SEK flows: SEK softer after Riksbank

EUR/SEK higher after the Riksbank statement, but upside limited. NOK/SEK has more scope for gains

EUR/SEK is trading firmer after the Riksbank meeting. There are slightly mixed messages, with the Riksbank still indicating that tight policy is required in the near term. But the key statement is “the policy rate can therefore probably be cut sooner than was indicated in the November forecast.” This triggered around a 4 figure rise in EUR/SEK, with Swedish front end yields falling a few bps while Eurozone yields have edged a touch firmer. They also said the possibility of the policy rate being cut in the first half of the year cannot be ruled out, but this is already priced into the market, with a 30bp decline in rates priced in by the May meeting.

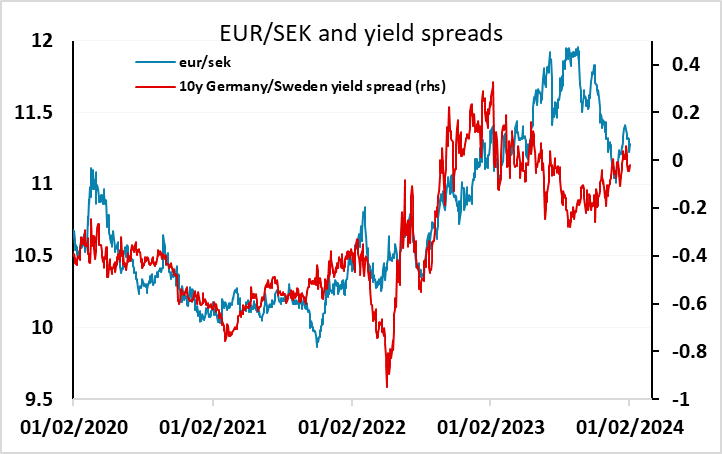

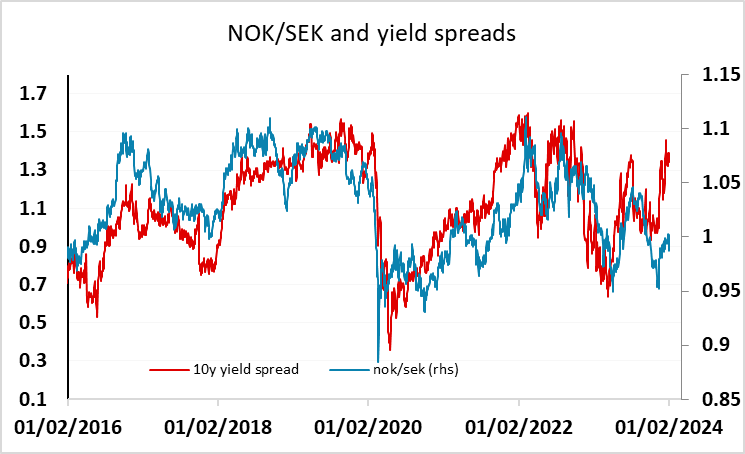

We don’t see major implications for EUR/SEK, as Riksbank policy looks likely to closely mirror the ECB and EUR/SEK is already close to fair based on the recent correlation in yield spreads, having corrected the SEK weakness seen through much of the second half of 2023. The Riksbank noted this, with no repeat of the currency being unjustifiably weak as they said in November. However, the SEK still looks strong relative to the NOK, based on the historically very robust correlation with 10 year yield spreads. This suggests there is scope for NOK/SEK gains, but they may have to come via EUR/NOK rather than EUR/SEK.