FX Daily Strategy: APAC, Oct 10

CAD risks on the downside on consensus Canadian employment report…

…but USD/CAD has only modest scope to break above 1.40

EUR/NOK remains range-bound near term, but NOK may yet be re-rated

Hard to find a trigger for near term reversal of JPY weakness

CAD risks on the downside on consensus Canadian employment report…

…but USD/CAD has only modest scope to break above 1.40

EUR/NOK remains range-bound near term, but NOK may yet be re-rated

Hard to find a trigger for near term reversal of JPY weakness

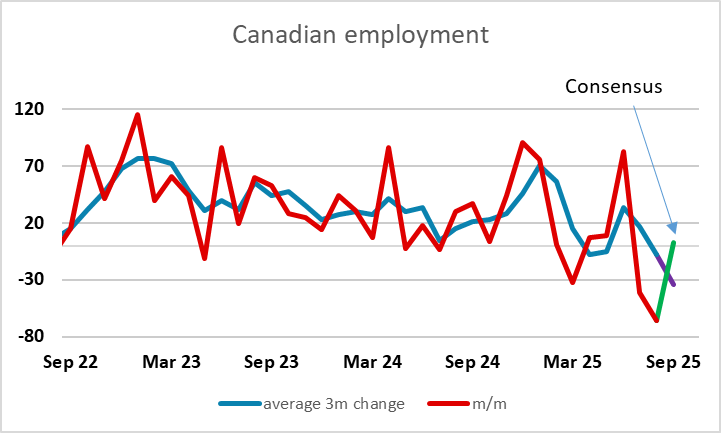

In the absence of US data we have the Canadian employment report on Friday. The market consensus is for a 2.8k rise in employment, following declines of 41k and 66k in the previous two months. This looks like an improvement, but the two declines followed an 83.1k rise in June, so a 2.8k rise would still represent a deterioration in the 3 month average. As it stands, the BoC is priced as a 65% chance to cut rates at the October 29 meeting, and we would see a number in line with the consensus as supportive of that cut, as it would suggest a deteriorating employment trend.

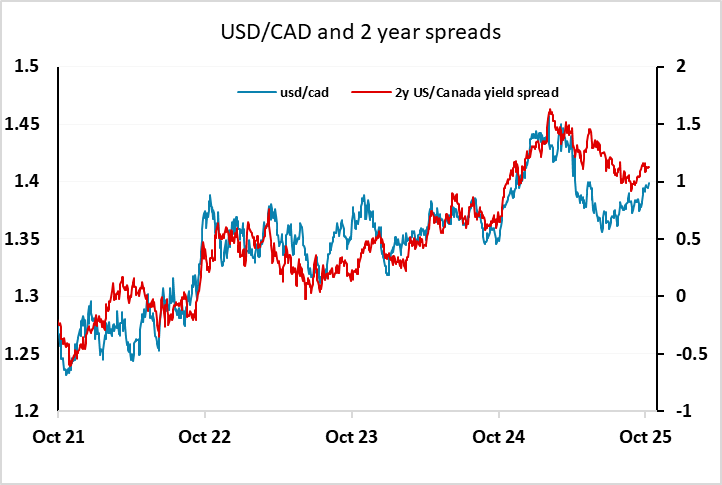

USD/CAD made a 5 month high on Thursday above the May 19 high of 1.3973, supported by a generally USD positive tone. The Fed is still priced as a 95% chance to cut rates 25bp at the October 29 meeting, so if both go ahead, there is scope for the CAD to weaken further, with a USD/CAD likely to trade above 1.40. We have already nearly returned to the level consistent with the historic correlation with 2 year yield spreads, so we wouldn’t see a lot of CAD downside, and there would likely be a bigger reaction if the BoC don’t cut. So a large rise in employment could be expected to result in a significant CAD recovery, as the market reduces its expectation of easing. But this looks less likely than a USD/CAD test above 1.40 on a consensus number.

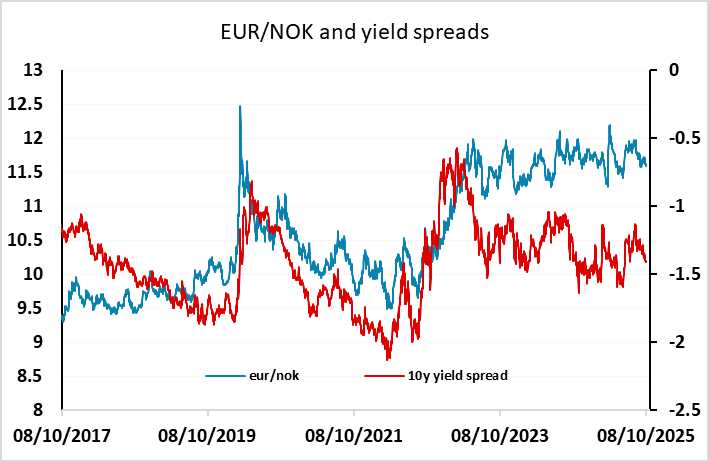

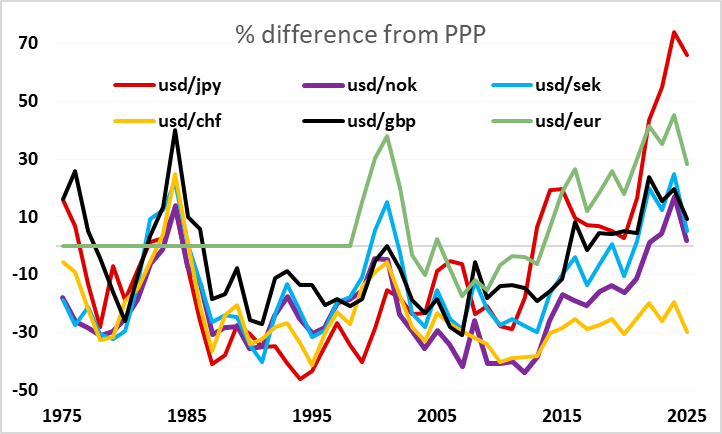

Before the Canadian data we have September Norwegian CPI in Europe, with the consensus looking for an unchanged y/y rate both in the headline and the core at 3.5% and 3.1% respectively. EUR/NOK has been mostly contained in an 11.30-12 range this year, but this is a range well above the historic norm. Norwegian yields remain attractive, the Norwegian economy has continued to outperform, and the Norwegian fiscal and current account surpluses make it objectively a very safe haven. But the NOK has tended to sell off sharply on any risk negative news, and liquidity is poor, while the government pension fund is a consistent NOK seller as they invest in foreign assets. From once being valued as highly as the CHF, the NOK is now back on a par with the SEK and GBP in terms of its level relative to PPP. This looks wrong from a big picture perspective, and while the timing of a break higher is hard to forecast, and is unlikely to come in response to this (or any other) Norwegian data, we still favour the NOK upside as a long term play.

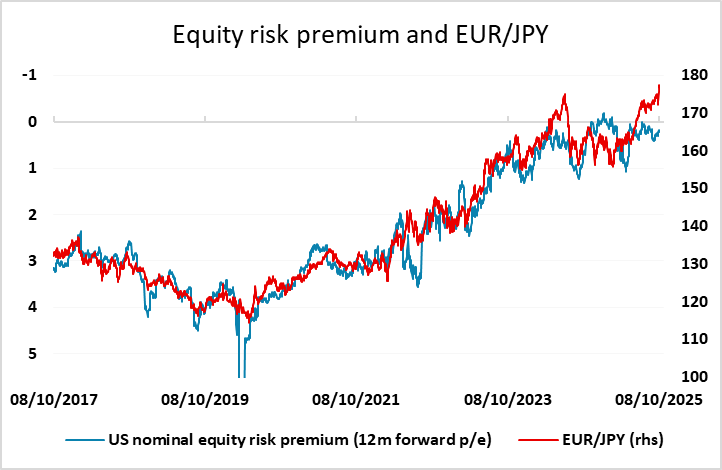

The USD showed some general strength on Thursday. It made more ground against European currencies than the JPY, but USD/JPY’s rise this week still makes it look the most out of line with normal metrics. There has been some reduction in expectations of action from Takaichi’s government, partly because it has yet to be formed and the lack of an LDP majority in parliament means plans may need to be scaled back to satisfy any coalition partners. JPY weakness still looks unlikely to reverse without some government or BoJ opposition to the recent decline, or a turn in the global risk picture. The overvaluation of (US) equities and low level of risk premia have been recently highlighted by the IMF and the ECB as a significant risk, but any correction or reversal will require a trigger, and it’s hard to see where that is coming from any time soon.