FX Daily Strategy: N America, January 22nd

GBP softer after public sector borrowing numbers

CAD could be at risk if market starts to take tariff threat seriously

AUD continues to represent long term value

EUR and JPY both look too weak despite challenges

GBP softer after public sector borrowing numbers

CAD could be at risk if market starts to take tariff threat seriously

AUD continues to represent long term value

EUR and JPY both look too weak despite challenges

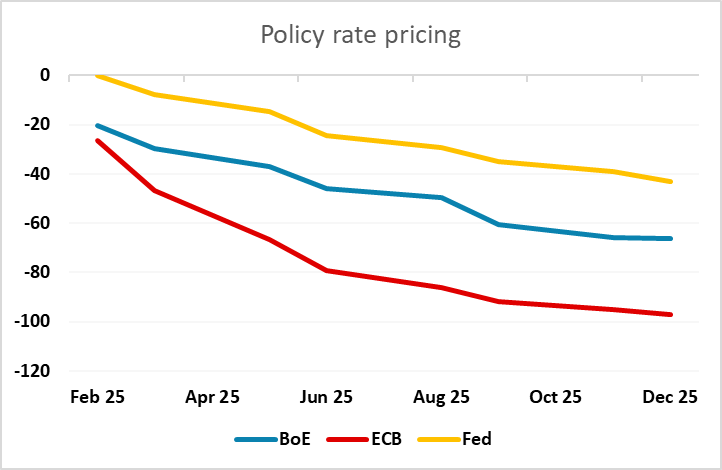

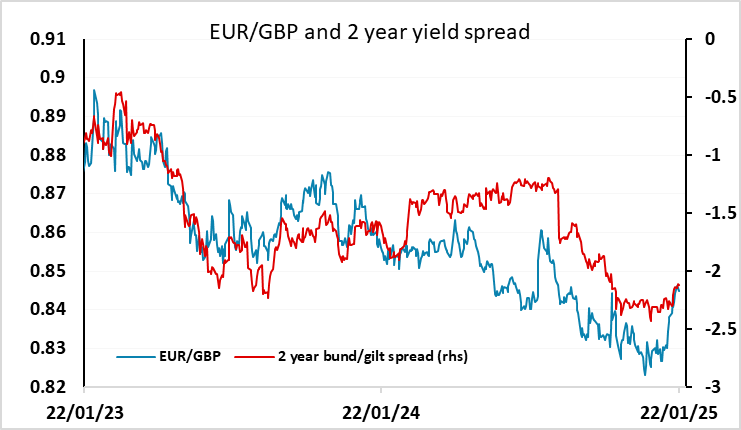

GBP has fallen slightly after the UK public sector net borrowing numbers showed December borrowing £3.6bn higher than expected at £17.8bn. These are volatile numbers and the PSNCR was slightly below last December’s number, so we wouldn’t conclude anything significant from the data at this stage. But UK public borrowing is set to rise over the next year, and all the more so if growth doesn’t improve, so the picture for GBP remains negative with further deterioration in the public finances likely unless the BoE cuts rates more aggressively. Both scenarios are GBP negative, so we look for a move above 0.85 in EUR/GBP after the February 6 BoE meeting if not before.

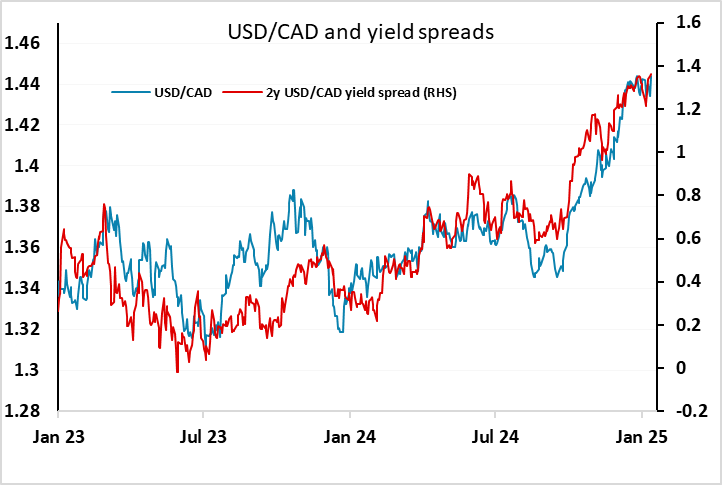

Otherwise, the FX market looks fairly quiet and will await any further news from the White House on tariff policy. The announcements thus far have seen the USD soften modestly, but the warnings of potential tariff increases for Canada and Mexico from February 1 mean USD/CAD may be most in play in the near term. We doubt that the threat of a 25% tariff increase will be carried out, with the Canadian government sure to negotiate to avoid a trade war, and this also seems to be the market view, as USD/CAD continues to move essentially in line with yield spreads rather than showing any risk premium related to the tariff threat. Risks may therefore be on the CAD downside if the market starts to think that Trump will carry out his threats.

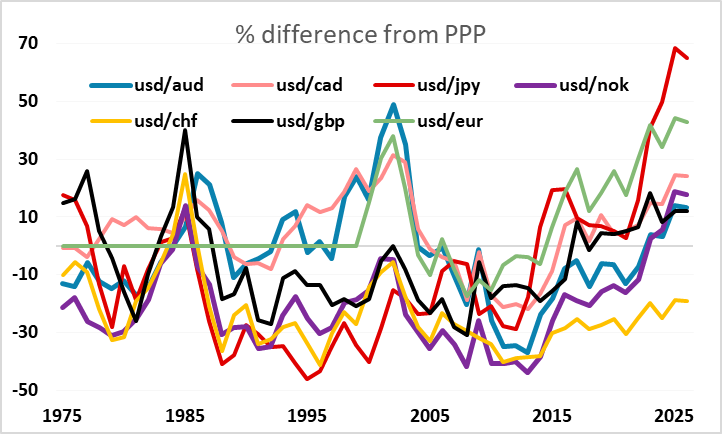

Elsewhere, we continue to see upside scope for the AUD, which has been the biggest underperform of yield spread correlations in the last year. Some of this underperformance relates to concern about China, and in part may reflect some worries about US tariffs on China and the impact on global trade and sentiment. But such concerns don’t look sufficient to justify the scale of AUD underperformance, and we suspect the los seen at 0.6131 on January 13 could turn out to be a long term base.

However, in terms of long term value, the JPY and the EUR look by far the cheapest of the G10 currencies. Some of this relates to their relatively low yields, but the weakness also seems to reflect a belief that both Japan and the EU are failing to keep pace with US growth, are over-reliant on old industries and suffer from overregulation. Growth has certainly been weak, and the Japanese and German car industries are under pressure from Chinse and US competitors. Nevertheless, valuation looks too extreme, and while they may continue to underperform on the growth front, it is hard to see further significant declines against the USD from here. This may not mean any immediate significant recovery, but with downside limited risks favour JPY and EUR bulls.