U.S. February Advance Goods Trade Deficit remains very high, marginal good news from claims and GDP

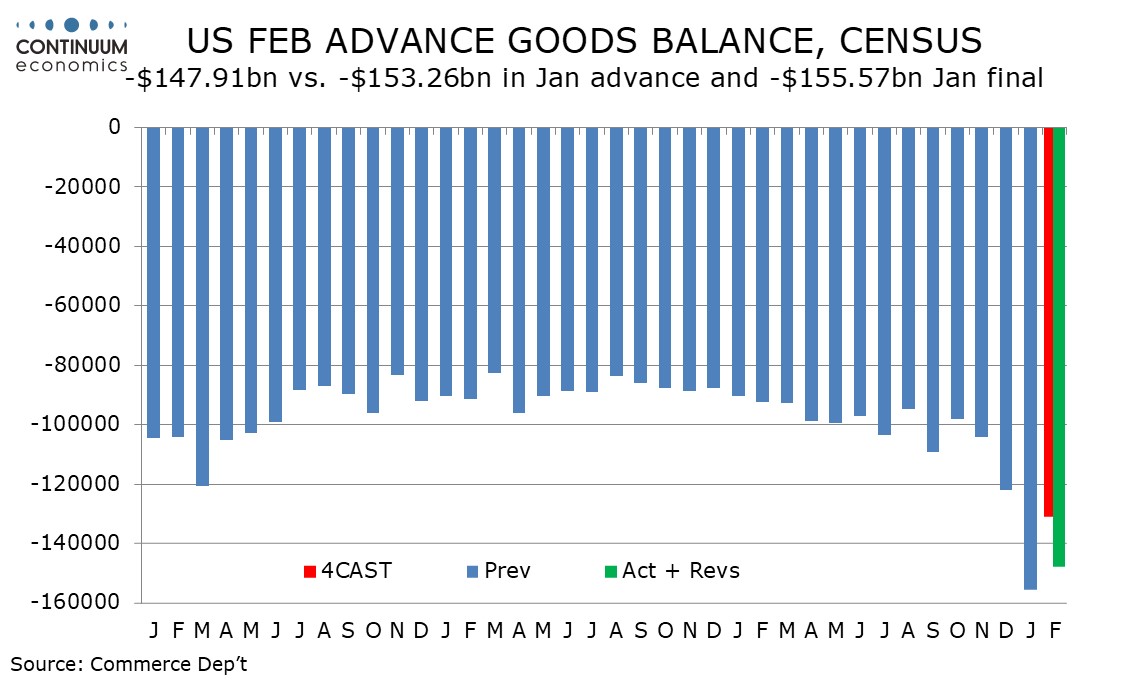

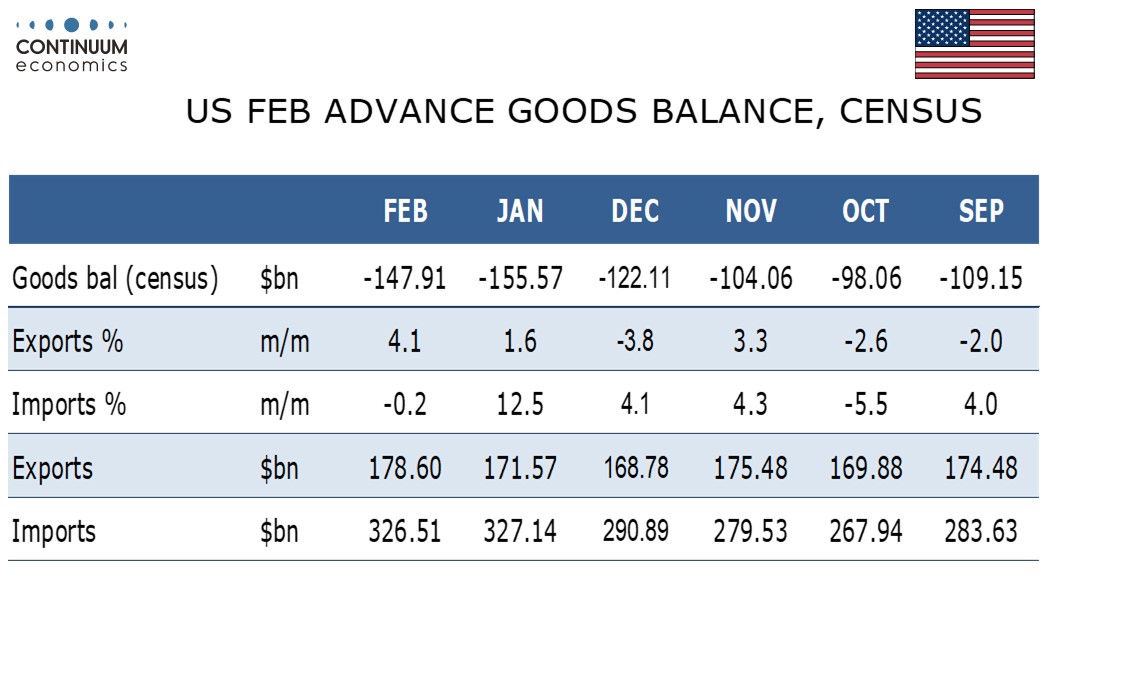

The advance goods trade deficit of $147.9bn in February, while down from January’s record $155.6bn remains very high and suggests a sharp negative from net exports in Q1 GDP, while the inventory offset, +0.3% for wholesale and +0.1% for retail is modest. Initial claims remain low at 224k, while Q4 GDP has been revised marginally higher but core PCE prices revised marginally lower.

The trade deficit remains well above December’s $122.1bn, which itself was a record before January’s data. Exports are up only 2.5% yr/yr while imports are up 22.5% yr/yr, in a surge designed to beat threatened tariffs.

On the month the trade data shows a respectable 4.1% increase in exports to follow a 1.6% rise in January, with the exports gain led by a 12.7% rise in autos. This may be in an attempt to beat threatened tariffs and potential retaliation.

Imports fell by a marginal 0.2% after a 12.5% increase in January. Industrial supplies corrected lower by 4.9% after a 34.3% increase in January. Subcomponents are not yet available but the January rise here was led by fixed metal shapes, gold in particular, and it is likely the February correction is too. Elsewhere in the imports detail food fell by 2.1% after a 4.3% January rise but the other components continued to rise. Moves in autos have been relatively modest in the case of imports, up 1.2% in February after a 2.3% rise in January.

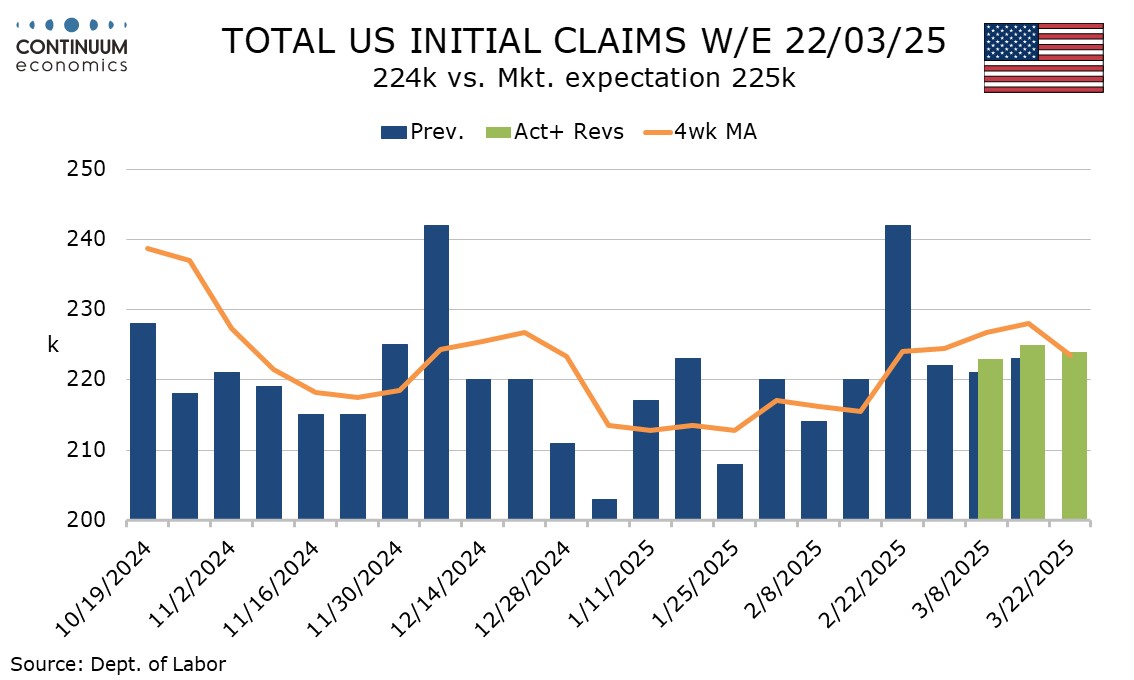

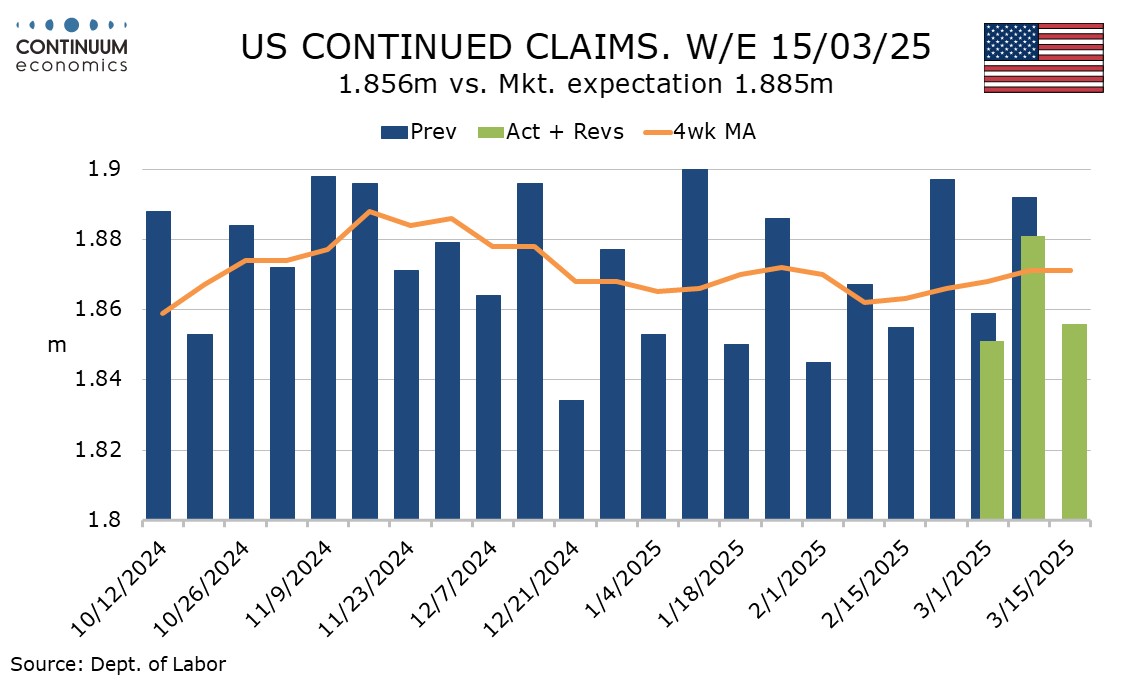

Initial claims at 224k from 225k remain low, while continued claims fell to 1.856m from 1.881m, largely reversing a rise in the preceding week. The continued claims data covers the survey week for March’s non-farm payroll, initial claims the week after. The labor market still looks healthy according to claims.

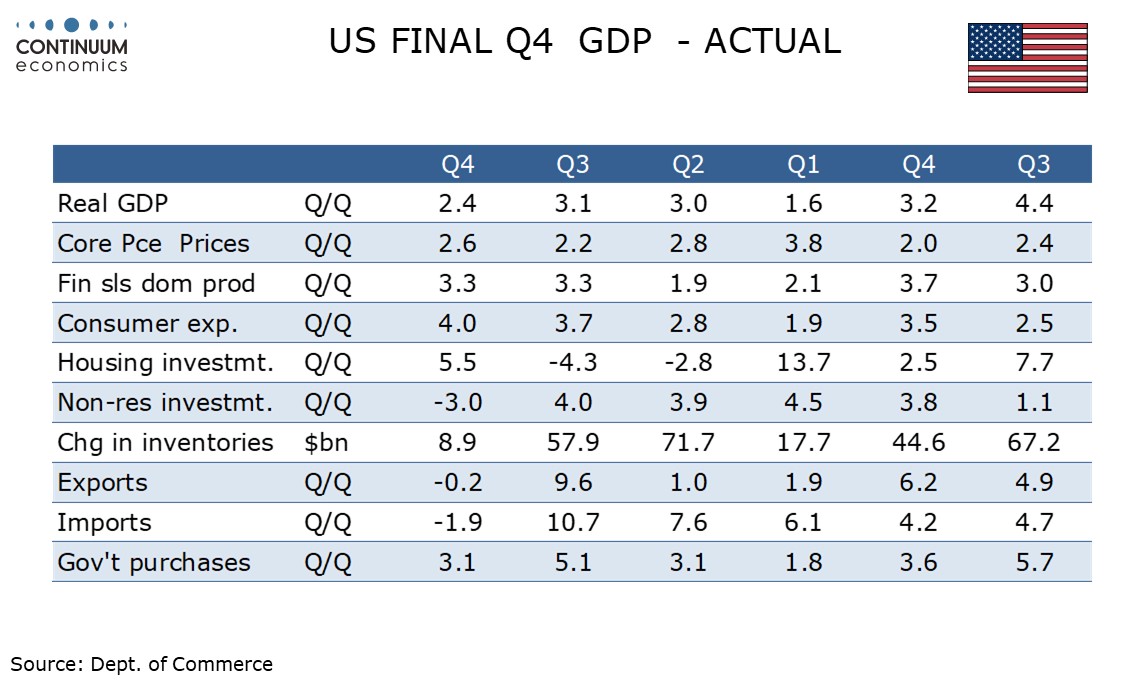

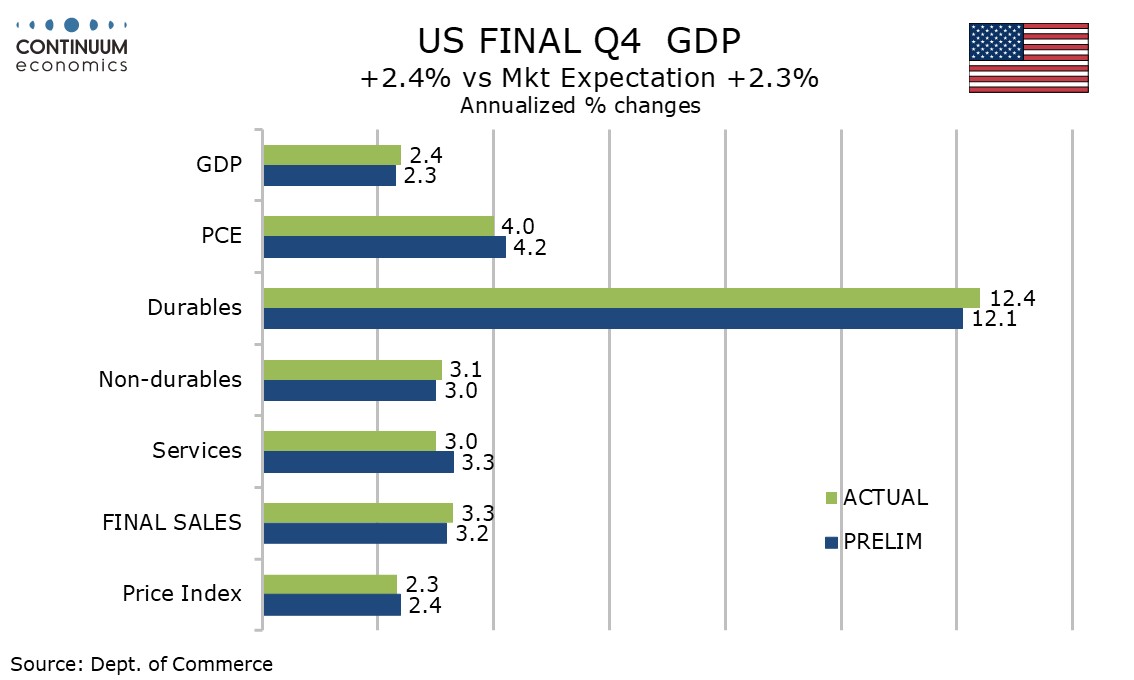

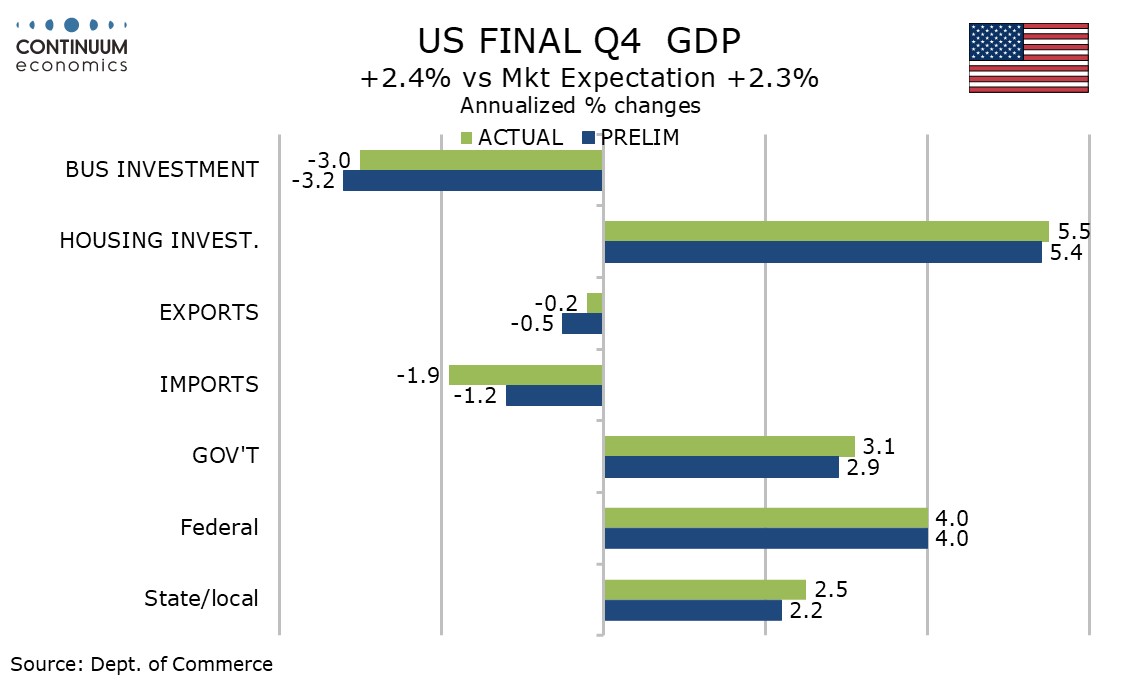

The third estimate of Q4 GDP of 2.4% is a marginal upward revision from 2.3%. The main positive in the revision was net exports, with exports revised up to -0.2% from -0.5% and imports revised down to -1.9% from -1.2%, but net exports look sure to be a sharp negative in Q1, even with March data not yet available. There were also modest upward revisions to government, and fixed investment.

Inventories saw a marginal downward revision, while consumer spending was revised down to 4.0% from 4.2% with marginal upward revisions in retail offset by a downward revision to services to 3.0% from 3.3%. Real disposable income however was revised down to 1.9% from 2.5% with Q3 revised to 0.2% from 1.1%. While these numbers are negative Gross Domestic Income, in this case the first estimate, outperformed GDP with a rise of 4.5%.

The core PCE price index of 2.6% from 2.7% is a marginal, if welcome, downward revision, but minimal compared with future tariff-related inflationary risks. The GDP price index was revised down to 2.3% from 2.4% but overall PCE prices were unrevised at 2.4%.