JPY, AUD, NOK flows: JPY strength continues, risk currencies pressured, NOK good value

JPY strength has continued as risk positions have been unwound with the AUD suffering in particular. EUR/NOK is testing its highs in Europe but NOK represents good value longer term

JPY strength was once again the main feature overnight, with more unwinding of carry positions. AUD/JPY shows the most striking decline, breaking below 100 for the first time since May 1 and testing the bottom of the rising trend channel and 200 day moving average at 99.81. Clearly, this has been one of the favourite carry trades in Asia. It’s possible that we see a pause at this level now the frothy positions have been taken out, but from a valuation perspective there remains a lot of JPY upside potential, with the recent JPY gains barely scratching the surface of JPY weakness. Further moves may wait until after the US GDP data this afternoon, but unless we see a significant recovery in risk assets, there will be plenty of JPY buyers on any dips.

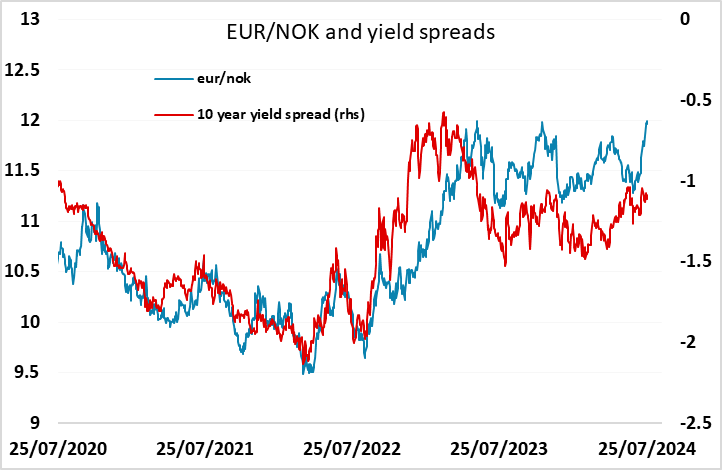

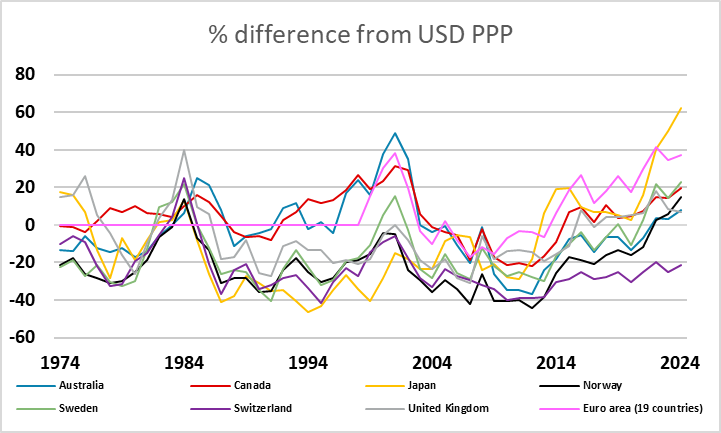

The JPY strength overnight has been very much a risk off trade, with the CHF also benefiting from the deterioration in sentiment, and the commodity currencies under the most pressure. Within Europe, the NOK has been the weakest currency, with EUR/NOK at new highs for the year and threatening the 2023 all time highs (excluding the pandemic spike) of 12.06. The weakness of the NOK remains something of a puzzle, as it didn’t really benefit from the risk positive story seen in the first half of the year, and Norway has remained one of the better fundamental economic performers. Of course, the picture is complicated by the substantial official flows relating to the government pension fund being invested abroad but from a valuation perspective the NOK continues to looks cheap by historic standards. This morning’s Q2 industrial confidence survey showed the strongest reading since Q1 2022, and yield spreads continue to be relatively attractive. If the risk negative momentum persists, we may well see new EUR/NOK highs, but there is good value in the NOK here for longer term players.