FX Daily Strategy: N America, January 3rd

US ISM and JOLTS in focus

EUR/USD close to fair near 1.0950

JPY has upside scope against CAD and CHF

US ISM and JOLTS in focus

EUR/USD close to fair near 1.0950

JPY has upside scope against CAD and CHF

The US manufacturing ISM data is the main release on Wednesday. We expect a December ISM manufacturing index of 47.5, up from two straight months at 46.7 which generally underperformed most comparable manufacturing surveys. The underlying picture remains marginally negative, but the survey has been little changed for the past year, bumping along at the lowest level seen since the GFC (pandemic excluded). The services survey later in the week is likely to attract more attention, providing more of a guide to the growth picture. Nevertheless, the bounce we expect may serve to support the more positive USD tone seen on Tuesday.

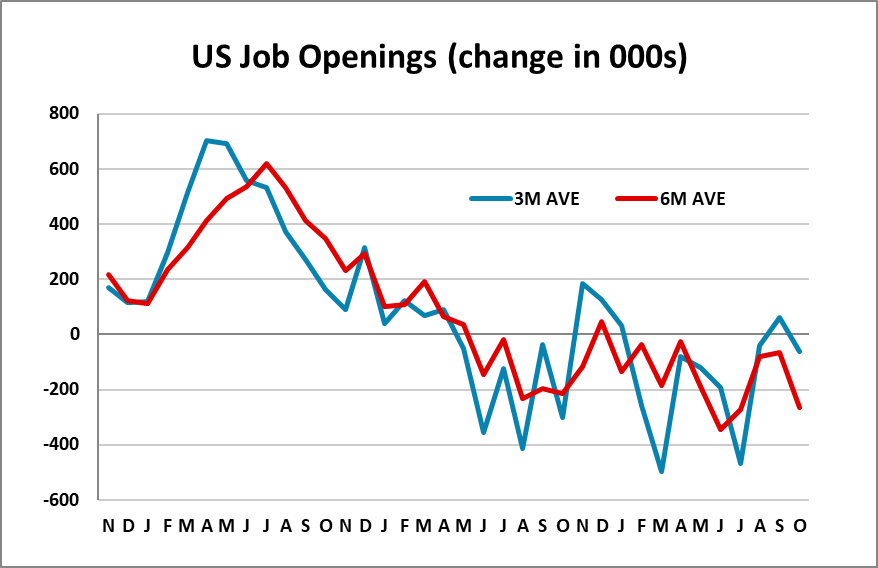

There may be more interest in the JOLTS data, which did have a mild impact in December when the October data was released. Openings fell by 617k in October after a revised modest fall of 147k in September (which was originally reported as a 56k increase) and a strong rise of 577k in August. The data turns the 3-month average marginally negative at -62k. While this was still not a convincing sign of labor market weakness, there was a negative impact, and there will be more focus on the data this month ahead of the payroll numbers on Friday.

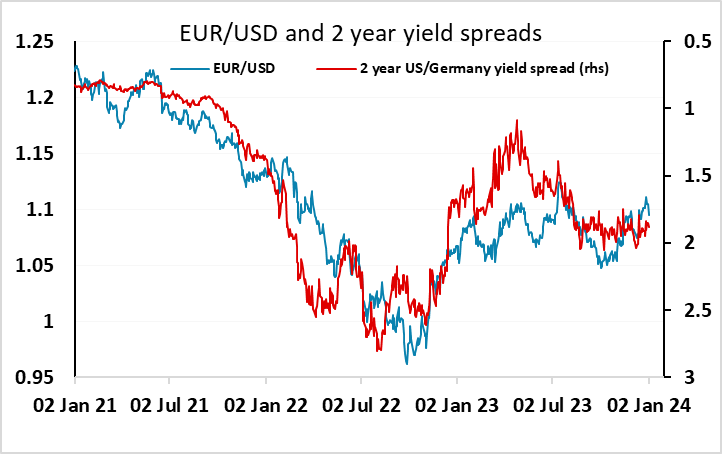

Ahead of the US data we have had German unemployment data, but not a lot else. German unemployment has now been rising steadily since March, and we saw another but smaller rise than expected in December. While the market doesn’t tend to take a lot of notice of the monthly data, the steady increase is a factor that will reduce upward pressure on wages and supports market expectations of ECB easing. However, with 157bps of easing already priced into the EUR curve for this year, further declines in front end EUR yields look likely to be hard to achieve without evidence of a change of tone from the ECB. While the EUR was soft on Tuesday, the money data if anything showed some signs of stabilisation, and there might be more market impact if German unemployment data showed evidence of labour market recovery. However, EUR/USD near 1.09 looks consistent with current yield spreads.

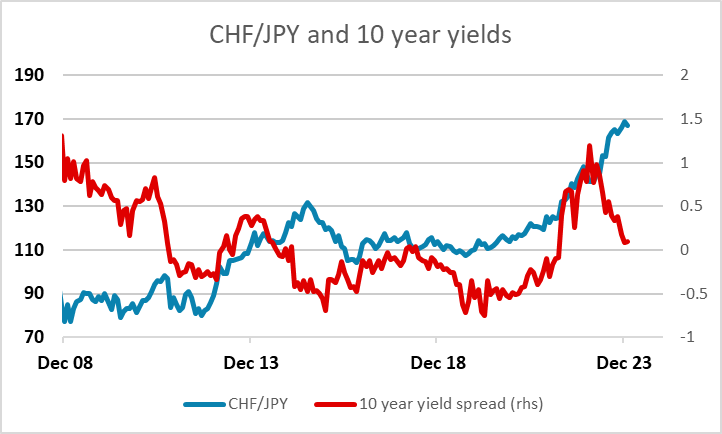

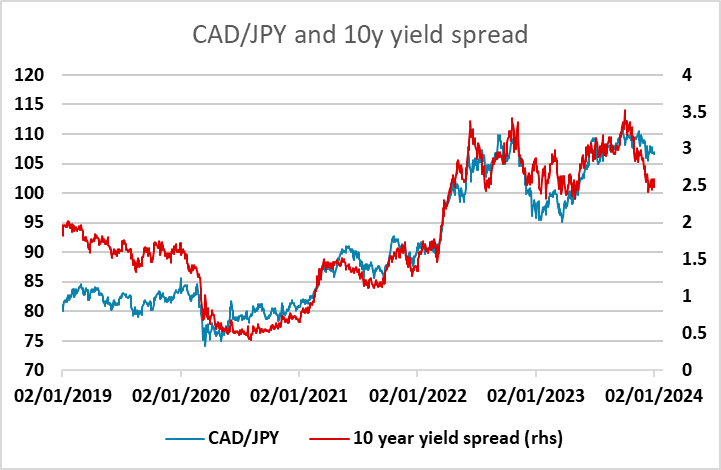

As well as USD strength there was strength for the JPY on the crosses on Tuesday, and we continue to see a case for JPY gains, though in the short term this looks to be greatest on the crosses. CAD/JPY and CHF/JPY look to have the most scope for declines. CAD/JPY because from a yield spread perspective we are some 5% above the level seen when we were last at current spreads, and CAD/JPY has tended to be very well correlated with yield spreads. CHF/JPY is more of a pure value play. The CHF has been strong over the turn of the year, but there is little yield advantage over the JPY to support the huge gains in the last few years, and the JPY should be the more attractive of the alternative safe havens.