoJ rate hike in December.

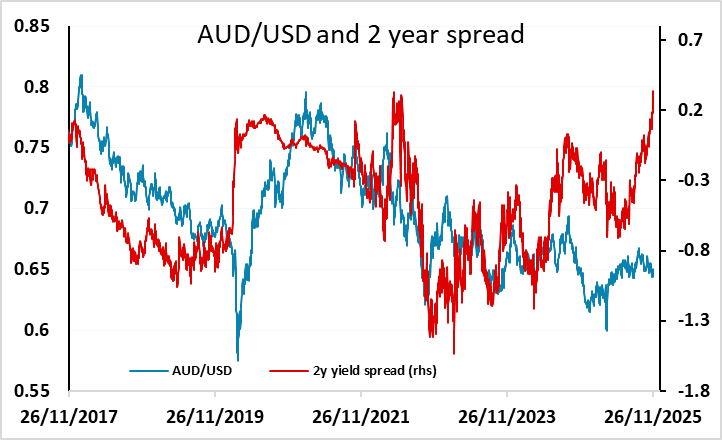

From here, equity gains are likely to prove a little more difficult as we approach the highs seen at the end of October when the S&P traded above 6900. Valuations remain very stretched, and there is now less scope for US yields to fall to boost equity prices. This should limit the scope for JPY declines on the crosses, although there should still be scope for gains in some of the higher yielders. The AUD in particular continues to look very good value relative to yield spreads.

GBP finished the day a little stronger against the EUR after the UK Budget. This looked to be more a consequence of the changes in the OBR forecasts for the economy than the Budget measures themselves. There was little net change in front end UK yields, with a BoE rate cut in December still seen as an 85% chance, but the Budget was somewhat less contractionary than expected because the fiscal “hole” was estimated to be smaller than anticipated. The Budget measures themselves were mostly delayed until 2028 or later. Whether this is credible is highly doubtful, given a likely 2029 election and general uncertainties around the next couple of years. However, with a less tight fiscal picture for the next year there may be less immediate pressure on the BoE to ease. We would still expect GBP real rates to gradually converge towards EUR rates in the next couple of years, and while they are likely to remain above EUR levels, this would suggest EUR/GBP has potential to rise steadily towards 0.90, with Wednesday’s correction lower likely to be short-lived.