EUR flows: EUR downside risks on weak German production

Weak German Decmeber production data underlines the weakness of the economy and increases the chance of early ECB easing

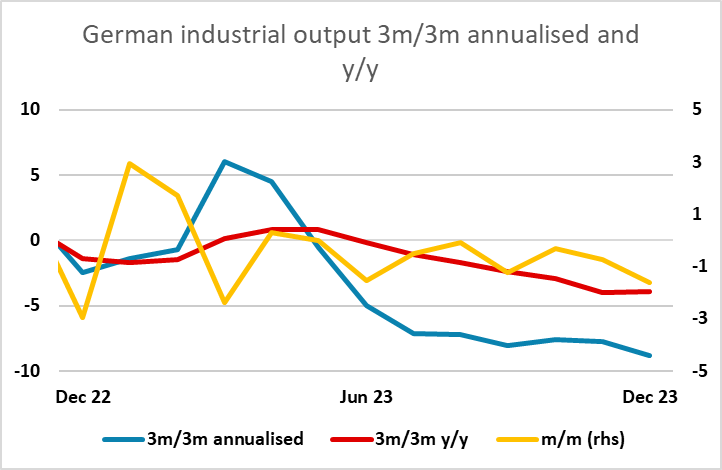

Very weak German December industrial production hasn’t initially had a negative impact on the EUR. Indeed, the EUR is starting the European session a little firmer, but the 1.6% decline in German production in December should be a concern as it suggests the trend is still deteriorating. While yesterday’s December orders data provided some grounds for optimism about the future, the orders data is volatile and there is no guarantee the sharp December rise won’t be reversed in January. The production data tends to show a more stable trend, and the near 9% annualised decline in the last 3 months underlines the weakness of the German manufacturing sector. This should increase the chances of an ECB easing in April, which is currently priced as around a 60% chance. EUR/USD risks are consequently on the downside, with the recent rise in front end yields following the US employment report looking hard to justify on the basis of European economics.