FX Daily Strategy: APAC, December 12th

Some USD downside risks on US CPI

USD/JPY and CAD/JPY looks the most vulnerable

EUR/USD upside limited given widening short end spreads

GBP gains may be reaching their limit

Some USD downside risks on US CPI

USD/JPY and CAD/JPY looks the most vulnerable

EUR/USD upside limited given widening short end spreads

GBP gains may be reaching their limit

US CPI is the main data on Tuesday, but there is also UK labour market data as an appetiser before the main course of the US data.

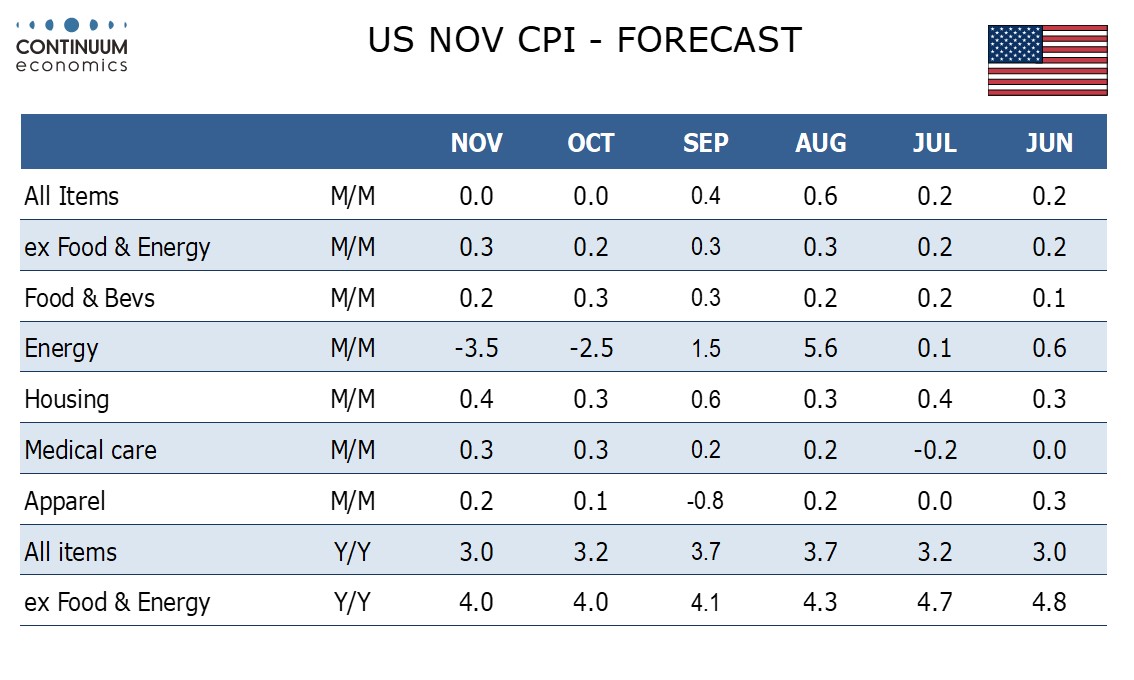

We expect November CPI to be unchanged for a second straight month, though ex food and energy we expect a 0.3% increase to follow October's 0.2% rise. Before rounding however we expect a core rate of 0.26%, meaning that a second straight 0.2% rise is more likely than 0.4%. This is a more important number than usual given the FOMC meeting on Wednesday. The market is expecting a slightly more hawkish Fed after the solid US employment data on Friday, but more evidence of slowing inflation could be expected to tilt expectations more dovishly. Market consensus is in line with our forecast, so we would see risk to the downside for yields and the USD.

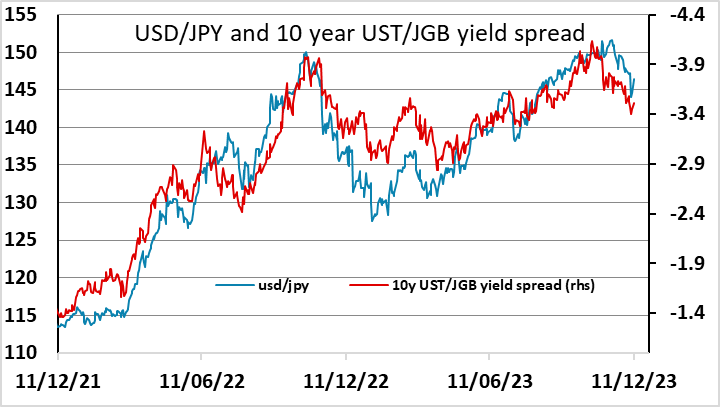

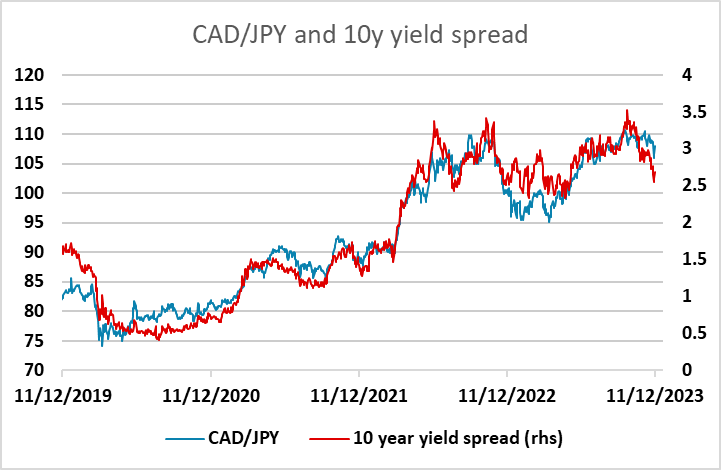

We still see USD/JPY as the most vulnerable pair to lower US yields, as in spite of the impact of the reports on Monday on the JPY, yield spreads still point firmly to a stronger JPY. The reports suggested that there would be no rate hike in December, but that shouldn’t be a surprise. Ueda’s comments that boosted the JPY last week didn’t suggest an imminent tightening, but indicated that the BoJ were planning for an exit from ultra-easy policy next year. The JPY sell off on Monday may not reverse quickly, but there is a danger of a JPY rally on any more hawkish BoJ language next week. In the meantime, USD/JPY, and particularly CAD/JPY, look to have rallied too far based on modest moves in yield spreads.

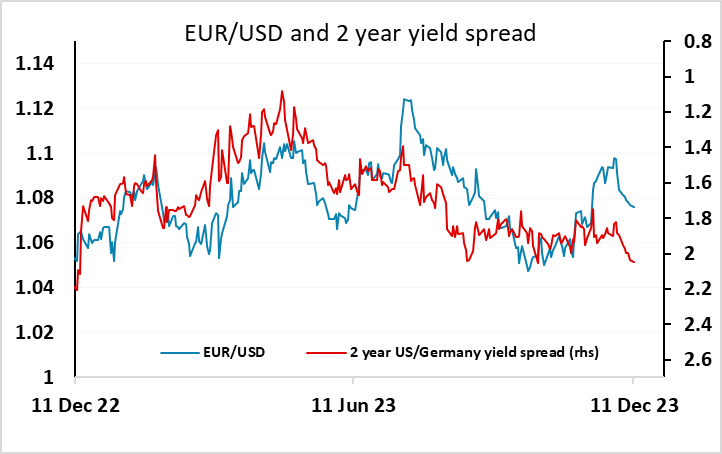

While EUR/USD might get a boost if US CPI is on the soft side, it still looks a little extended based on current spreads, with the 2 year US/German spread reaching a 1 year high on Monday above 2%. However, any softness in CPI will tend to help riskier currencies via a positive equity impact as well as yield spread effects, so downside for EUR/USD is likely to be limited ahead of the data. But on as expected numbers, we would favour the EUR/USD downside and a possible test of 1.07.

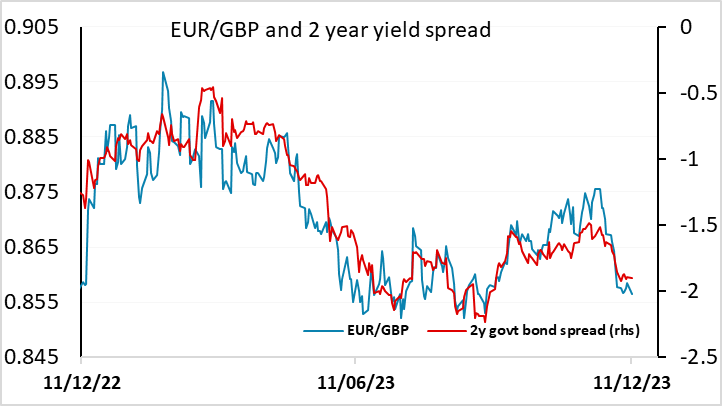

For the UK labour market data, we see more signs of a loosening, with the jobless rate already up 0.5 ppt in the last three months but where data on employment and activity will still be missing and where the ONS will make estimates based on HMRC numbers. However, the average earnings figures will be released and may still be the most closely watched and where we see regular pay growth (3 mth mov avg) slowing slightly to just under 7% but the headline rate down around a full ppt to just over 7%. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing has already been seen. GBP was firm on Monday, with EUR/GBP dipping to 0.8550 for the first time since September, but the downside is looking more limited ahead of the central bank meetings this week. The market is already pricing quite a sharp spread widening in GBP’S favour form here, so the risks may be for a less sharp move and a rise in EUR/GBP. In any case, we doubt there is much more scope for GBP gains.