FX Weekly Strategy: Europe, January 26th-30th

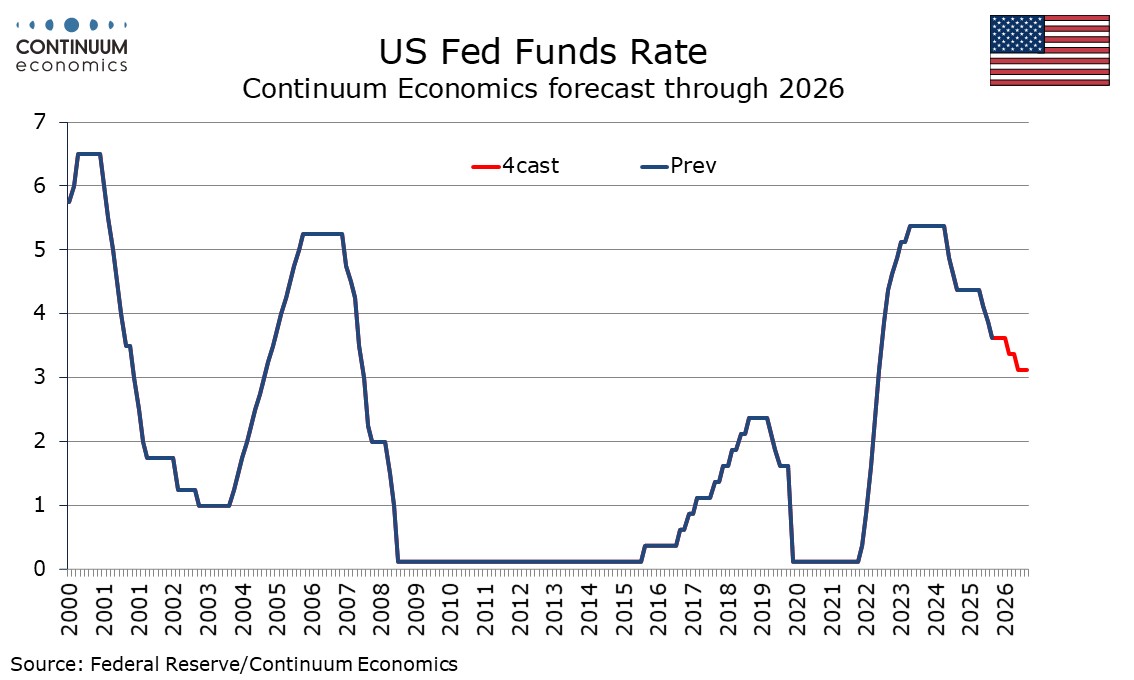

No change with early 2026 data awaited for FOMC

Slate of U.S. Data

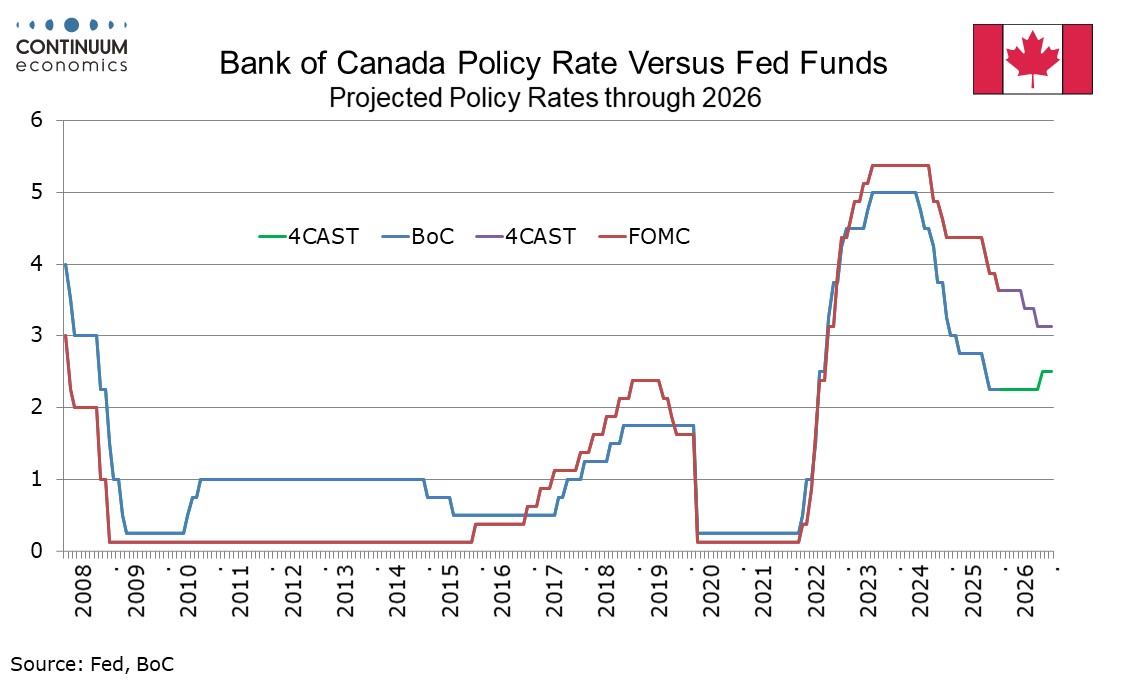

Bank of Canada Rate level still appropriate

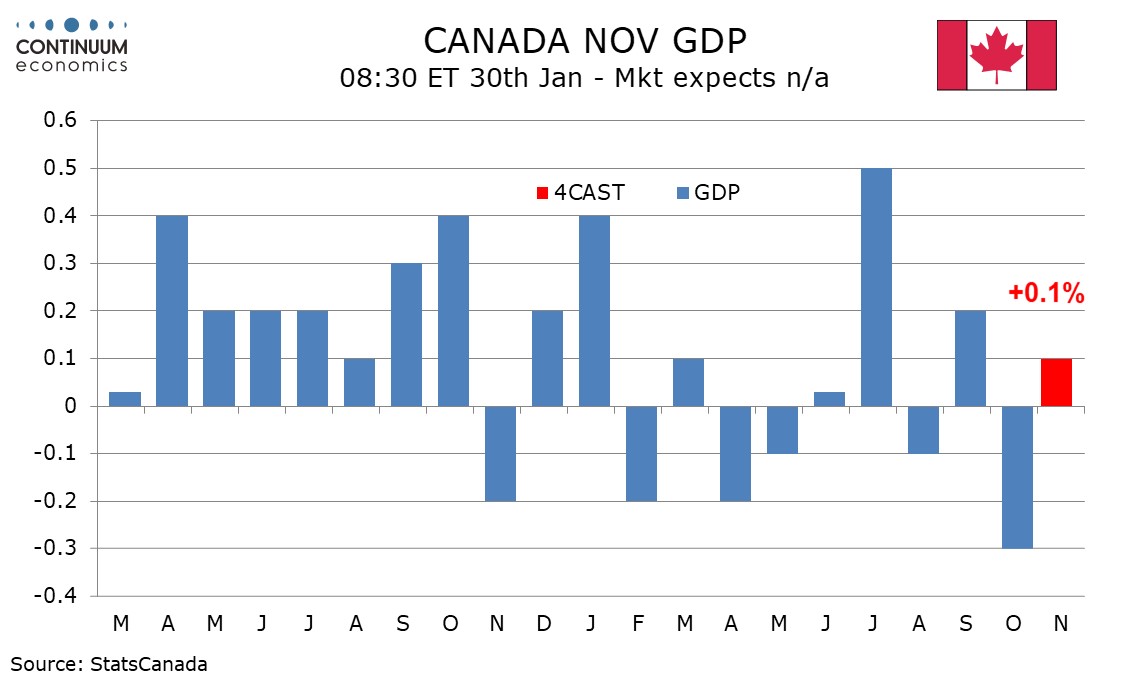

Canada November GDP Show Partial reversal of October's dip

The FOMC meets on January 28 and rates look set to be left at 3.5-3.75%, and while rates are likely to move lower in 2026, they are unlikely to give many hints over what is likely in March, with future decisions dependent on data. The FOMC will not update its economic forecasts or dots at this meeting. We expect only one dissenting vote, with dovish Governor Stephen Miran likely to call for a 50bps easing. This will signal broad support for Chair Jerome Powell at the FOMC, despite pressure from President Trump for lower rates. The voting line up will change, with hawks Hammack and Logan, moderate Kashkari and the slightly dovish Paulson replacing the recently hawkish Schmid, Goolsbee and Musalem, as well as moderate Collins. The net effect of this on policy decisions will be marginal.

The statement will be fine-tuned to take recent data into account, but few other changes are likely. December’s statement described growth as moderate. Given a stronger than expected Q3 GDP and positive signals on Q4 any fine-tuning will be positive but cautiously so. Job gains remain quite slow, but December’s unemployment rate of 4.4% was unchanged from September. December’s statement stated unemployment had edged up from September. December’s statement noted that inflation had moved up since earlier in the year. It now appears to be stabilizing, though the FOMC is likely to continue describing it as somewhat elevated.

All this will allow the Fed to take a cautiously optimistic view on both growth and inflation, suggesting no urgency for any policy change. The Fed will be watching for incoming data. While any change from the currently fairly flat labor market picture would be noted, it is inflation data that is likely to be of most significance. Recent years have tended to see a pick up in Q1. If that occurs this year, the Fed may pause into Q2, as is our expectation, though further progress on inflation would raise confidence that inflation is heading back towards target. We do not expect easing in March, but it is unlikely to be ruled out. At the press conference, Powell will face many questions about the future of the Fed. He will choose his words carefully, but will stress the importance of Fed independence.

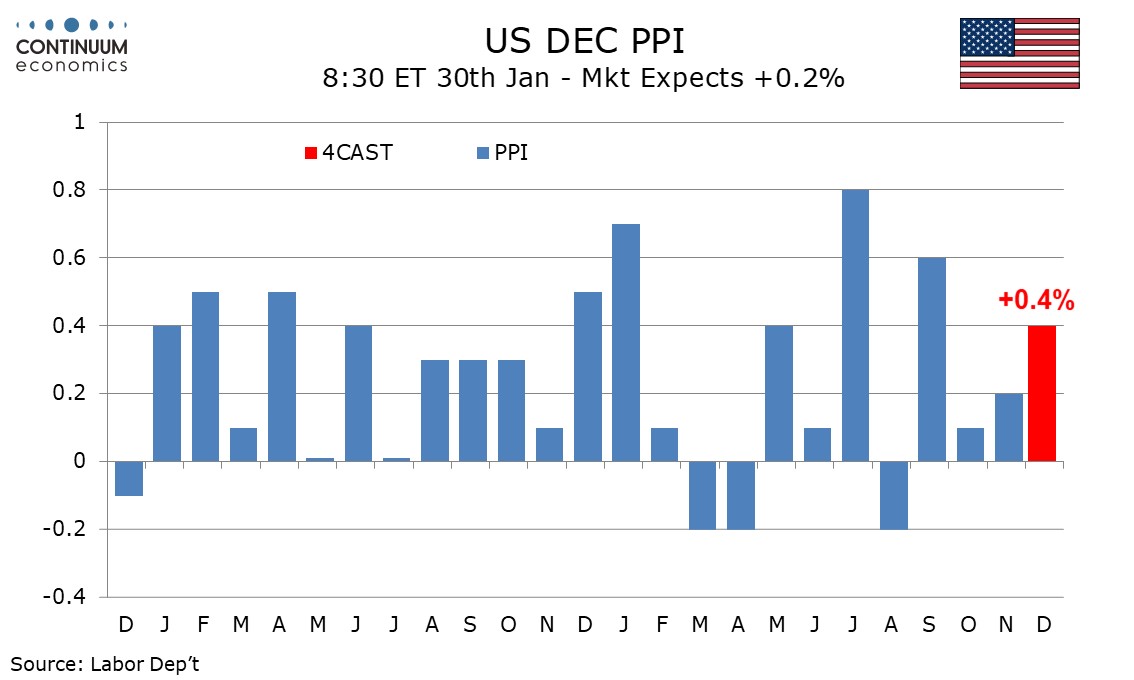

Despite signs in the CPI that inflationary pressure has slowed in Q4, we expect December PPI to show above trend gains of 0.4% both overall and ex food and energy. Ex food energy and trade however we expect a moderate gain of 0.2%, which would match November’s outcome in that series. We expect goods PPI to rise by 0.3% overall and ex food and energy, with food and energy both seeing modest gains. Goods ex food and energy have risen by 0.2% three times and 0.4% three times in the last six month suggesting trend remains near 0.3%, as were the gains seen in February, March, April and May.

Services may be due for a bounce from a flat November given that the volatile trade series fell by 0.8% in both October and November. We expect trade to explain around half of a 0.4% December rise in services. Yr/yr PPI would then slip to 2.8% from 3.0% overall, and to 2.9% from 3.0% ex food and energy. Ex food energy and trade we also expect yr/yr growth to slow, to 3.3% from 3.5%.

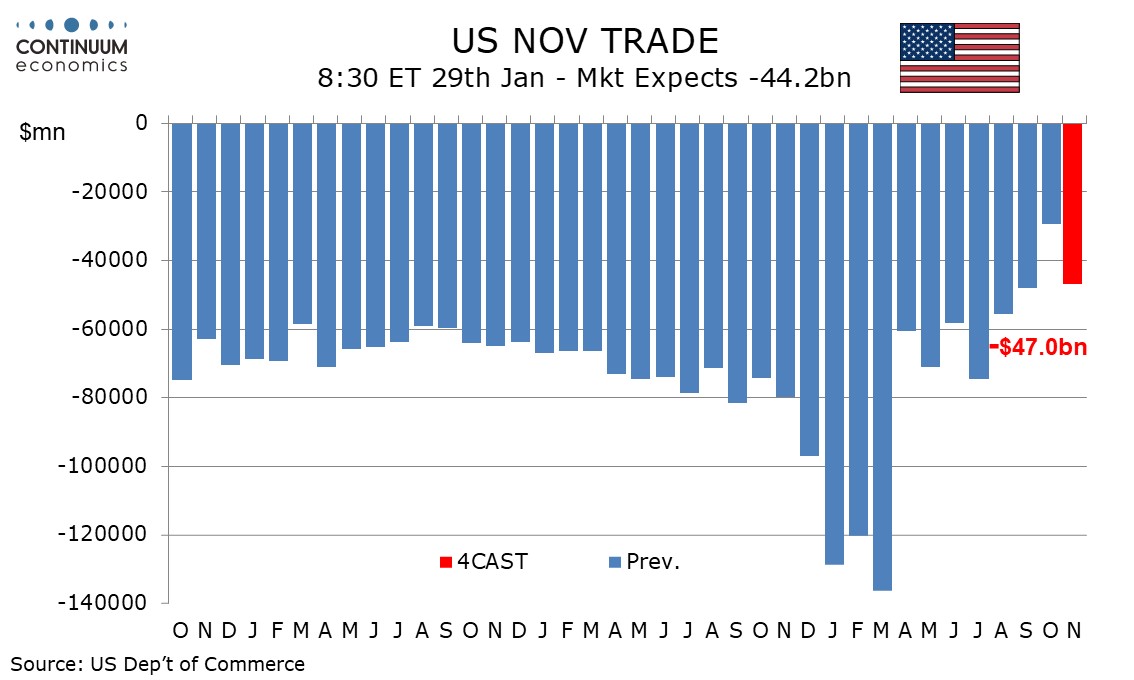

We expect a November trade deficit of $47.0bn, up from October’s $29.35bn which was the lowest since June 2009 and which looks unsustainably low, but still slightly narrower than September’s $48.14bn, which was itself the narrowest since March 2020. The sharp narrowing in October’s deficit came largely from a second straight sharp rise in exports of nonmonetary gold, and a sharp fall in imports of pharmaceutical preparations which more than fully reversed a strong rise in September. While it is far from certain that data will return to underlying trend as soon as November, such a move would see a sharp fall in goods exports reversing most of the September and October gains, and goods imports somewhere between the levels of September and October.

We expect goods exports to fall by 6.0% after gains of 5.6% in September and 3.8% in October while goods imports rise by 2.5% after a 4.3% fall in October that followed a 1.0% increase in September. Price gains will contribute around 0.5% to the November gains in each series. We expect service exports to rise by 0.5% after a 0.7% October gain while service imports rise by 0.1% after bouncing by 1.4% in October, leaving overall exports down by 3.7% and overall imports up by 1.9%. t will be some time before the underlying trade picture becomes clear given continuing volatility in policy but it is likely that the deficit remains below underlying trend after surging in Q1 ahead of the tariffs. The average deficit in the first 10 months of 2025 is $78.3bn, not far from an average monthly deficit of $75.3bn in 2024.

The Bank of Canada looks highly likely to leave rates unchanged at 2.25% on January 28 and reiterate that rates are at about the right level if the economy evolves as expected, while adding that uncertainty remains elevated. We expect that the next BoC move will be a modest tightening, but this will not be seen until Q4. Easing before then is possible if geopolitics gives the economy a fresh hit. After easing to 2.25% in October, putting rates at the bottom of the BoC’s neutral range of 2.25-3.25%, the BoC stated that if the economy evolved in line with its October projection, it saw policy at about the right level to keep inflation close to 2% while guiding the economy though this period of structural adjustment. This was repeated at the December meeting, when rates were left unchanged.

This meeting will be of most interest for updated economic forecasts. Since October’s forecasts ere made we have seen Q3 GDP significantly exceed the BoC’s expectations with 2024 also revised significantly higher, though we expect that the BoC will expect a modest correction lower in Q4 and a moderate start to 2025. We expect revisions to 2026 and 2027 GDP forecasts will be modest, but overall the economy is looking a little stronger than the BoC had expected. CPI has exceeded the BoC’s expectation in Q4, though their core rate, as measured by the average of CPI-Median and CPI-Trim, was a little softer than expected. The Q4 acceleration in overall CPI is in part due to a sales tax holiday a year ago inflating the base, and that will continue in early Q1, though the BoC was aware this was coming when it made its forecasts in October. In April the year ago base will be boosted as the abolition of the carbon tax in April 2025 drops out of the base, and that’s should see overall and core CPI rates converging. The BoC has reason to feel a little more optimistic about underlying inflation than in October, and may trim its 2026 and 2027 projections. We expect they will now look for the 2.0% target to be reached in 2027, which in October it saw at 2.1%.

A slightly stronger growth view than in October but a slightly softer inflation view suggests that despite the surprises seen in data since October, the BoC will not need to change its view that rates are at about the right level. High uncertainty given the geopolitical environment, with Greenland and the upcoming USMCA negotiations both carrying significant risks for Canada, will mean that the BoC will reiterate that if the outlook changes it is prepared to respond. Our central view has the economy in late 2026 seeing growth back in line with potential and inflation getting close to target, with a 25bps tightening in October and another in 2027 to put rates in the middle of the neutral range. However, a shock that damages the outlook sufficiently to see the BoC resuming easing is a significant risk.

We expect November Canadian GDP to increase by 0.1% in line with a preliminary estimate made with October’s report, when a 0.3% decline was reported. We expect the preliminary estimate for December will also show a modest increase. If November GDP rose by 0.1% and October is unrevised, a flat December would leave GDP down by around 0.5% annualized, correcting a 2.6% increase in Q3. If December manages a modest increase, Q4 may be close to unchanged.

The preliminary estimate for November saw weakness in manufacturing and mining but gains in construction, educational services and transport and warehousing. This suggests that goods will slip for a second straight month, even with a rise in construction, but services will recover from an October decline. Given a dip in November 2024, yr/yr GDP would then pick up to 0.7% from 0.4% in October. October saw these lowest yr/yr gain since February 2021 ended a string of negatives seen because of the pandemic.