U.S. September Existing Home Sales - Picture remains weak

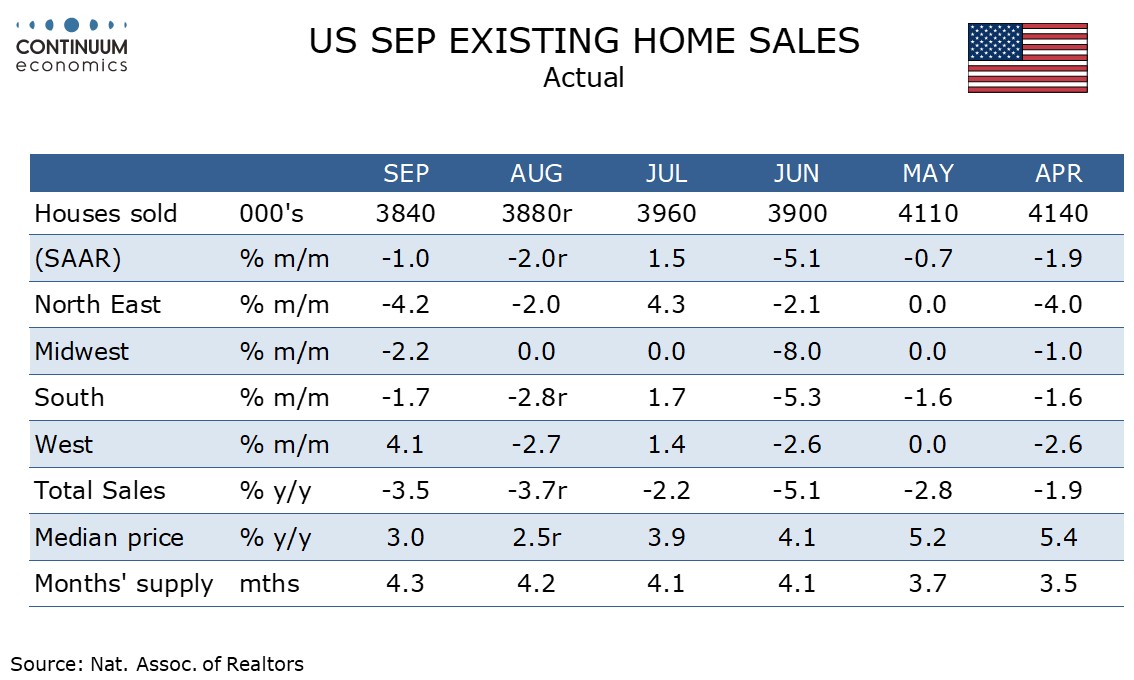

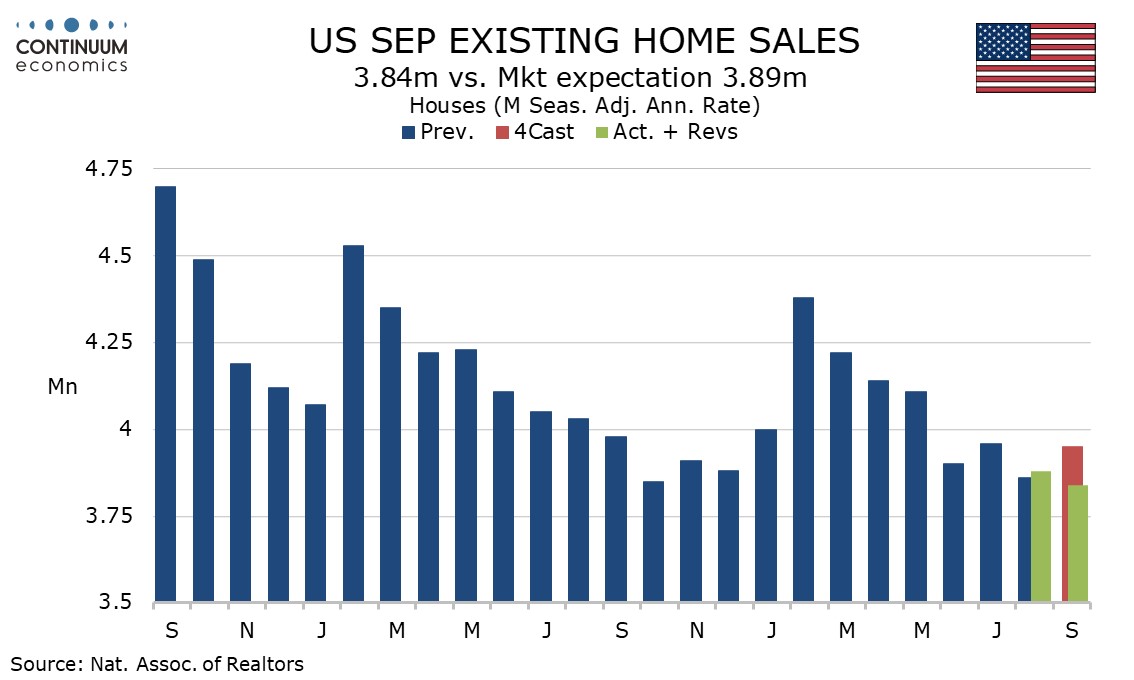

September existing home sales are weaker than expected, falling 1.0% to 3.84m to the lowest level since October 2010. The softer data contrasts some signs of stronger housing demand in some September surveys, but signals for October are mixed.

September saw improved survey evidence from the MBA and NAHB, with the NAHB survey improving further in October, responding to falling bond yields and the start of Fed easing. However with Fed easing expectations being toned down and bond yields picking up again, the most recent weekly MBA data has lost momentum.

September’s weaker existing home sales data maintains a negative trend that has been in place since strong gains seen in January and February. There may be some seasonal adjustment issues with 2023 also having seen a sharp bounce in February before gradual slippage through October. However a negative yr/yr pace of -3.5% suggests a modestly negative underlying trend and the level is historically weak.

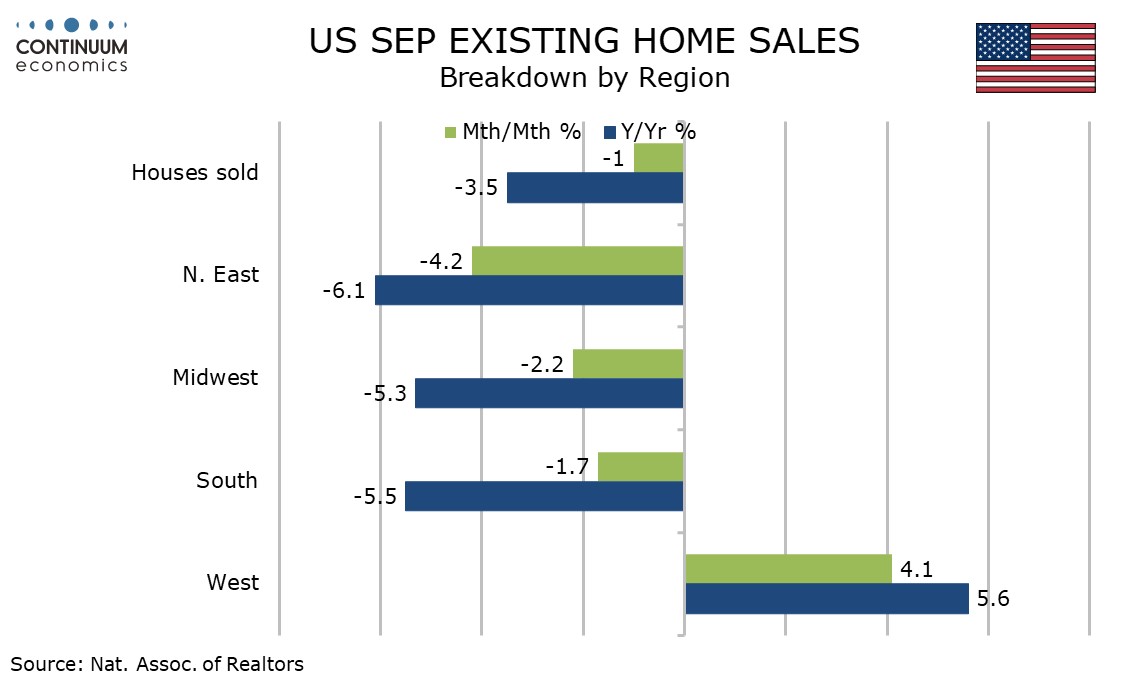

Regional data shows dips in three out of the four regions with no exceptional weakness in the South despite the arrival of Hurricane Helene late in the month. The exception to the negative picture is the West which is up both on a month/month and yr/yr basis.

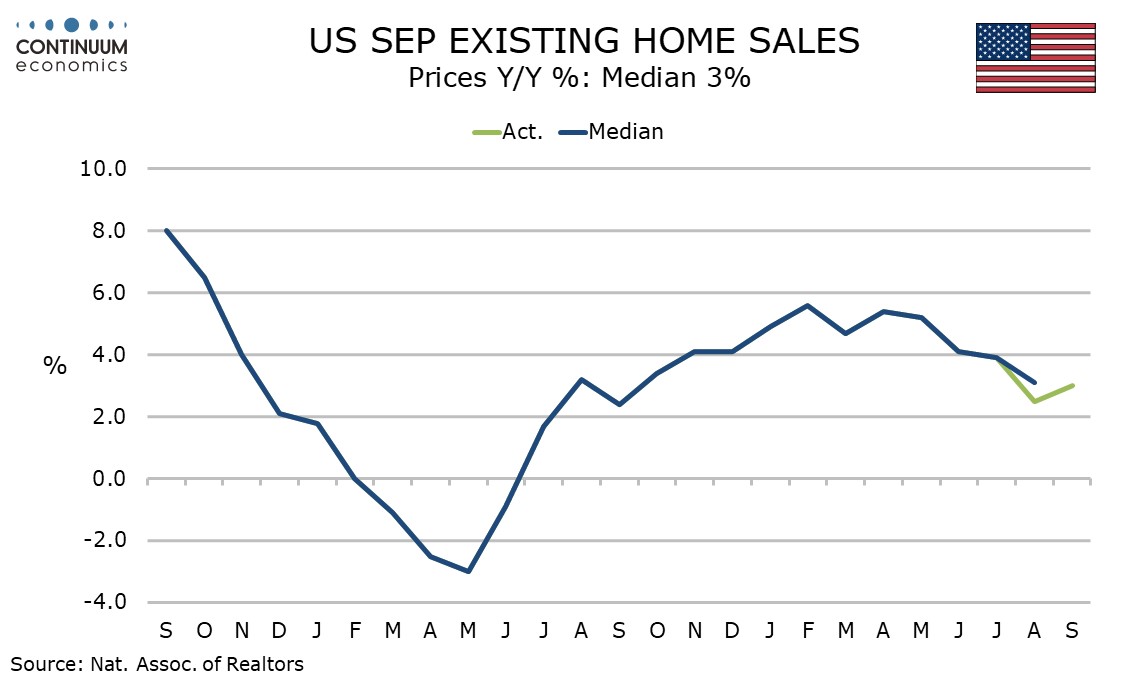

The median price fell by 2.3% on the month for a third straight dip though these declines are in part seasonal. Yr/yr growth actually ticked up to 3.0% from 2.5% but remains subdued, if less weak than the sales picture.