FX Daily Strategy: N America, January 31st

EUR slips on weak data

CAD awaiting tariff news more than GDP

JPY strength can extend further

EUR slips on weak data

CAD awaiting tariff news more than GDP

JPY strength can extend further

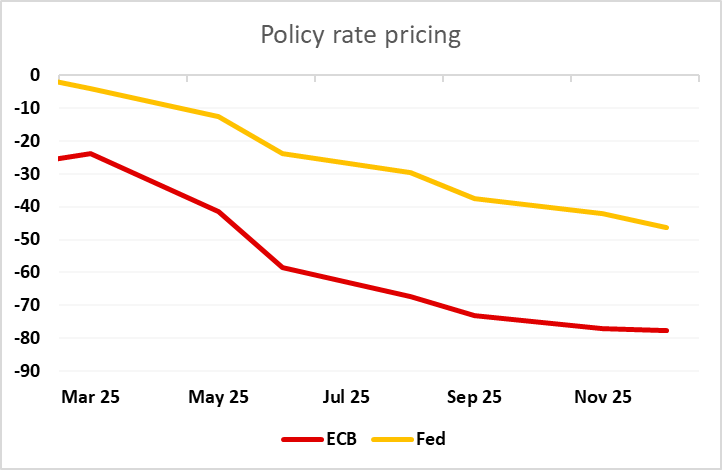

French CPI came in weaker than expected at -0.2% m/m on a HICP basis, and German state CPIs are coming in much weaker than expected as well. The consensus for German national CPI is for the y/y rate to be unchanged at 2.8% (HICP basis) or 2.6% (national basis). But the state CPIs are generally coming in weaker than expected, with the largest state NRW seeing a big decline in the y/y rate to 2.0% from 2.5%, while Bavaria and Baden-Wuerttemberg are also showing large declines in the y/y rates to 2.5% and 2.3% respectively, from 3.0% and 2.6%. While other (smaller) states are more mixed, this data suggests the national CPI will dip to 2.6% or below on an HICP basis. Along with the French data, this maintains the downward pressure on front end EUR yields, with EUR 2 year yields down 8bps on the day. The market is now pricing in 3 more 25bp rate cuts by year end.

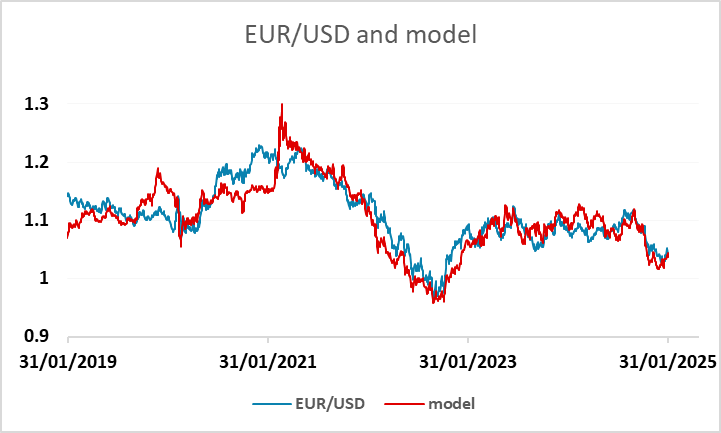

EUR/USD has lost ground as a result, with the 2 year spread with the US widening. But we still wouldn’t expect a further significant decline, as the lower yield structure will support European equities, which tends to be supportive for the EUR. Our model still suggests we will hold near 1.04.

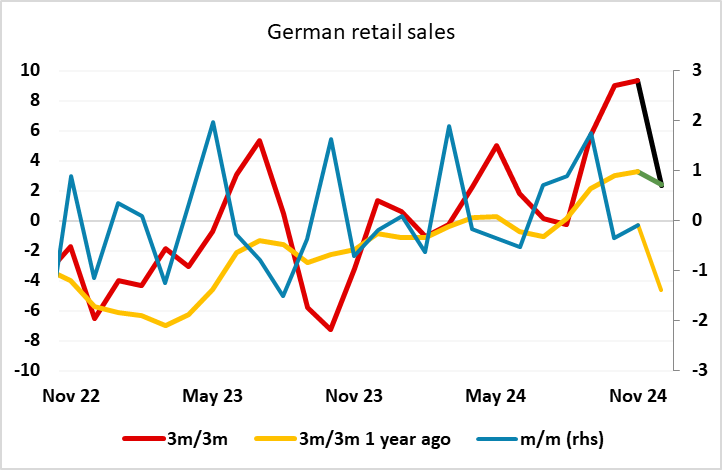

The session kicked off with weak German retail sales, which fell 1.6% m/m in December. This is now the third consecutive monthly decline, and significantly undermines the recent narrative of an improving trend. Coupled with the weak Q4 German GDP data released yesterday, the picture in Germany continues to look quite grim, even though the survey data improved modestly in the last month.

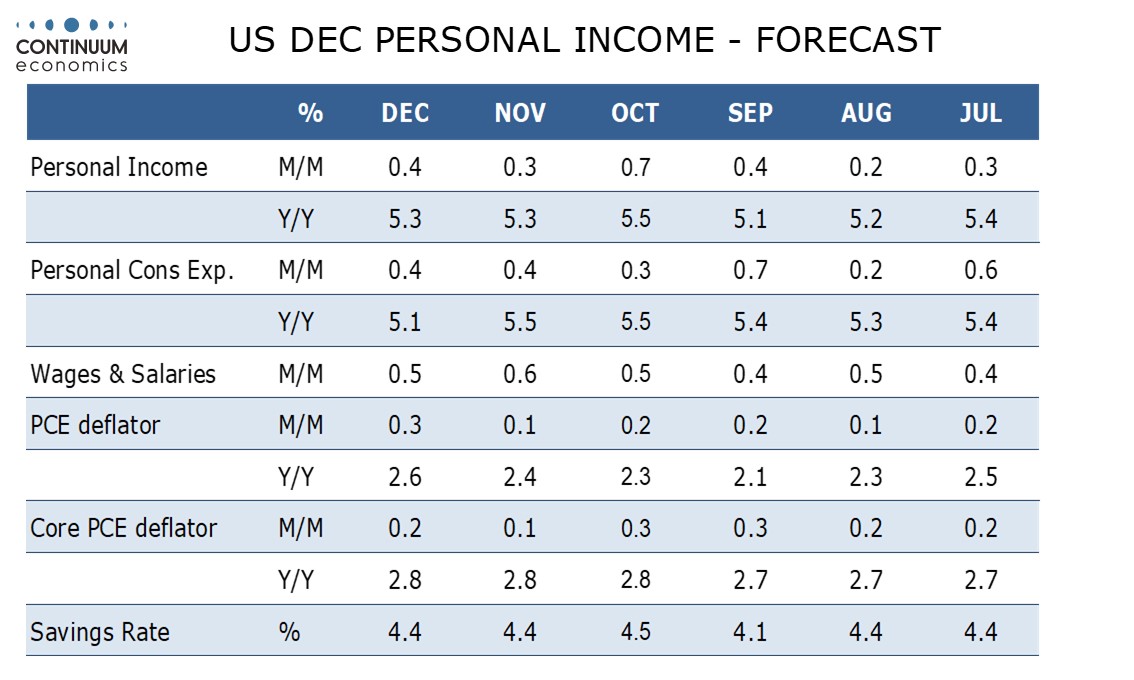

December’s US personal income and spending report will be largely old news, with Q4 totals seen with the GDP report on January 30. Our pre-GDP forecasts for a 0.2% rise in core PCE prices and a 0.4% rise in personal income still look valid, though the GDP data is consistent with a 1.3% rise in personal spending, for which our original forecast was for a 0.4% increase. December is unlikely to rise so sharply, which suggests upward revisions in October and November. But impact should be modest given the Q4 data released on Thursday.

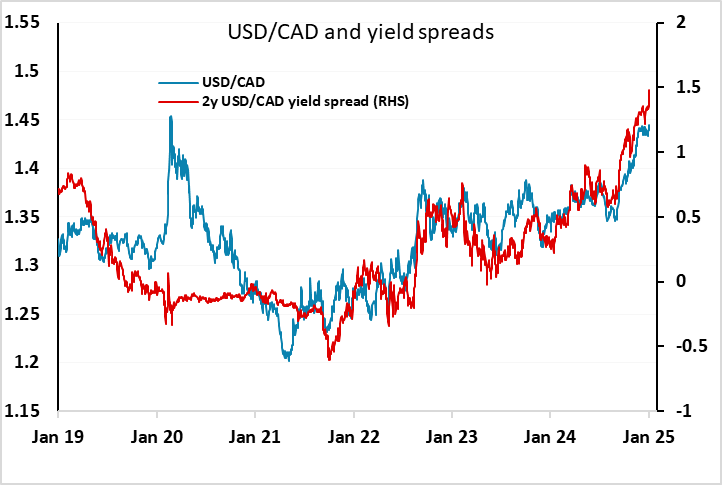

We expect Canadian GDP to see a 0.1% decline in November, in line with a preliminary estimate made with October’s 0.3% increase, and in line with consensus That would suggest a trend of around 0.1% per month. A 0.1% increase in December would leave Q4 marginally below 2.0% annualized, up from 1.0% in Q3. The Bank of Canada expects a 1.8% annualized gain in Q4. However, the data will probably be less important for USD/CAD than any news on whether Trump will be true to his word and impose a 25% tariff on Canada from February 1. The market is assuming here will be a last minute reprieve, but the longer we go with no news, the more nervous the CAD is likely to get. As it stands, USD/CAD has moved fairly closely with yield spreads, so there isn’t much risk priced in, suggesting most of the risk is on the USD/CAD upside.

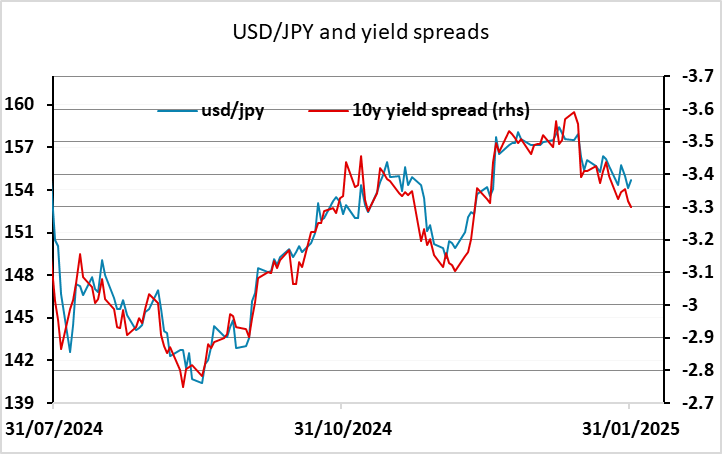

Otherwise, the JPY was the best performer on Thursday, with yields in the US and Europe generally a little lower, supporting JPY strength. As it stands, the US/Japan spread still suggests some downside risk for USD/JPY to 133, so JPY strength is hard to oppose, especially given the tariff risks which represent a significant risk to global equities.