FX Daily Strategy: APAC, July 10th

Equities firm despite tariff threat

JPY sees modest recovery after recent sharp losses

EUR and CHF may be more at risk from tariff announcements now

Potential for a NOK/SEK rally

Equities firm despite tariff threat

JPY sees modest recovery after recent sharp losses

EUR and CHF may be more at risk from tariff announcements now

Potential for a NOK/SEK rally

Thursday is another relatively quiet calendar, with the market still waiting for some more definitive news on tariffs. Comments from Trump on Wednesday were shrugged off by equity markets, even though he threatened to impose a 50% tariff on imported copper and soon introduce levies of up to 200% for pharmaceuticals. The latter is of the most concern for Europe, and particularly for Ireland and Switzerland that have huge pharma sectors. Trump said he would "probably" tell the European Union within two days what rate it can expect for its exports to the United States.

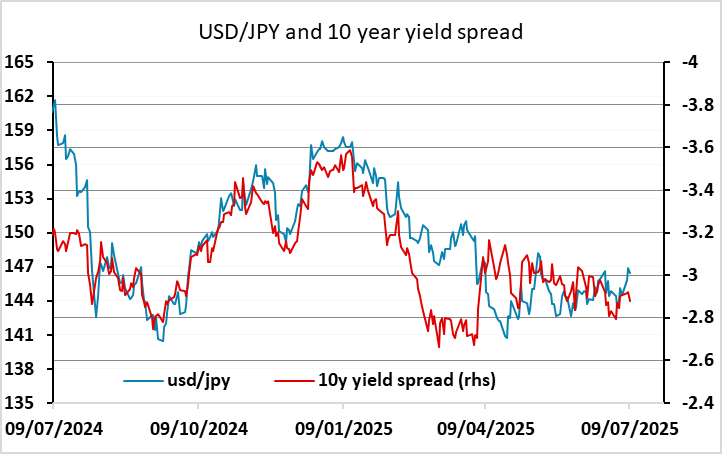

While equities were firm, yields were generally on the soft side on Wednesday, with the drop in US yields helping the JPY to stage a modest recovery after declining sharply on Monday and Tuesday. The risks in the coming days of tariff announcements that hurt Europe may mean the JPY has scope to recover further. While Japan is seen as least likely to achieve a trade deal with the US, and is facing a 25% tariff, this is already in the price to a large extent, while European currencies have held up much better against the USD. The CHF in particular has been very strong this year, but if the pharma sector is targeted, EUR/CHF and USD/CHF could see some upward pressure. Having said this, the CHF reaction is unpredictable with the CHF typically reacting positively to increased risk aversion. But the CHF gains against the JPY this year look overdone if Switzerland sees similar tariffs to Japan.

US yields may also have slipped lower because of talk of the potential appointment of White House economic adviser Kevin Hassett as the next chair of the U.S. Federal Reserve. The Wall Street Journal reported this on Tuesday, saying Hassett met with President Trump about the Fed job at least twice in June. Trump has accepted he can’t get rid of Powell until his term ends next year, but there has been talk of an early announcement of his successor. Hassett, though qualified, would be seen as playing Trump’s tine and looking for easier policy. However, with this all speculation and any appointment not coming until March 26, it should have limited scope for current impact.

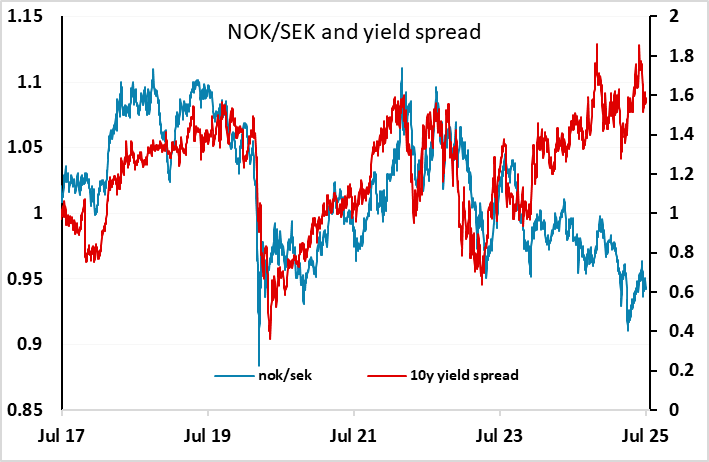

Datawise there isn’t a great deal on the calendar, with just the usual Thursday claims data in the US. But there is Norwegian CPI and Swedish GDP, confidence and production data in Europe. Norges Bank slightly surprisingly cut their policy rate last time around in June, and are seen as likely to cut again in September. Meanwhile, the SEK has rallied after stronger CPI data on Monday reduced market expectations of Riksbank easing. NOK/SEK continues to look strangely cheap relative to yield spreads, and we continue to look for buying opportunities. A core CPI inflation number above the 3% consensus in Norway or more evidence of real sector weakness in Sweden might provide such an opportunity.