FX Daily Strategy: N America, January 20th

UK labour market data may indicate potential for more BoE easing

Scope for GBP to decline against the EUR even on current yield spreads

Greenland uncertainty may favour the JPY

Supreme Court decision on tariffs becomes more important

UK labour market data may indicate potential for more BoE easing

Scope for GBP to decline against the EUR even on current yield spreads

Greenland uncertainty may favour the JPY

Supreme Court decision on tariffs becomes more important

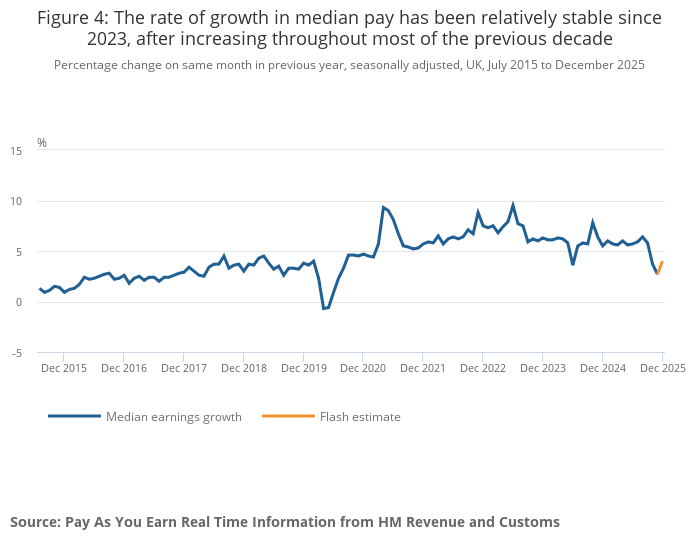

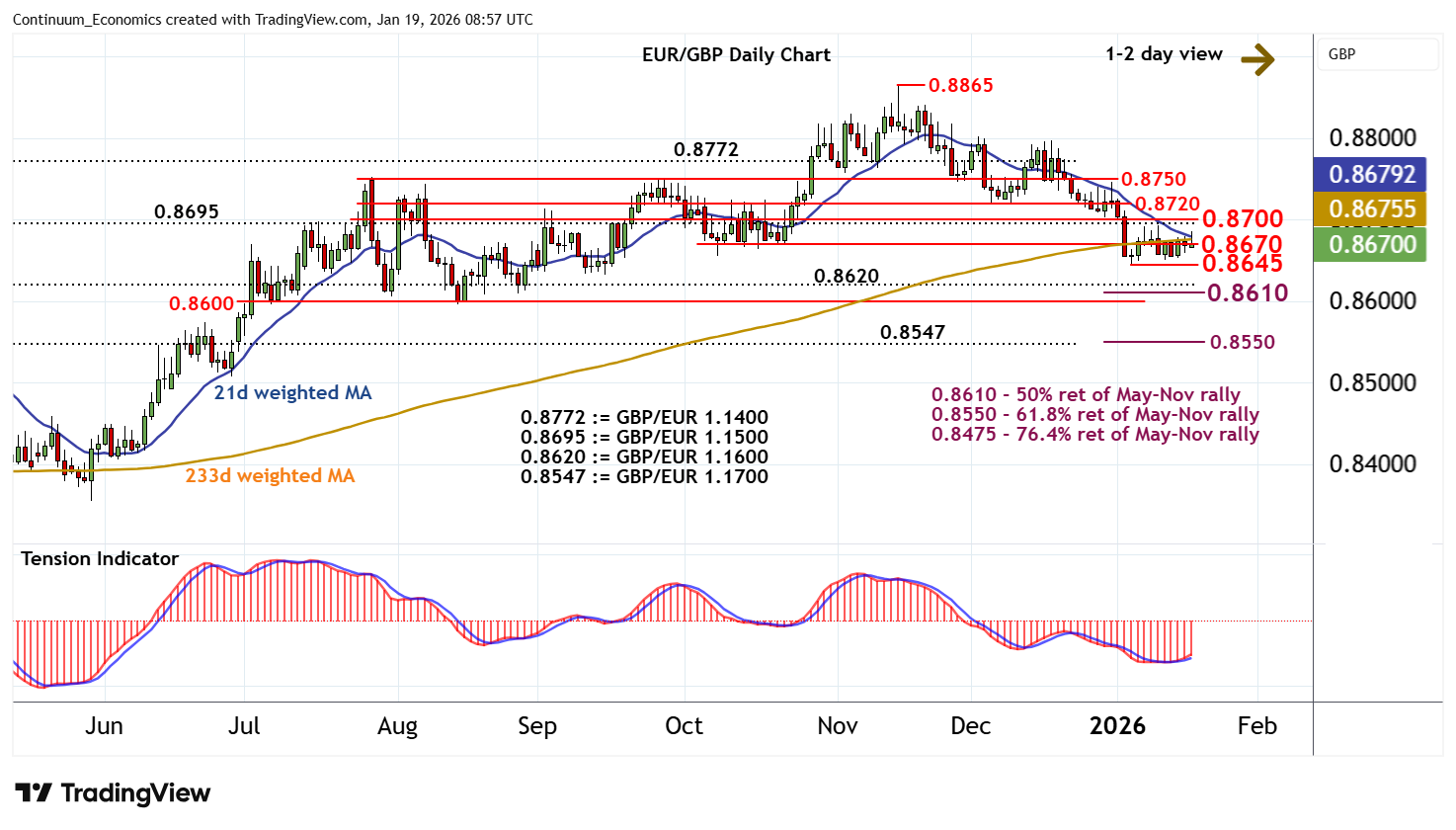

GBP has moved a little higher after the UK labour market data, which was broadly in line with consensus. Average earnings growth edged lower to 4.5% y/y in the 3 months to November based on the ONS data, while more up to date HMRC data showed median monthly pay for payrolled employees rose slightly to 4.0% y/y in December after a sharp dip in November to 2.7% y/y. Payrolled employment growth continues to negative based on the HMRC data while ONS data shows a broadly flat picture. The data provides little reason for any change in market expectations of BoE policy, so extended GBP gains look hard to justify despite the initial positive response. 0.8650 still looks like a strong base for EUR/GBP, and we would expect stabilisation in the 0.8650-0.8700 range near term.

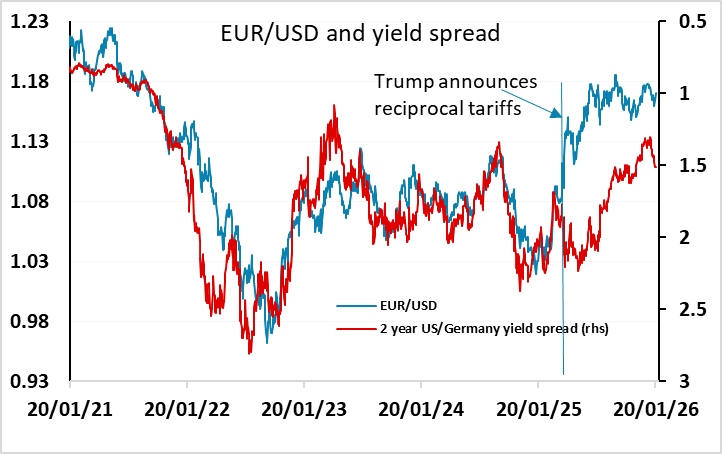

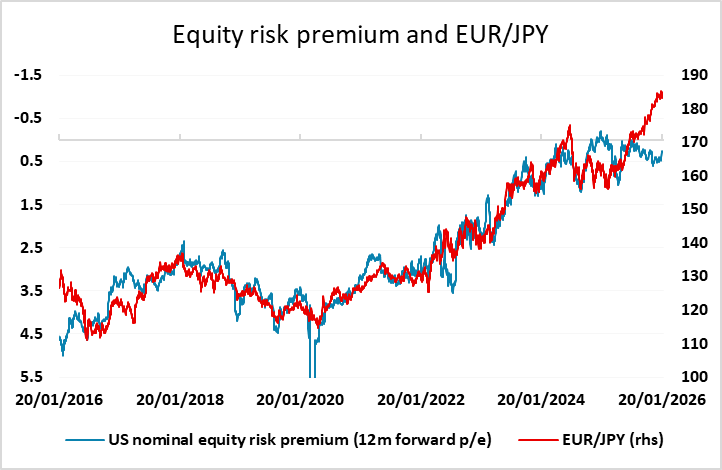

The market focus may, however, continue to be more on the Greenland situation than on data. European opposition to the US claiming the territory is clear, and the threat of tariffs isn’t going to change their minds. If tariffs are imposed in an attempt to pressure Europe, we are likely to see some extension of the equity market weakness we saw on Monday, which ought to lead to some more risk negative trading. However, the FX market reaction has so far been more USD negative than risk negative, with the JPY actually losing ground on the crosses on Monday. This may reflect the fact that the USD lost ground after the reciprocal tariffs were announced in April, with the JPY also underperforming from June as equities recovered from the initial losses. Indeed, the JPY failed to gain on the crosses despite the initial decline in equities. However, we expect it will be different this time around, as the focus is completely on Europe this time, and we are starting at much higher levels of equities and of EUR/JPY. We consequently see more scope for JPY gains.

One other factor to consider is whether the Supreme Court rule the Trump reciprocal tariffs as illegal. This becomes more important now, both because of the new tariff threat, and because the trade deal with the EU might well not be ratified if the Greenland problems persist. This would make the original reciprocal tariffs relevant, which they wouldn’t be if the US trade deal with the EU was in place. The Supreme Court could rule as early as Tuesday, and the market odds suggest around a 70% chance that they rule the tariffs illegal (if they do rule). A ruling that the tariffs were illegal would undermine Trump’s position, but the FX impact is unclear. Trump would be unlikely to accept any such ruling without a fight, so we expect the reaction would be USD negative, and potentially risk negative.