USD, JPY, AUD flows: USD soft on positive risk sentiment and strong Japanese data

Rising equities and storng Japanese GDP keeping the USD on the back foot

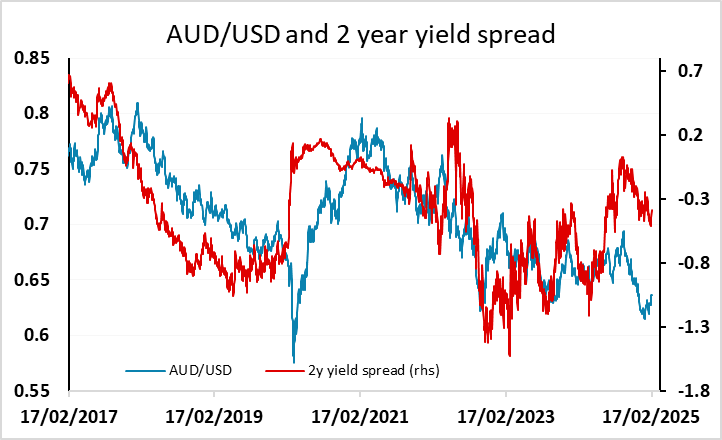

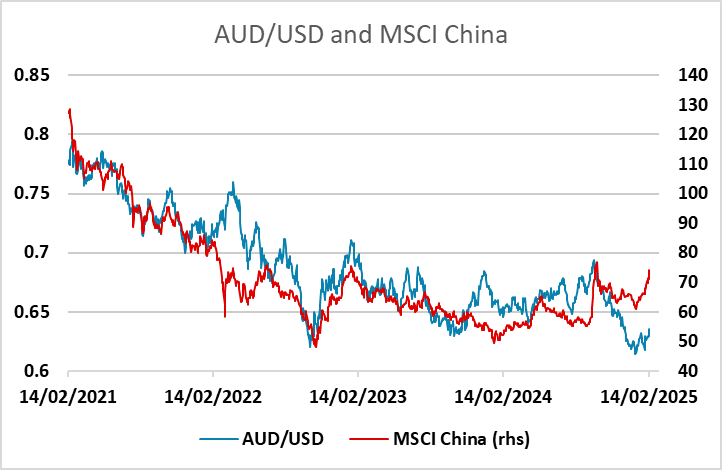

The usual quiet Monday calendar but the USD is starting on the back foot due to a combination of generally positive risk sentiment and strong Q4 Japanese GDP data released in early Asia. Equity futures are generally firmer, with the S&P 500 future on the edge of all time highs, and this is encouraging the riskier currencies, with the AUD leading the way, reaching another new high for the year overnight. We continue to see upside scope for the AUD as long as risk sentiment remains steady or positive, as yield spreads continue to suggest value.

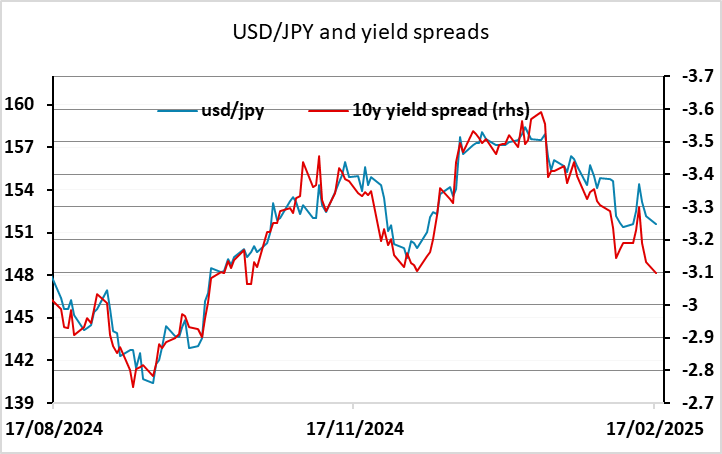

The JPY would normally struggle in a risk positive world, but has benefited from the 0.7% q/q rise in Q4 GDP reported overnight, which exceeded the consensus expectation of a 0.3% rise. While the details were less strong than the headline, as consumer spending only rose 0.1% and capital spending only 0.5%, with a lot of the strength due to a decline in imports, the data nevertheless supports a more hawkish view of the likely BoJ stance. Japanese 10 year yields made another new 15 year high, and spreads suggests scope for USD/JPY to sink below 150.