FX Daily Strategy: Europe, July 2nd

US employment report and French and UK elections are the event highlights

Reaction to elections likely to be muted

Mild USD downside risk on employment report

JPY remains in the spotlight

JPY weakness remains the big FX story

BoJ action needed to steady an increasingly one way market

EUR gains post-French election may fade

ECB central bank conference a focus

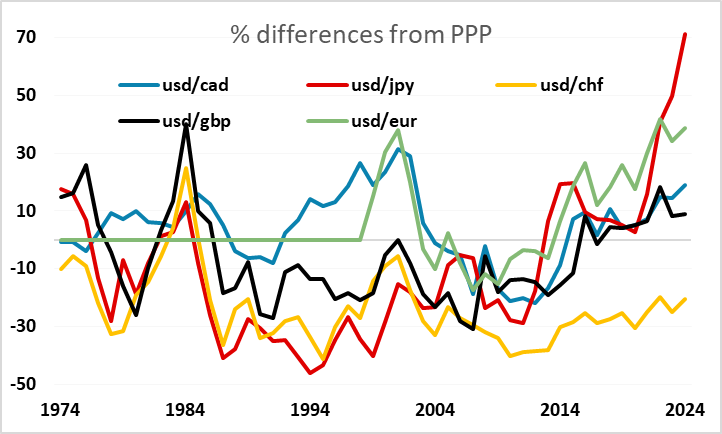

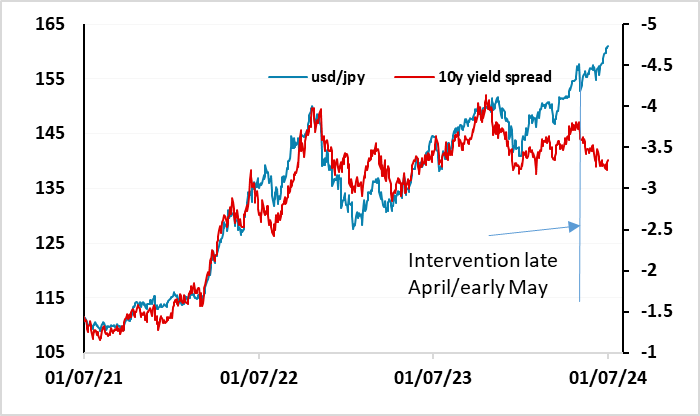

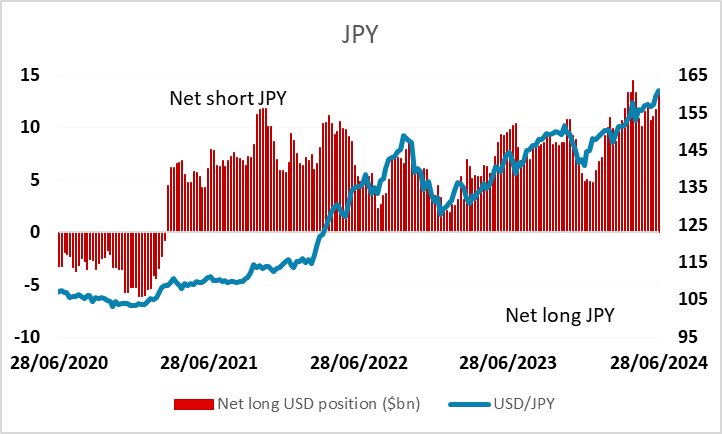

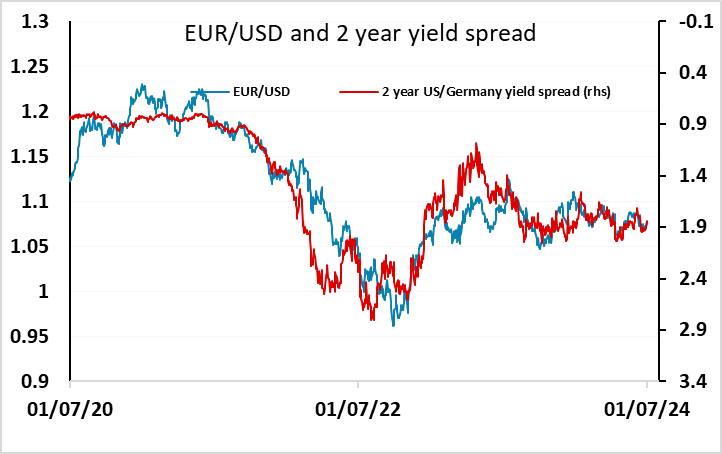

While the news focused on the French election result on Monday, the market impact was fairly modest, with EUR/USD gaining less than half a figure on the day. The main market theme remains JPY weakness, with the BoJ still refraining from intervention but the JPY reaching new all time lows almost every day. There has generally been little fundamental support for the JPY’s decline in recent weeks, but the overnight news of a significant downward revision to Q1 GDP (and H2 2023 GDP) provided some support for the JPY’s latest decline. At the margin, the revisions reduce the chance of early BoJ tightening, although it still seems that there is a good chance of a rate hike and reduction in JGB buying being announced this month. The market is currently pricing a 10 bp rate hike as slightly better than a 50-50 chance. And despite the news, yield spreads still support a significant JPY rally.

But momentum is the main market driver of the JPY at the moment and it is difficult to oppose. Even so, the JPY’s decline is starting to look overdone. IMM data show net speculative short JPY positions at their highest since the intervention in late April. GBP/JPY has had 11 consecutive days of gains, a run that has only ever been seen once before in the last 35 years, in June 2022. A pause looks due, but the BoJ will probably need to do something more active if we are to see any sort of sustained JPY recovery.

There isn’t a great deal to get excited about on Tuesday’s calendar. There is no data of note in the US, and Eurozone data is limited to final CPI which the national data suggests might be slightly softer than originally expected. This could mean some modest reversal of the gains in German yields seen on Monday, much of which was due to the unwinding of short France/long Germany trades after the French election. This did provide some support for the EUR, but softish CPI data suggests that he risks are to the downside.

There is some potential for comments from Fed Chair Powell and ECB president Lagarde from the ECB central banking forum in Sintra, but in practice their comments are more likely to be around the general practice of central banking than any specifics of their current situations. We do see some scope for the Fed to take a slightly more dovish view in the coming weeks given the soft tone to much of the US data, but we wouldn’t expect much action in US rates ahead of Friday’s employment report.